Brazilian soybean farmers have emerged as the clear winners in China’s evolving agricultural trade landscape, steadily gaining market share at the expense of the United States and other exporters.

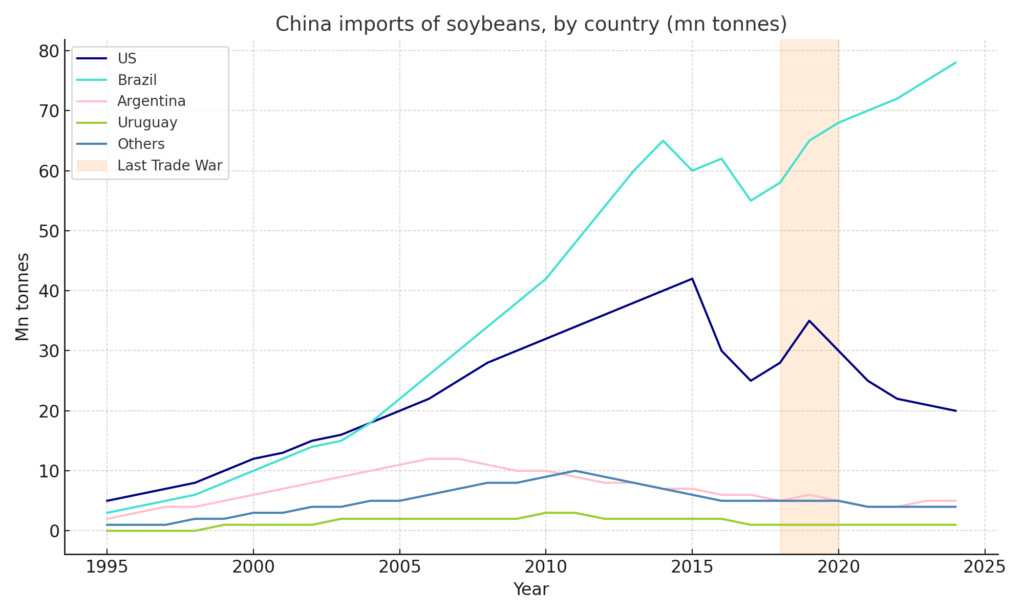

Data from the American Soybean Association and Trade Data Monitor show that China, the world’s largest soybean importer, has dramatically increased its reliance on Brazil over the past two decades. From near parity with the U.S. in the early 2010s, Brazil’s exports to China have surged to nearly 60 million tonnes annually by 2024—more than double U.S. volumes.

Trade Wars Reshape Flows

The turning point came during the U.S.–China trade war (2018–2020), when Beijing imposed tariffs on American soybeans. The disruption forced Chinese buyers to pivot towards Brazilian suppliers, thereby entrenching long-term relationships and accelerating infrastructure investments in Brazil’s agribusiness and logistics sectors.

While U.S. soybean exports partially recovered after the trade war, they remain well below earlier peaks. Argentina, Uruguay, and other smaller players, once seen as potential alternatives, continue to supply marginal volumes by comparison.

Why Brazil Fits China’s Needs

Brazil has several structural advantages that explain its dominance:

- Staggered harvest cycles provide China with flexibility, ensuring year-round supplies that complement the U.S. harvest timing.

- Logistics modernisation, including upgraded ports and railways, has reduced costs and enhanced reliability.

- Currency competitiveness: the Brazilian real’s depreciation against the U.S. dollar has kept exports attractive.

- Policy alignment: Brazil’s willingness to invest in large-scale agribusiness dovetails with China’s long-term food security priorities.

Implications Beyond Soy

This shift has broader consequences:

- Geopolitical leverage: Brazil’s clout as China’s key soybean partner boosts its negotiating position on climate, trade, and investment.

- U.S. farmers squeezed: Reliance on volatile political goodwill makes American producers more vulnerable to future shocks.

- Feed and dairy ripple effects: Soybeans remain a cornerstone of global animal feed. Brazil’s dominance could influence feed costs in Asia, with downstream impacts on dairy and meat affordability.

- Climate vulnerability: The concentration in Brazil also heightens China’s exposure to South American droughts and deforestation-linked supply chain risks.

The Road Ahead

China’s long-term strategy is clear: secure stable feed supplies to underpin its vast livestock and dairy sectors. With Brazil firmly established as the top supplier, the U.S. faces an uphill battle to reclaim its lost market share. The trade war demonstrated that once trade flows shift, they rarely revert to their previous patterns.