Aiming for Growth Amid Market Volatility

Dodla Dairy, one of India’s leading private dairy companies, is charting an ambitious growth path. With plans to increase its production volume by 10% and drive revenue growth by 15% by March 2025, the company is making significant investments in infrastructure, market expansion, and product diversification.

In an exclusive conversation with CNBC-TV18, Dodla Sunil Reddy, Executive Director and Managing Director, shared insights into how the company is navigating industry challenges and capitalizing on emerging opportunities.

Strategic Infrastructure Expansion

A cornerstone of Dodla Dairy’s strategy is the establishment of a ₹280 crore state-of-the-art facility in Maharashtra, boasting a 10 lakh-litre per day processing capacity. This investment underscores the company’s commitment to strengthening its foothold in Western India and expanding its reach into newer markets.

“We are actively laying the groundwork in Maharashtra. With our new plant, we aim to scale procurement to an ambitious 2.5 lakh litres per day over the next three to four years,” said Reddy.

Currently, Dodla Dairy operates a plant in Shelgaon, Solapur district, procuring 2 to 2.5 lakh litres of milk daily. With the new facility, the company expects a phased expansion in procurement capacity, reinforcing its supply chain and boosting product availability. This expansion is expected to enhance Dodla Dairy’s ability to process milk into value-added products like curd, butter, and ghee, further increasing its revenue potential.

Market Leadership and Regional Expansion

Dodla Dairy continues to dominate Karnataka as the top private dairy player, while ranking among the top three in Andhra Pradesh, Tamil Nadu, and Telangana. The company aims to balance its geographic footprint, targeting a 25% contribution from Andhra Pradesh, Karnataka, Tamil Nadu, and Maharashtra each.

“A diversified presence across key dairy-producing states helps mitigate price fluctuations and strengthens our overall market resilience,” Reddy explained.

With Telangana’s milk production still lower compared to other states, Dodla Dairy is focusing on expanding procurement in Andhra Pradesh, Tamil Nadu, and Karnataka, where supply chains are more robust. The company believes this strategy will help stabilize procurement costs and maintain competitive pricing.

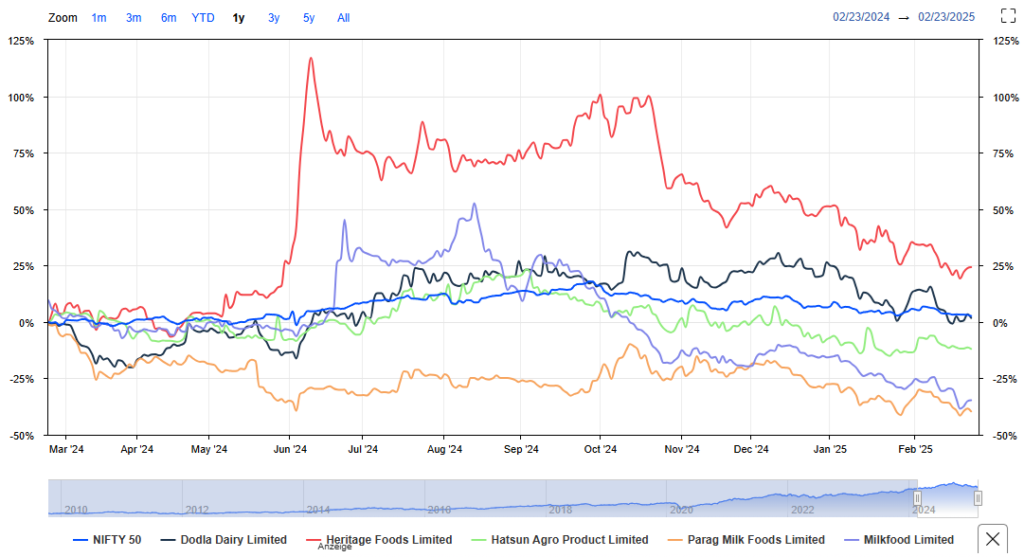

Stock Market Performance & Competitive Landscape

“We believe in steady, long-term growth rather than short-term spikes. Our strategic investments in infrastructure and procurement are aimed at strengthening our market share,” noted Reddy.

Analysts point out that consolidation in the dairy industry is accelerating, with larger companies acquiring smaller players to gain a competitive edge. In January 2025, Hatsun Agro acquired Milk Mantra, further intensifying competition among leading dairy brands.

Consumer Demand and Pricing Trends

The dairy industry has witnessed a gradual rise in milk procurement prices, with Dodla Dairy reporting a ₹2 per litre increase, which has been passed on to consumers. Despite the price adjustments, demand for dairy products remains strong, particularly for value-added items.

“We are seeing an offtake in consumption, which is encouraging. Summer is a crucial period for us, and we expect significant growth in seasonal products like curd and ice cream,” said Reddy.

Dodla Dairy expects higher demand for dairy products during the summer months, particularly in the curd and ice cream segments, which have historically performed well. This seasonal demand is likely to drive overall revenue growth and help balance procurement cost increases.

Value-Added Product Segment Growth

Dodla Dairy has been focusing on value-added dairy products, which currently contribute 30% to its total revenue. With an increasing shift toward high-margin products, the company aims to sustain this level while capitalizing on growing demand.

“Last year, our ghee sales were exceptionally strong. We aim to maintain similar growth with continued demand for premium dairy offerings,” Reddy noted.

With more consumers shifting towards premium dairy products, including organic and fortified dairy, Dodla Dairy is investing in new product innovations to capture a larger share of this lucrative market.

Expanding the Animal Feed Business

Dodla Dairy is also strengthening its cattle feed business, which has ₹300 crore revenue potential. The company expects this segment to grow from ₹120 crore to ₹200 crore next year, with further expansion as milk procurement scales up.

“Our feed business complements our core dairy operations and is a key part of our long-term strategy,” Reddy said.

With higher milk production costs, many dairy farmers are turning to nutrient-rich cattle feed solutions to improve milk yields. Dodla Dairy is leveraging this demand by expanding its cattle feed production capacity, ensuring better supply chain integration.

Looking Ahead: Industry Consolidation & Growth Strategy

Industry consolidation is another major trend shaping the dairy market, with acquisitions playing a crucial role in Dodla Dairy’s growth strategy.

“In the coming years, we will see more mergers and acquisitions in the dairy sector. We continuously evaluate opportunities for both organic and inorganic expansion,” Reddy revealed.

Dodla Dairy is currently evaluating potential acquisitions in North India, which could further strengthen its national footprint. Reddy confirmed that opportunities in both domestic and international markets are being assessed regularly.

With India’s dairy sector evolving rapidly, companies must focus on innovation, operational efficiency, and regional diversification to stay ahead. Dodla Dairy’s strategic investments in infrastructure, product expansion, and market positioning reinforce its commitment to long-term success.