The FAO Food Price Index climbed 1.6% in July 2025, reaching 130.1 points, as sharp increases in vegetable oil and meat prices offset declines in cereals, dairy, and sugar, according to the latest update from the UN Food and Agriculture Organisation (FAO).

While this marks a significant month-on-month rise, global food prices remain 18.8% below their March 2022 peak. However, they are still 7.6% higher than in July 2024 — underscoring a mixed but inflationary trend in international food commodity markets.

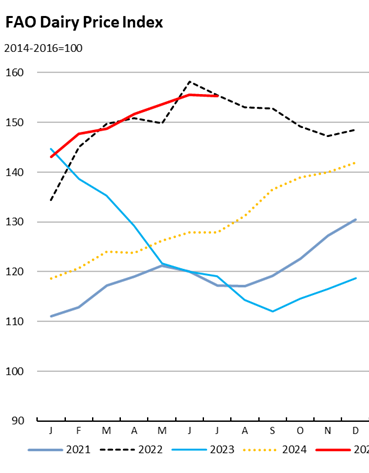

📈 Long-Term Context: Dairy Price Index Still 30% Above 2023 Levels

While July showed a marginal decline, the broader picture tells a story of sustained inflation:

| Metric | July 2024 | July 2025 | YoY Change |

|---|---|---|---|

| Dairy Price Index | 119.10 | 155.32 | +30.4% |

| Butter Index | 137 | 224 | +63.5% |

| SMP Index | 102 | 109 | +6.9% |

| WMP Index | 116 | 147 | +26.7% |

| Cheese Index | 121 | 154 | +27.2% |

📉 Dairy Prices Ease for the First Time in Over a Year

The FAO Dairy Price Index edged down 0.1% to 155.3 points, marking its first decline since April 2024. This modest dip was mainly due to:

- Falling prices for butter and milk powders, driven by ample global export availability

- Weaker import demand, especially from key Asian markets

- Despite the decline, cheese prices continued to firm, supported by strong demand in Asia and the Near East, and reduced export volumes from the European Union

This signals a mild cooling in global dairy markets, even as overall demand for value-added dairy products remains strong.

“The dairy market is adjusting to increased supply, especially in milk powder segments, while cheese and value-added products are still holding strong — showing differentiated demand dynamics,” noted a senior dairy analyst.

🌾 Cereals and Sugar Ease, While Vegetable Oil and Meat Surge

- Cereal Price Index: Fell 0.8%, with wheat and sorghum leading the decline. Northern Hemisphere harvests exerted downward pressure despite crop stress in North America.

- Vegetable Oil Index: Soared 7.1%, the sharpest monthly rise in 3 years. Strong demand for palm, soy, and sunflower oils lifted the index, even as rapeseed oil fell due to new crop arrivals in Europe.

- Meat Index: Rose 1.2% to an all-time high. Beef and lamb prices climbed on robust imports by China and the U.S., while poultry rebounded due to resumed Brazilian exports. Pig meat fell on weak EU demand.

- Sugar Index: Declined slightly by 0.2%, extending its downward streak for five months. Anticipated bumper harvests in Brazil, India, and Thailand kept prices subdued.

🧭 Implications for the Indian Dairy Sector

With global dairy prices slightly softening, Indian exporters of milk powders and butter may face price pressure, especially in Asian markets. However, continued strength in cheese and high-value dairy products may offer resilient export channels.

For domestic stakeholders, international softness in milk powder prices could impact export-linked procurement strategies, while feed oil price inflation — linked to vegetable oil surges — may raise input costs for Indian dairy farmers.