Global dairy prices decline again—Indian analyst sees stabilisation ahead

Global dairy prices slipped further at the recent Global Dairy Trade (GDT) auction, marking a fourth consecutive decline, as supply continues to outpace demand. The overall GDT price index decreased by 4.3%, with average prices reaching US$4,274/MT.

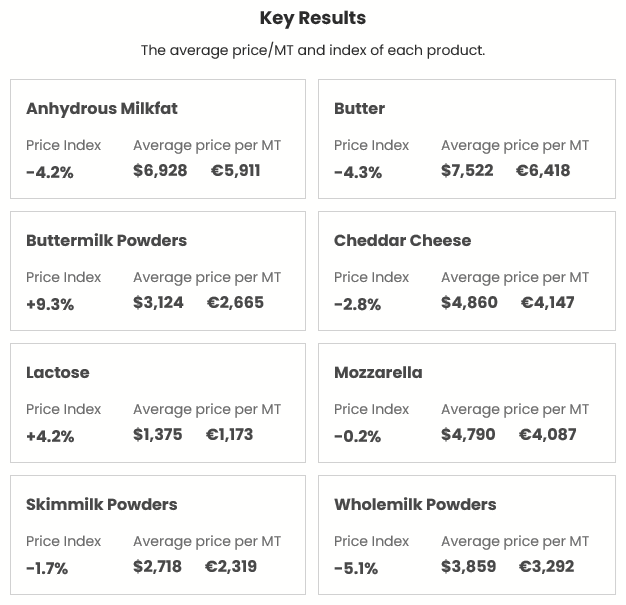

📊 Key Product Movements:

- Wholemilk Powder: ↓ 5.1% — US$3,859/MT

- Butter: ↓ 4.3% — UUS$7,522MT

- Anhydrous Milkfat: ↓ 4.2% — USUS$6,928T

- Cheddar Cheese: ↓ 2.8% — US US$4,860

- Skim Milk Powder: ↓ 1.7% — US $US$2,718Mozzarella: ↓ 0.2% — US $4US$4,790uttermilk Powder: ↑ 9.3% — US $3,124/MT

- Lactose: ↑ 4.2% — US$1, US$1,375. The slide may concern producers, but Prashant Tripathi, a dairy market analyst with Jordbrukare Insights, describes the dip as “a predictable seasonal correction” rather than a prolonged downturn.

“What we’re witnessing is classic cyclical oversupply. The US and EU have pushed out significant volumes post-peak, while the Southern Hemisphere—particularly New Zealand—is ramping up,” Tripathi explained. “This mismatch in timing temporarily pressures prices, but we expect stabilization in the next 1–2 auction cycles.”

Mehta projects that farm-gate returns will remain steady, with payout projections still averaging around US$100 million in milk solids, aligning with extensive cooperative forecasts. However, he flagged U.S. tariff negotiations and shifting trade patterns in Asia as wildcard factors that Indian exporters must watch closely.

“If tariff conditions shift, especially with the US and China recalibrating dairy trade terms, demand redirection could significantly impact both commodity prices and export viability for Indian dairy processors.”

For Indian stakeholders—from cooperatives to private dairies—this signals a time for caution but not panic. While prices have dipped, value-added segments such as buttermilk powders and lactose have shown positive movement, reflecting differentiated demand trends.

📣 Expert Quote (Indianised)

“This is not a price crash—it’s a timing mismatch. As Northern Hemisphere output eases and Southern Hemisphere demand strengthens, prices should rebound. Indian players should remain agile, especially in high-margin export categories,” says Prashant Tripathi, Dairy Market Analyst, Jordbrukare Insights.