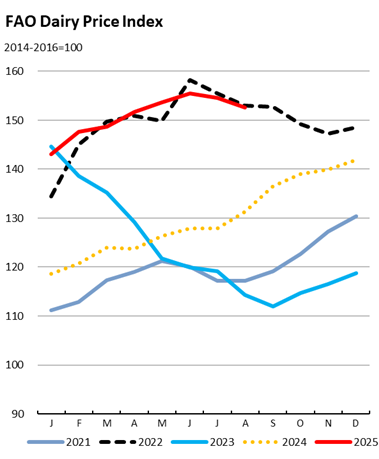

In August 2025, the FAO Dairy Price Index slipped to an average of 152.6 points, marking a 1.3% decline from July and continuing its downward trajectory for a second consecutive month. However, when viewed on an annual scale, the index remains 16.2% higher than August 2024, reflecting the underlying tightness that continues to characterise global dairy markets.

The latest dairy market updates show that the dip was primarily influenced by weaker international prices for butter, cheese, and whole milk powder (WMP). This trend coincides with seasonally strong milk production in key exporting regions like New Zealand and the European Union, where dairy yields have outpaced expectations. At the same time, import demand has softened, especially from major Asian markets, notably China and Southeast Asia, which have become increasingly cautious in their purchasing patterns due to economic uncertainty and stockpiled inventories.

Yet, not all product categories followed this downward slide. Skim milk powder (SMP) prices showed modest strength, underpinned by limited export availability from New Zealand, where climatic factors and shifting herd dynamics have constrained output. This divergence among dairy commodities highlights a delicate market equilibrium, with fat- and protein-rich dairy products facing pressure from ample supply. In contrast, powder-based dairy products exhibit resilience amid regional scarcity.

“The current price behaviour is less about a global glut and more about regional realignments in production and demand,” said a senior dairy analyst. “We’re seeing classic market balancing—where an overall surplus masks specific shortages that can still drive price volatility.”

In the future, the outlook remains mixed. While the Indian dairy industry may benefit from relatively lower global butter and cheese prices, exporters and processors must remain alert to volatile demand cycles, particularly in the Asia-Pacific region. The milk supply shortage in some Southern Hemisphere regions, coupled with shifting trade dynamics, could lead to unexpected price rebounds—especially for value-added dairy powders.