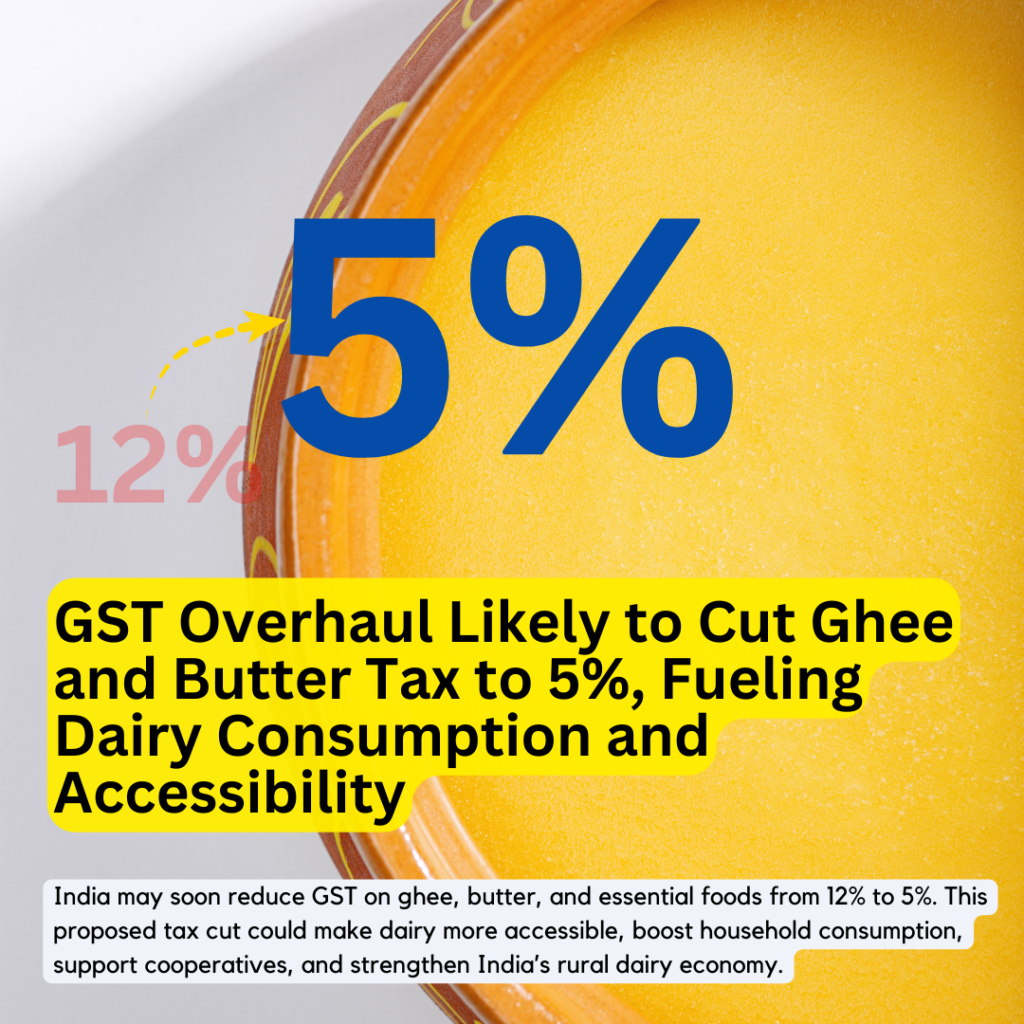

The Indian dairy sector could soon benefit from a landmark policy reform, as the Centre prepares to roll out a major overhaul of the Goods and Services Tax (GST) regime. Among the key proposals is a reduction in GST on essential dairy items such as ghee and butter—currently taxed at 12%—to a more affordable 5%, a move that could increase consumption, improve nutritional access, and boost the dairy economy.

The revamped structure, aimed at simplifying India’s indirect tax system, is expected to be unveiled around September or October 2025 during the 56th GST Council meeting. If approved by the Group of Ministers (GoM) through majority consensus, this reform could significantly lower the cost of various goods and services for consumers.

🧈 Ghee: From Luxury to Everyday Staple

Under the draft proposal, essential items like ghee, butter, packaged foods, fruit juices, and coconut water—currently taxed at 12%—may shift to the 5% GST slab. The change is part of a broader rationalization plan that seeks to replace the existing multi-slab system (5%, 12%, 18%, and 28%) with a simplified two-rate structure: 5% and 18%.

For dairy consumers, especially in rural and semi-urban India, this could make a meaningful difference.

- 📉 Price Drop: Retail ghee prices could reduce by 6–7%, making it more affordable for households.

- 🍽️ Boosted Access: Middle-income and rural families will have easier access to a nutritious, traditional food staple.

- 📈 Consumption Surge: Lower prices could drive higher consumption of ghee and butter across the country.

- 👨🌾 Farmer Benefit: Rising demand will support milk procurement and income for dairy farmers.

- 🏢 Organized Sector Advantage: Cooperatives and branded players may see a rise in sales volume and market penetration.

“Cutting GST on ghee isn’t just economic relief—it’s nutritional empowerment,” said a dairy policy analyst. “It opens doors for better food access, safer production, and rural prosperity.”

🏛️ What Else is in the GST Reform Package?

The broader GST reform is not limited to dairy. The GST Fitment Committee has drafted a comprehensive overhaul, which includes:

- Elimination of 12% and 28% slabs: Items will move to either 5% or 18%.

- Common-use items prioritized: “Daily-use items will fall under the 5% GST rate,” a source confirmed.

- Nearly 99% of 12%-taxed goods may shift to 5%.

- Approximately 90% of 28%-taxed goods could move to 18%.

- Footwear and apparel under ₹1,000, air conditioners (up to 32 inches), dishwashers, and small vehicles under 250cc may see rate reductions.

- Cement could shift from 28% to 18%, offering relief to the construction and real estate sectors.

- Compensation cess to be simplified into a flat 40% rate on a limited set of sin goods like tobacco and pan masala.

Despite concerns over a potential revenue loss of 0.2 to 0.4% of GDP, officials believe this will be offset by stimulated household consumption and broader economic growth.

The proposals will be reviewed by the GoM led by Bihar Deputy Chief Minister Samrat Choudhary on August 20–21, and—pending consensus—will go to the GST Council for final consideration in mid-September 2025.