India’s dairy industry is expected to experience robust revenue growth of 13-14 percent this financial year, driven by strong consumer demand and improved raw milk supply. Demand will be bolstered by rising consumption of value-added products such as ghee, paneer, butter, curd, ice cream, cheese, yogurt, and whey. Meanwhile, ample milk supply will be supported by favorable monsoon prospects, according to a CRISIL Ratings analysis.

The CRISIL analysis also highlights that the increase in raw milk supply will lead to higher working capital requirements for dairy companies. Alongside ongoing capital expenditure (capex) by organised dairies over the next two fiscal years, this will result in a slight rise in debt levels. However, the credit profiles of these dairies are expected to remain stable, supported by strong balance sheets.

The analysis covered 38 dairies, which account for about 60 percent of the organized segment.

“Despite modest growth of 2-4 percent in realisation, the dairy industry’s revenues are projected to rise due to a healthy 9-11 percent increase in volumes. The value-added products segment, contributing about 40 percent of the industry’s revenue, will be a major driver. This growth is fueled by rising income levels and a shift towards branded products. Additionally, increased sales of value-added products and liquid milk in the hotels, restaurants, and cafes (HORECA) segment will further support revenue growth,” says Mohit Makhija, Senior Director at CRISIL Ratings.

Strong consumer demand will be complemented by improved raw milk supply, expected to increase by at least 5 percent this financial year due to better cattle fodder availability, thanks to a favorable monsoon outlook.

According to the analysis, milk supply is anticipated to rise to 240-245 million tonnes this financial year, up from 230 million tonnes the previous year.

Milk availability will also benefit from the normalisation of artificial insemination and vaccination processes, which had previously been disrupted. Additionally, measures such as genetic improvement in indigenous breeds and increased fertility rates in higher-yield breeds will help enhance milk supply.

Steady milk procurement prices are expected to support dairy profitability, with operating profitability projected to improve by about 40 basis points to approximately 6 percent this fiscal year.

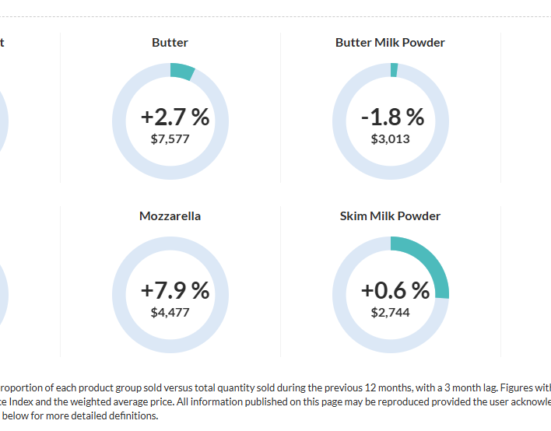

“While revenue and profitability for dairies are expected to improve in 2024-2025, debt levels are also likely to rise for two main reasons. First, healthy milk supply during the flush season will lead to higher inventories of skimmed milk powder (SMP), which will be consumed throughout the year,” says Rucha Narkar, Associate Director at CRISIL Ratings.

SMP inventory typically accounts for about 75 percent of the working capital debt of dairies. Second, sustained milk demand will necessitate increased debt-funded investments in new milk procurement, milk processing capacities, and expanding distribution networks, she adds.

Despite the additional debt for working capital and capex, credit profiles are expected to remain stable due to low leverage. The sector’s annual capex is anticipated to stay robust at Rs 2,600-2,700 crore, consistent with the past two fiscal years, the CRISIL analysis revealed.

Source : New Indian Express