Milk Deliveries Decline, Impacting Dairy Product Availability

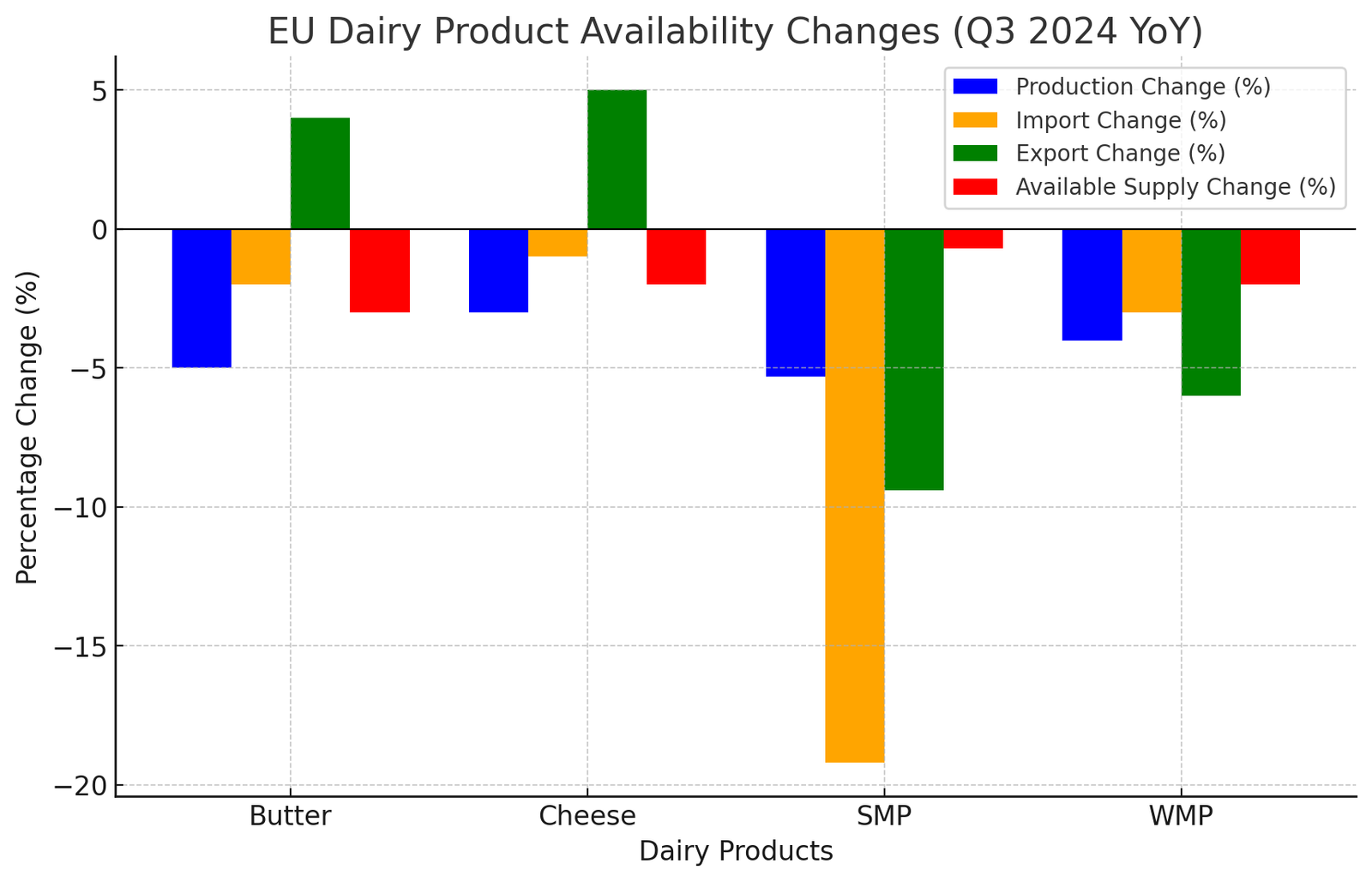

In Q3 2024, the availability of dairy products in the EU declined compared to the same period in 2023. Milk deliveries fell marginally by 0.2% year-on-year, affecting overall production. Coupled with increased exports, this led to tighter butter and cheese supplies, while milk powder availability also suffered due to lower production and imports. Amidst rising food inflation, consumers remained cautious in their purchasing behavior, limiting stockpiling activities.

Dairy Exports Grow Despite Challenges in Powder Markets

Despite supply constraints, total dairy exports in the EU increased by 0.4% in Q3 2024 year-on-year. Strong global demand for butter and cheese supported export growth. However, exports of milk powders declined due to weak demand from China and the Middle East, further exacerbated by EU powder prices remaining higher than global market rates.

Butter Stocks Continue to Shrink

The availability of butter declined in Q3 2024, primarily due to reduced production and lower imports. Industry reports indicate persistently low stocks and high cream prices, prompting processors to redirect milk fats into alternative dairy products. Strong retail demand for butter further tightened supply, reinforcing a bullish market sentiment.

Cheese Supplies Drop Amid Lower Production and Rising Exports

Cheese availability also declined in Q3 2024 as production slowed and exports increased. Competitive EU pricing supported robust cheese shipments, particularly to key markets like the UK, the US, and the Middle East. However, weaker demand from China curtailed further export growth, limiting the overall market upside.

Milk Powder Supplies Decline Due to Production and Import Reductions

Skimmed Milk Powder (SMP) supplies fell by 0.7% in Q3 2024 year-on-year. Production dropped by 5.3%, while imports declined sharply by 19.2%. Lower export volumes, down 9.4%, partly offset the supply squeeze. The decline in demand from China, Malaysia, Indonesia, Vietnam, and the Middle East was a key factor in reduced exports.

Whole Milk Powder (WMP) production also declined in Q3 2024, driven by lower milk deliveries and weaker global demand. Heightened competition from New Zealand put further pressure on EU WMP exports, which saw reductions in shipments to the UK, Asia, and Africa. As a result, overall WMP availability fell modestly by 2.0%.

Outlook: Modest Recovery Expected in 2025

According to the European Commission’s short-term outlook, EU milk deliveries are expected to increase by 0.2% in 2025. This modest growth will balance an uptick in milk yields against a declining dairy herd. Stable raw milk prices and lower input costs provide a positive outlook for farmers, though much will depend on domestic and global demand recovery.

Macroeconomic and geopolitical uncertainties continue to influence trade flows. Additionally, EU-wide policy and legislative pressures, including environmental targets and stricter animal welfare regulations, are set to shape the industry’s future. Disease outbreaks, including Foot and Mouth disease in Germany and the ongoing impact of Blue Tongue disease in certain regions, remain key risks to watch.

With fluctuating demand and evolving regulations, the EU dairy industry faces a complex landscape in the coming months.