By Dairy Dimension Editorial Team

GDT Auction Highlights

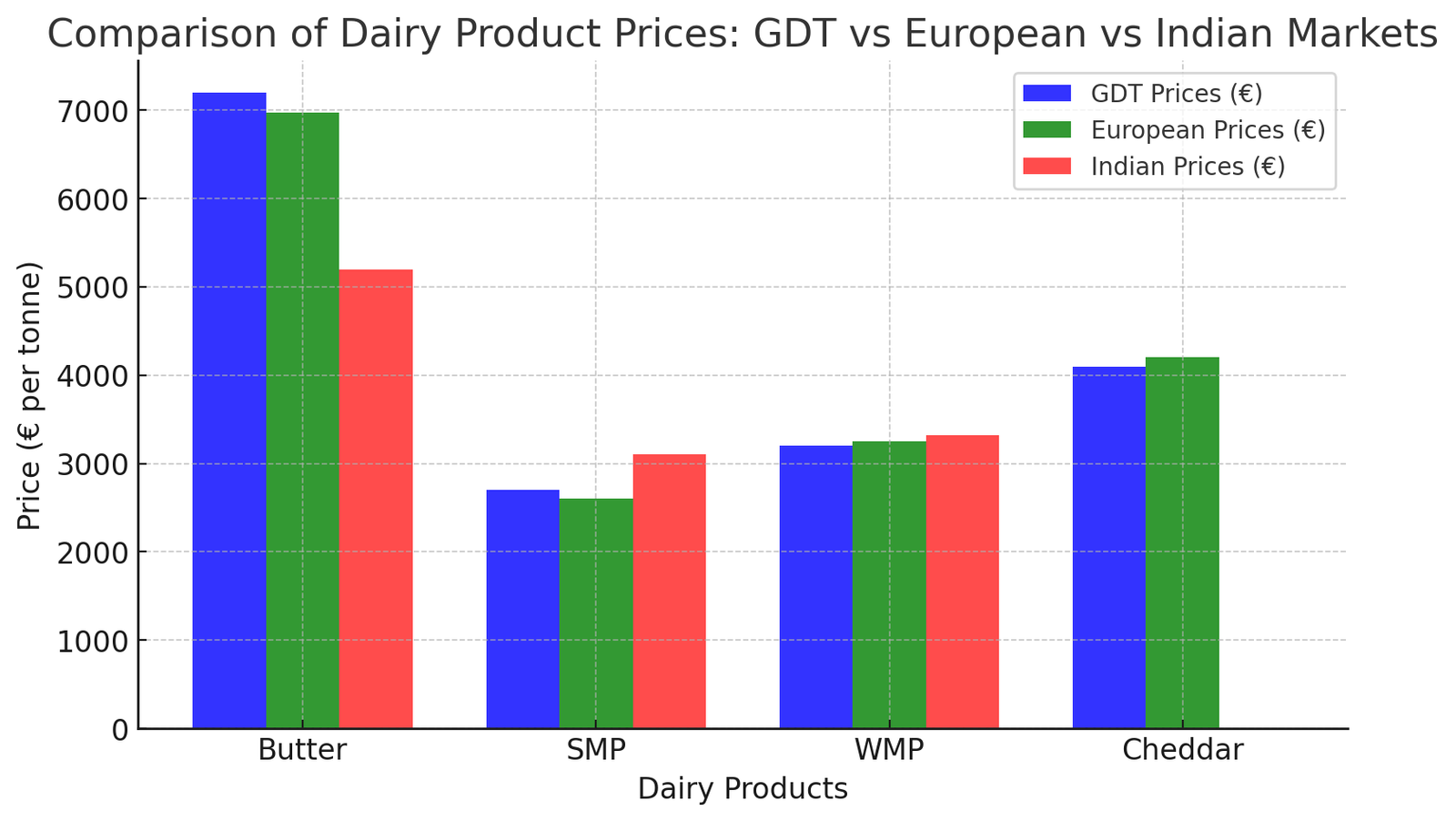

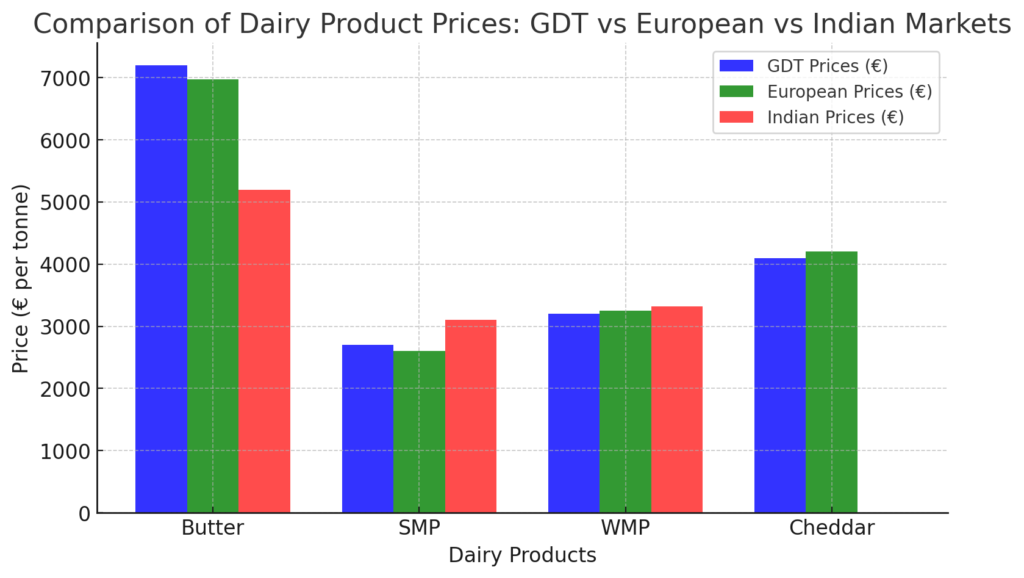

In a significant development, the latest Global Dairy Trade (GDT) auction has seen butter and skim milk powder (SMP) prices surpass those in Europe, marking a rare shift in global dairy trade dynamics. The overall GDT index registered a 0.6% decline, with SMP falling by 2.5% and cheddar cheese declining by 3.4%. On the other hand, butter prices rose by 2.2%, while whole milk powder (WMP) recorded a marginal 0.2% drop. This trend, where GDT butter and SMP outprice their European counterparts, reflects evolving global demand patterns, benefiting Irish and New Zealand dairy exporters.

European Market Outlook

European dairy prices have continued to show a downward trajectory. Butter prices have fallen below the €7,000 per tonne threshold for the first time since August 2024, currently standing at €6,970 per tonne. Although this level remains historically high—similar to peak prices in 2022—it signals a gradual decline. WMP prices have remained stable, cheddar has experienced modest gains, while SMP prices have witnessed slight reductions.

Indian Dairy Market Projections (Jordbrukare Estimates)

India, once a competitive player in global SMP exports, has seen a sharp rise in prices over the past three months. Indian cow SMP is currently priced at $3,000 CFR, while mixed milk SMP is at $3,300 CFR, effectively reducing its export competitiveness in the short term. In contrast, Indian butter remains a viable option in global markets, with mixed milk butter available at $5,150 CFR and cow butter at $5,300 CFR. Additionally, Indian WMP is estimated at $3,317 CFR, following the upward trajectory of SMP prices. These estimates suggest that India will likely remain uncompetitive in SMP and WMP exports for at least the next two months, while butter continues to hold an attractive pricing advantage globally.

India, once a competitive player in global SMP exports, has seen a sharp rise in prices over the past three months. Indian cow SMP is currently priced at $3,000 CFR, while mixed milk SMP is at $3,300 CFR, effectively reducing its export competitiveness in the short term. In contrast, Indian butter remains a viable option in global markets, with mixed milk butter available at $5,150 CFR and cow butter at $5,300 CFR. Additionally, Indian WMP is estimated at $3,317 CFR, following the upward trajectory of SMP prices. These estimates suggest that India will likely remain uncompetitive in SMP and WMP exports for at least the next two months, while butter continues to hold an attractive pricing advantage globally.

The premium pricing of GDT butter and SMP compared to European market rates presents a strategic opportunity for Irish dairy exporters. Additionally, India’s diminished SMP and WMP competitiveness could shift trade flows, potentially benefiting Irish and European suppliers in key export markets such as Bangladesh and Southeast Asia.

Performance of Dairy Giants

Leading European dairy companies, including Arla and FrieslandCampina, have reported robust profitability in 2024, rebounding from weaker performances in 2023. Likewise, Kerry Dairy Ireland has demonstrated strong results, reinforcing the resilience of the European dairy sector despite price fluctuations.

Final Thoughts

The current global dairy landscape is witnessing dynamic shifts. While butter remains a competitive product across international markets, India’s rising SMP and WMP prices indicate that the country will struggle to maintain export competitiveness in these categories in the near future. These developments create opportunities for Irish and European exporters, particularly in regions where India has traditionally been a dominant supplier.

Stay tuned to Dairy Dimension for the latest insights into global dairy markets.

Source: Global Dairy Market Update: GDT vs European and Indian Prices – Jordbrukare