📉 UK Milk Prices Dip Slightly, But Volumes Surge: Key Takeaways for India’s Dairy Sector

June 2025 | Dairy Dimension

The UK’s dairy sector continues to show signs of consolidation, with average milk prices easing slightly. Yet, production volumes are reaching record highs, according to new data released by the Department for Environment, Food & Rural Affairs (Defra) and the Agriculture and Horticulture Development Board (AHDB).

🇬🇧 UK Dairy Overview (April 2025)

- Farm-gate Milk Price: Dropped to 43.69 pence per litre (ppl)—down 1.2ppl or 2.6% from March, yet still 14% higher than April 2024.

- Milk Volume: Rose to 1,396 million litres, a 1.8% increase month-on-month and 6.5% growth over the year.

- Butterfat: Fell by 1.7% from March to 4.29%; down 0.5% YoY.

- Protein Content: Stable at 3.41%, with only a marginal annual decrease (0.4%).

“While prices have dipped slightly, they remain at historically good levels,” said Susie Stannard, Lead Analyst at AHDB. “Feed costs are reasonable and the milk-to-feed price ratio is at a near 20-year high—driving strong production.”

📈 Surge in Production, Yet Fewer Farmers

Despite volume growth, the number of active dairy producers in Great Britain has declined to 7,040, down 160 producers in six months and 190 year-on-year—a 2.6% drop. This aligns with a decade-long trend of industry consolidation, where larger, more efficient farms continue to expand as smaller operations exit due to regulatory, economic, and demographic pressures.

“Many exits occurred before the high-cost winter season. Ongoing challenges like inheritance tax, environmental compliance, interest rates, labour shortages, and an ageing farmer population continue to shape the landscape,” added Stannard.

🇮🇳 What This Means for India’s Dairy Sector

1. Price Drops Don’t Always Signal Weakness

Despite the UK’s slight price dip, the overall economic health of dairy farms remains strong—a lesson for Indian cooperatives and processors facing periodic price corrections. Maintaining farmer margins through feed subsidies or procurement incentives is key during such phases.

2. Structural Consolidation is Accelerating Globally

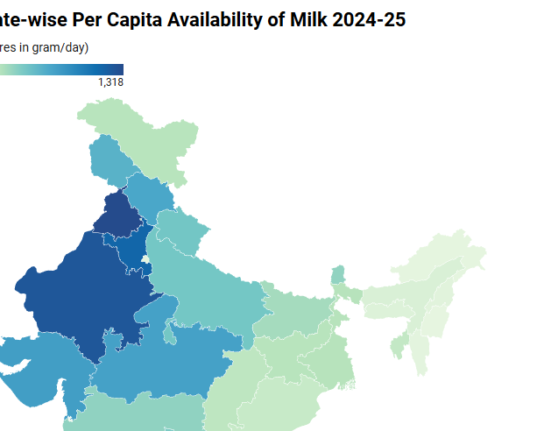

The UK trend of fewer but larger farms mirrors early signs visible in parts of India, especially in Punjab, Gujarat, and Maharashtra, where commercial dairies are gaining ground. India’s dairy planners must now balance scale with inclusivity, ensuring smallholder viability through cooperative digitisation, group housing models, and shared chilling infrastructure.

3. Protein and Fat Standards Are Key to Value

In the UK, changes in butterfat and protein levels directly affect farm income. For India to advance toward value-based procurement systems, a wider rollout of automated milk testing and transparent farmer pricing based on SNF/fat ratios is necessary.

4. Export Opportunities Amid European Tightness

Interestingly, Europe is experiencing a shortage of milk fats, which is supporting the prices of cream and butter. This presents a strategic opportunity for India to explore ghee exports, particularly with high-quality private labels and origin-based marketing, targeting the Gulf and Southeast Asian markets.

🧠 Expert Insight

“India’s dairy ecosystem should closely monitor global production trends. The UK’s volume growth despite falling producer numbers shows how consolidation and efficiency are redefining dairy economics. For India, the focus should be on digital integration, nutrition-rich feed, and climate-smart policies to remain globally competitive.”

— Dr. A.K. Mishra, Dairy Policy Analyst