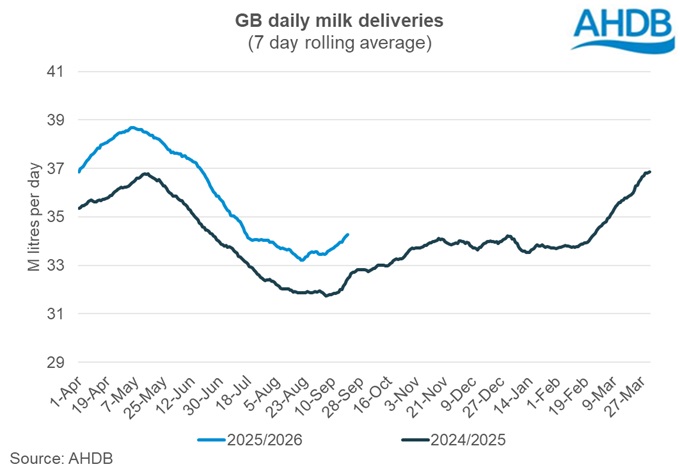

Record-Breaking Milk Output

Milk production in Great Britain has reached 5.53 billion litres for the milk year to date, standing 217 million litres ahead of last year (+5.2%) and 4.1% above the five-year average. This is by far the highest point in the past decade, despite drought conditions restricting grass growth across parts of the UK. Supplies have been bolstered by a near twenty-year high in the milk-to-feed price ratio and record compound feed sales.

Why Commodity Markets Did Not Collapse

Normally, such production would build stock levels and drive down prices, yet unusual market conditions have delayed this correction. A shortage of EU milk, linked to Bluetongue outbreaks in the Netherlands, France and Germany, reduced output through increased culling. Domestically, strong seasonal demand for cream, aided by a bumper berry crop, tightened butter supply. Additionally, Irish exports to the US surged ahead of tariff changes, further supporting commodity values.

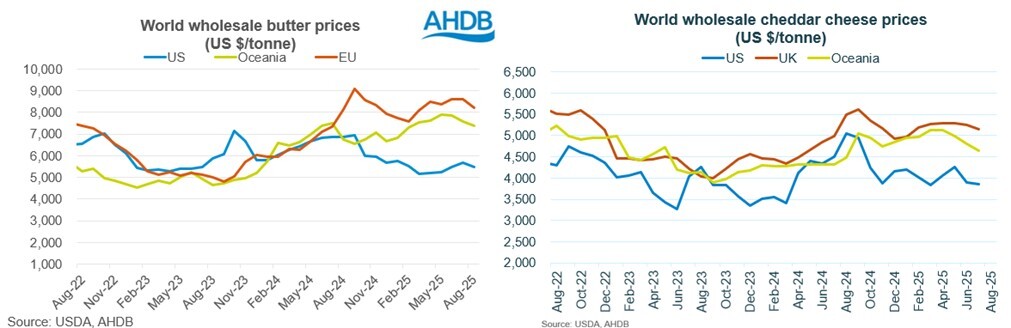

Shifting Global Supply Balance

The global outlook is changing rapidly. US milk production rose by 3.3% in August, supported by larger herds and improved yields, while New Zealand posted 1.8% growth in its new season, benefiting from exceptional weather and margins. The EU, after a period of weakness, has now stabilised and begun modest growth. This supply rebound has widened the price gap between Europe and other regions, with EU butter commanding a 51% premium and cheddar 33% higher than US prices. Such disparities suggest that a global price correction is increasingly likely.

UK Price Pressures Intensify

The UK market is already under pressure. AHDB wholesale figures for September revealed sharp declines, with butter prices falling over £500 per tonne and mild cheddar dropping £410 per tonne. Sellers are keen to release the product but remain constrained by high milk costs. AMPE and MCVE both weakened, signalling farmgate milk prices may fall from 43.7ppl to 40.4ppl by December, with further downside risk if global markets continue to soften.

Farm-Level Implications

For farmers, margin pressures are mounting. Organic producers remain shielded from sharp falls, but conventional contracts are exposed to commodity-linked volatility. Lower feed costs offer some relief, yet rising expenses for bought-in forage, straw and labour are eroding the milk-to-feed advantage. With beef prices holding firm, producers may turn to herd culling as a winter strategy to stabilise finances and adjust to falling milk values.

Outlook for 2025

The dual challenge of record output and weakening markets shapes the near-term outlook. While feed affordability supports high production, sustained price drops and broader cost pressures could trigger structural adjustments in the sector. Strategic planning, including forward contracting of feed and close monitoring of global trade flows, will be crucial as the UK dairy sector faces an uncertain winter.