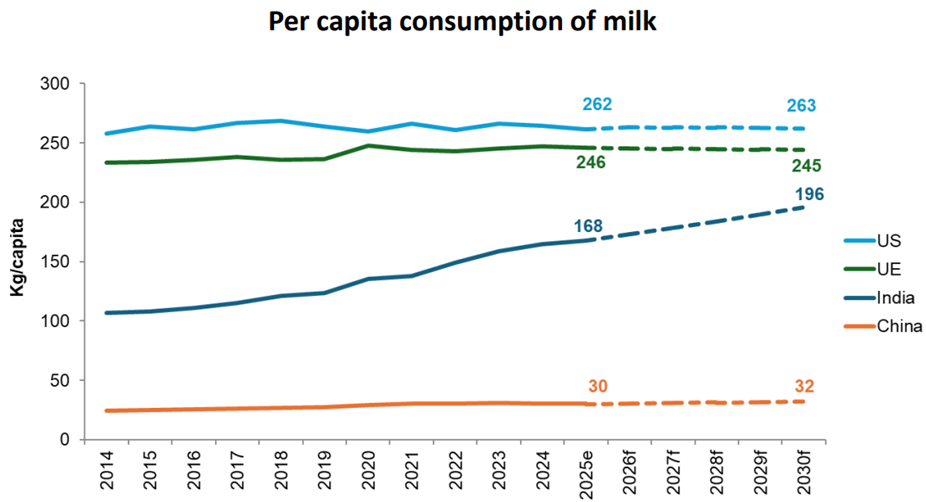

India’s dairy sector is undergoing dynamic transformation, with milk consumption rising at an impressive 3.1% per capita per year, according to Gira’s research. Fuelled by rapid population and income growth, the country is emerging as one of the leading global drivers of dairy demand.

With a population of around 1.5 billion people, nearly half of whom are under 25, India’s youthful demographic and expanding middle class are significantly reshaping consumption patterns. The nation’s GDP is forecast to grow by 6.3% in 2026, while rising rural incomes and urbanisation continue to lift demand for value-added dairy products. For a largely vegetarian population, dairy remains a vital source of protein, fat, and calories.

Shifting consumption and premiumisation trends

Liquid milk remains the most consumed dairy product in India, but consumer preferences are steadily evolving towards nutritious and value-added options. Traditional ghee continues to dominate Indian kitchens, yet demand for processed dairy products is surging. Yoghurt and cheese consumption are expected to grow by 12% and 11%, respectively, between 2025 and 2030.

Paneer remains the dominant cheese type, though cheddar, processed cheese, and mozzarella are projected to grow faster. Consumers are increasingly prioritising quality, health benefits, and brand trust, showing a readiness to pay a premium for products perceived as wholesome or high quality.

The rapid expansion of supermarkets and online retail is reshaping sales channels, offering greater product variety and convenience to urban consumers. Meanwhile, the prevalence of lactose intolerance in India is driving innovation in lactose-free dairy lines, opening new market segments for domestic and international players.

Source: Gira

Milk production to rise 3.6% annually through 2034

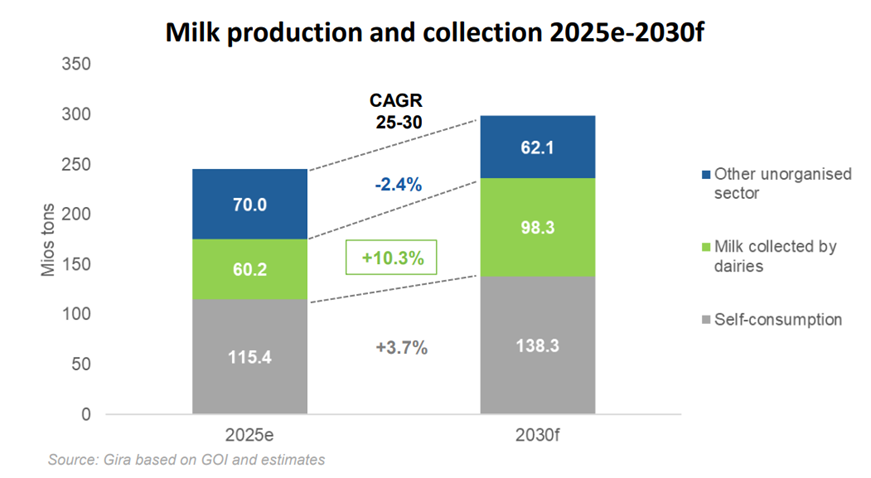

According to OECD projections, India’s milk production is poised to grow at a robust 3.6% per annum between 2025 and 2034, the highest rate globally. Growth will be driven by herd expansion, improved genetics, and productivity gains, supported by increased formalisation of the dairy supply chain.

Currently, only about 25% of milk passes through formal dairies, with the remainder distributed informally through milkmen, vendors, and direct household consumption. However, as logistics and cold-chain infrastructure improve, the share of milk processed through dairies is expected to increase by 10.3% from 2025 to 2030.

Despite advances, challenges persist, including feed and water availability, heat stress, and uneven access to modern technology across regions. Still, private sector investments and cooperative modernisation are accelerating the sector’s structural transformation.

Trade and market potential

Dairy contributes roughly 4% of India’s GDP and 25% of agricultural GDP, underscoring its economic importance. While India remains largely self-sufficient in meeting domestic demand, its fragmented supply chain and cold-chain bottlenecks continue to hinder efficiency and export competitiveness.

The government’s stated ambition to boost dairy exports through policy incentives, infrastructure upgrades, and compliance reforms reflects a growing intent to integrate India into global dairy trade. Future developments in milk powder and processing capabilities will play a crucial role in achieving export standards.

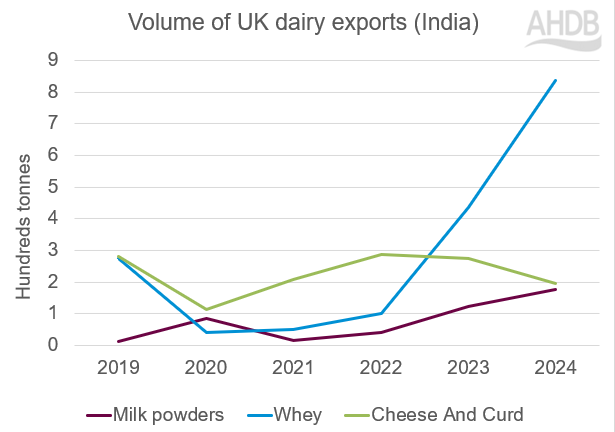

Source: HMRC compiled by Trade Data Monitor LLC

Between 2019 and 2024, UK dairy exports to India grew sharply, with overall volumes up 119.8% and value up 88.7%, according to HMRC data compiled by Trade Data Monitor LLC. Whey exports surged by 562 tonnes, followed by milk powders at 165 tonnes, while cheese exports saw a modest decline but remain strategically important.

India–UK dairy trade outlook

The UK–India Free Trade Agreement (FTA) presents new opportunities for high-quality UK dairy products, particularly in infant formula and protein concentrates. However, despite the trade deal, India’s tariffs of around 30% on dairy imports will persist, as the country remains protective of its domestic dairy sector due to its social and cultural importance.

As India modernises its dairy industry, balancing domestic growth, farmer welfare, and export ambitions will be key. The combination of rising demand, policy reform, and technological advancement positions India as both a dairy powerhouse and a potential global trade influencer in the decade ahead.