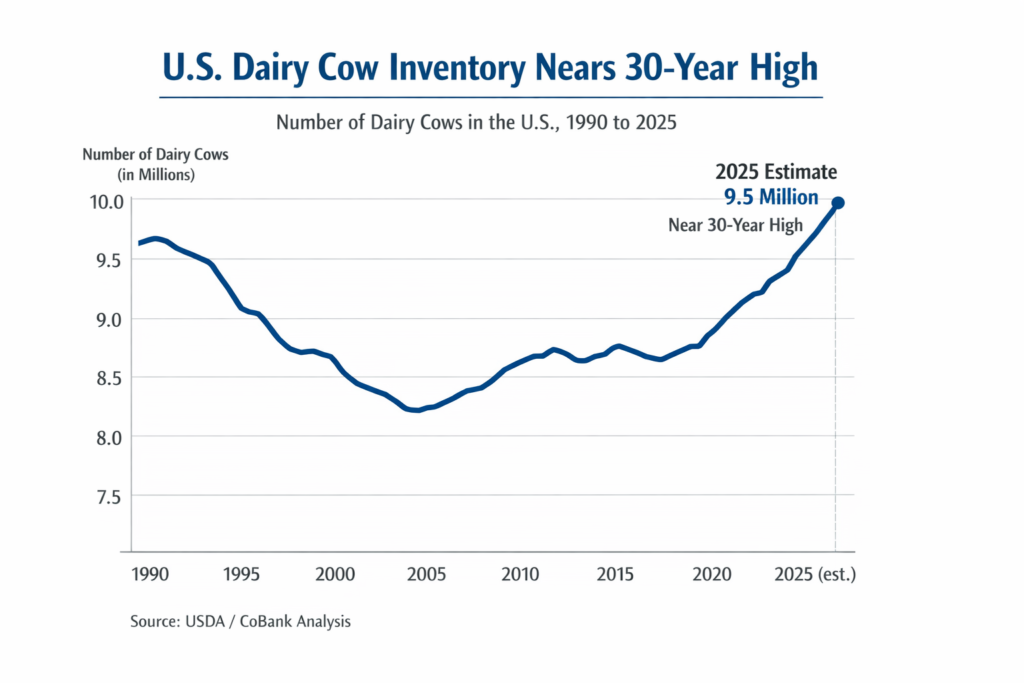

The U.S. dairy industry is experiencing a sharp rise in cow inventories, with national herd size climbing to levels not seen since the early 1990s—signalling a global shift in milk production dynamics that could ripple across the Indian dairy industry.

According to a recent analysis by CoBank and USDA data, the U.S. dairy herd is estimated to reach 9.5 million cows by 2025, approaching the 30-year peak of 1990. This resurgence marks a significant turnaround after two decades of contraction driven by farm consolidations and economic pressures.

Herd Expansion Outpaces Productivity Gains

Over the past year, an estimated 211,000 dairy cows were added to U.S. farms, contributing over 414 million additional pounds of milk. While improvements in per-cow productivity remain essential, the majority of recent production gains have come from increased cow numbers.

This shift is driven in part by the growing adoption of beef-on-dairy breeding programmes, which allow producers to diversify revenue streams without compromising core dairy output.

Implications for Global Milk Markets and India

The surge in U.S. milk output has contributed to softening prices in global dairy commodity markets. With U.S. Class III and Class IV milk prices facing downward pressure, countries that rely heavily on imports—such as those in the Middle East and Southeast Asia—may benefit from more competitive pricing.

For India, this global supply glut raises critical considerations:

- Export Competition: Indian dairy exporters face stiffer pricing competition from the U.S., New Zealand, and the EU.

- Policy Planning: India’s dairy policy conflicts with global overproduction, undermining domestic goals, especially as India seeks to expand its value-added dairy segment and raise milk procurement prices.

- Dairy Inflation & Input Costs: If global milk prices drop, Indian input costs (like feed and energy) must remain manageable to avoid margin pressures on Indian dairy farmers.

Contrasting Models: Large-Scale vs Cooperative Dairy

The U.S. model remains highly consolidated, with fewer but larger farms contributing to rising production. Meanwhile, India continues to champion a decentralised cooperative model, with states like Gujarat, Maharashtra, and Karnataka playing pivotal roles in milk procurement and processing.

India’s emphasis on suIndia’sle dairy farming, value-added dairy products, and dairy farming innovations offers a contrasting narrative to large-scale intensification in the U.S.

Key Takeaways for Indian Dairy Stakeholders

- Herd expansion, not just productivity, is reshaping U.S. milk output trends.

- Indian dairy exporters must monitor shifts in global milk supply and price movements.

- Strategic investment in technology, climate resilience, and organic dairy will be vital as India aims to balance domestic demand with global competitiveness.