Fonterra’s planned exit from its Mainland consumer business for approximately $4.2 billion marks a defining strategic inflexion for the world’s largest dairy cooperative, signalling a decisive pivot towards high-value dairy proteins, advanced ingredients, and foodservice-led growth. The move reflects a broader recalibration underway across global dairy, as cooperatives and processors seek resilience beyond low-margin consumer brands.

At the core of Fonterra’s strategy is surging global protein demand, described by executives as “off the scale” across key markets in Europe and the United States. Dairy proteins valued for their bioavailability, functional versatility and clean-label appeal are increasingly central to sports nutrition, medical foods, fortified beverages and convenience formats. This structural demand shift strengthens the co-op’s case for reallocating capital and management focus away from brand-heavy consumer operations.

Post-divestment, Fonterra will concentrate on its Ingredients and Foodservice divisions, significantly reducing capital intensity and operational complexity. Management believes the streamlined model can restore earnings to 2025 levels by 2028, even without consumer-facing brands. Importantly, higher-value non-reference products already deliver materially stronger returns on capital than regulated commodity streams, reinforcing the economic logic of the transition.

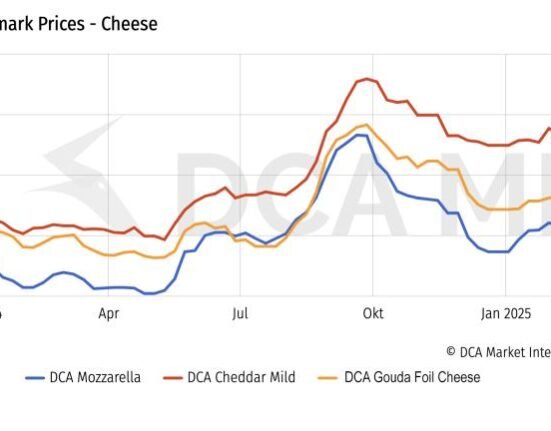

Market conditions remain volatile but supportive. While Global Dairy Trade prices softened late in 2025 amid strong milk production, the sharp rebound in early 2026, its strongest rise in nearly five years,s signals improving fundamentals. Seasonal production easing and stabilising demand suggest milk prices could remain firm near NZ$9.00 per kilogram of milk solids, barring major geopolitical or macroeconomic shocks.

Growth opportunities are increasingly concentrated in Asia, particularly Southeast Asia and China, where foodservice demand and middle-class nutrition consumption continue to expand. Fonterra’s emphasis on customer innovation, application-specific proteins and long-term partnerships positions it to capture value from evolving functional nutrition trends rather than volume-driven scale.

While Fonterra’s global ranking by revenue may decline following the sale, leadership is clear that profitability, efficiency and return on capital now outweigh size. For the global dairy sector, the shift underscores a wider transformation: from brand-led scale to ingredient-led specialisation, where protein economics, technology and customer proximity define competitive advantage.