By Prashant Tripathi, Jordbrukare India

The Gujarat Cooperative Milk Marketing Federation (GCMMF), India’s most extensive dairy cooperative and marketer of the Amul brand, has announced its second-largest investment in two years: a ₹10,000 crore (~$1.2 billion USD) expansion program aimed at scaling up processing capacity, value-added production, and distribution reach.

Referencing the Financial Express coverage (Sept 23, 2025), this move follows an ₹11,000 crore (~$1.32 billion) capital commitment made in 2023, signalling that Amul is not just scaling — it is reshaping its FMCG-led dairy footprint.

But what does this investment really mean for India’s dairy sector? Here’s a breakdown through a sectoral, competitive, and structural lens.

1. From Cooperative Dairy to FMCG Giant

GCMMF reported a turnover of ₹90,000 crore (~$10.8 billion USD) in FY25 and is now targeting the ₹1 lakh crore (~$12 billion USD) milestone within the next 24 months.

Amul today is far beyond a milk marketer. It is a full-stack dairy FMCG entity, with products spanning:

- Fresh and long-life milk

- Butter, ghee, paneer, curd

- Cheese, chocolates, ice creams

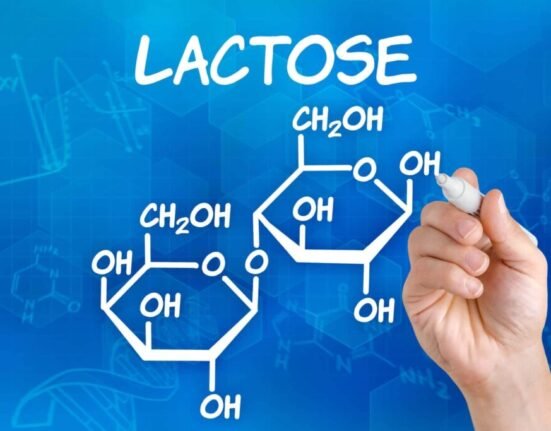

- Lactose-free and probiotic beverages

- Organic and premium dairy lines

This expansion aims to strengthen its control over milk-to-market integration and move decisively into value-added, high-margin segments that private players currently dominate.

Analytical Note: With per capita milk consumption stagnating in urban India, the real volume and margin growth lie in value addition — a play Amul is doubling down on.

2. Investment Allocation: Strategic and Targeted

According to public statements and market observations, the ₹10,000 Cr (~$1.2B) will likely be deployed across:

| Investment Area | Strategic Impact |

|---|---|

| 🏭 New Processing Plants | Enhances capacity for milk powders, ghee, curd, cheese, flavoured milk |

| ❄️ Cold Chain & Storage | Extends shelf life, supports inland logistics, boosts export readiness |

| 🌾 Organic & Specialty Dairy | Positions Amul in health-conscious and premium product markets |

| 🛍️ Retail Network Expansion | Competes with Nestlé, Mother Dairy, and regional private labels |

| 🌐 Digital Distribution Channels | Aligns with D2C and e-commerce dairy consumption trends |

Amul’s scale allows it to benefit from economies of scope — integrating procurement, processing, logistics, and branding within a cooperative governance model.

3. Reading Between the Lines: GST Reforms as Catalyst

A less-discussed yet pivotal trigger for this investment rationalisation is the GST rate rationalisation. The government’s decision to reduce GST on dairy items like ghee, UHT milk, butter, paneer, and chocolates to 5% has created an incentive for organised players to lower prices, widen their consumer base, and push volume growth.

GCMMF has already cut prices on over 700 SKUs, making it more competitive in a price-sensitive FMCG landscape.

Sectoral Insight: GST harmonisation has structurally shifted the advantage toward organized, tax-compliant dairy players like Amul, creating fresh pressure on the informal and unorganized sector.

4. Rural Procurement Meets Urban Consumption

While Amul’s milk procurement still relies on over 18,600 village-level cooperative societies, the focus of this investment is on serving India’s urban, upwardly mobile, and health-conscious consumers.

This includes:

-

High-protein beverages

-

Probiotic dairy

-

Lactose-free variants

-

Dairy-based sports nutrition products

The rural-urban linkage remains core to the model — but value capture is shifting to the consumption end of the chain.

5. What This Means for the Indian Dairy Sector

Amul’s expansion sends ripple effects across the entire dairy ecosystem:

| Sector Component | Implication |

|---|---|

| Private Dairy Brands | Will need to accelerate innovation and price competitiveness |

| Regional Cooperatives (e.g. Nandini, Verka) | May seek state support or federation-level tie-ups to compete |

| Export Ambitions | Amul’s enhanced capacity may support growth in Southeast Asia, MENA, and potentially Russia. |

| Farmer Income Linkage | Higher-value-added processing could mean better milk prices — if margin sharing is structured effectively. |

| Dairy Infrastructure Policy | Reinforces the need for allied cold chain, warehousing, and export subsidy frameworks |

Final Take

This is not just another investment headline. It’s a transformative signal that India’s dairy sector is transitioning into a value-led, technology-backed, export-oriented era — and GCMMF is positioning Amul at its helm.

For policymakers, this underlines the need to:

- Support large-scale cooperative expansions

- Push dairy innovation and product R&D

- Align export certification and infrastructure with new market ambitions

And for industry players — both cooperatives and private — the message is clear:

Compete on efficiency, brand trust, and value-addition — not just volume.