A bullish outlook for global dairy markets, driven by tightening supply and strong Chinese demand, has prompted the Bank of New Zealand (BNZ) to revise its 2025-26 milk price forecast upward to NZD 10.25/kgMS. This makes it the highest forecast to date, surpassing Fonterra’s midpoint projection by 25 cents.

BNZ Senior Economist Doug Steel attributed the upgrade to improving global macroeconomic sentiment, tightening milk supplies in key markets, and a resolution of trade disputes — notably between New Zealand and Canada — that have brightened the demand landscape for dairy exports.

“Several interconnected factors — from declining EU milk output due to weather and disease, to low Chinese whole milk powder (WMP) inventories, and firm fertiliser prices — are reinforcing a more optimistic global dairy outlook than we initially anticipated,” said Steel.

The forecast is particularly significant given that the 2024-25 season’s final price — set to be confirmed in October — is expected to surpass NZD 10/kgMS for the first time, signalling sustained high returns for producers.

Chinese Demand Recharges Global Dairy Trade

At the heart of the bullish price outlook is resurgent Chinese demand. Recent data from NZX shows Chinese WMP inventories were down 63% year-on-year in June, despite a 19% month-on-month lift — reinforcing concerns over tight domestic stocks. This shortage is expected to bolster demand through Q4, traditionally a high-consumption period ahead of the Chinese New Year.

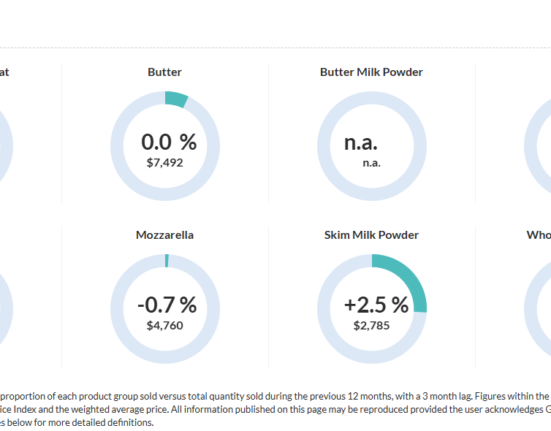

The most recent Global Dairy Trade (GDT) auction saw WMP prices climb 2.1% to USD 4,012/MT, helping push the overall index up by 0.7%. Steel noted that this modest lift was stronger than it appeared, given seasonal volume increases and a strengthening USD.

Fonterra’s collections in June saw a sharp +43% year-on-year rise in South Island supply, though it’s important to note this comes at a seasonal production trough. Nationally, milk production has increased by 3.4% year-to-date, with non-Fonterra processors posting even more substantial gains — up 26.1% in June and pushing above 30% monthly market share for the first time.

High Prices Spur Production and Storage Constraints in NZ

Warmer temperatures, increased rainfall, and improved cow condition are setting New Zealand up for a strong peak season. Soil moisture levels remain high, and anecdotal evidence points to “excellent pasture availability” — factors that are likely to drive an expected 2% increase in national milk output this season.

The high price environment has also incentivised dairy conversions, particularly in Canterbury, where over 15,000 new cows have been approved for production in the past six months. Storage space is already under strain, with chilled warehouse capacity “booked out” across New Zealand.

Global Market Dynamics: EU, US, and Southeast Asia

The European dairy sector is grappling with export competitiveness challenges. EU SMP exports to Algeria fell 51% in Q1 2025, though gains in Nigeria and Indonesia helped balance the ledger. The Algerian Government’s upcoming SMP tender will likely be a bellwether for EU pricing and market tightness.

In the US, volatility and rising freight costs have softened SMP export interest, despite competitive pricing. US exports to Asia fell 32% in April, and buyers remain wary of mid-shipment tariffs.

Meanwhile, Southeast Asian markets are stepping in with solid demand for both WMP and SMP, helping to support prices amid global supply volatility.

Analyst Outlook: Risks and Rewards Remain

Steel cautioned that while the outlook is strong, risks remain. Geopolitical instability, inflation concerns, and potential oversupply from high milk-to-feed ratios — particularly in the US — could temper price growth.

“If GDT prices hold steady or climb further, the NZ milk price could exceed even current elevated forecasts. However, the balance remains delicate,” Steel noted.

With favourable conditions aligning across China, New Zealand, and Southeast Asia — but counterweighted by global trade uncertainty — the stage is set for a pivotal season in global dairy markets.