📰 EU Dairy Supply Sees Mixed Trends in Q4 2024 Amid Market and Policy Pressures

Supply surge in butter and SMP contrasts with shrinking cheese and WMP output

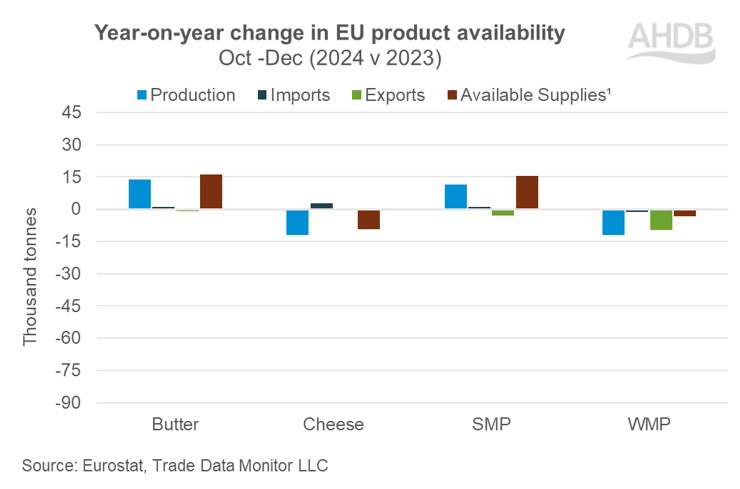

In the final quarter of 2024, the European Union’s dairy sector experienced a complex shift in product availability, marked by growth in butter and skimmed milk powder (SMP) supplies, while cheese and whole milk powder (WMP) faced noticeable declines. These trends reflect both supply-side dynamics and evolving trade patterns influenced by prices, policy changes, and global demand.

Butter and SMP Lead the Way

The EU witnessed a modest rise in milk deliveries—up 201 million litres (0.6%) year-on-year in Q4—fueling increased production of butter and SMP. Available butter supplies rose significantly, supported by higher domestic production and a slight uptick in imports. However, elevated butter prices limited its export competitiveness, causing a dip in international shipments. Still, strong seasonal domestic demand helped sustain production momentum, especially during the holiday season.

Similarly, SMP saw a 10.3% increase in available supplies. Production grew by 3.9% and imports by 11.9%, although exports slipped by 2.1%, with notable declines to Middle Eastern, South African, and parts of Asia and Africa markets.

Cheese and WMP Feel the Squeeze

In contrast, cheese availability declined, driven primarily by a significant drop in production. Export levels remained steady compared to last year, but lackluster international demand provided little incentive for processors to ramp up output. The domestic market held stable, cushioning the dip.

Meanwhile, WMP production declined as processors diverted more milk toward butter output. Weaker demand from the confectionery sector and lower exports, particularly to the Middle East, Africa, and Asia, contributed to a 4.3% decline in available WMP supplies.

Dairy Exports Up, But Outlook Clouded

Despite product-specific downturns, total EU dairy exports grew 18.6% year-on-year in Q4 2024. This uptick was largely driven by increased shipments of milk, cream, yoghurt, and whey. Key growth regions included the UK, US, and Asia, although butter and WMP exports shrank under price pressure.

Structural Shifts and Policy Risks

Looking ahead, supply trends may soften. A Rabobank report forecasts a 0.2% decline in EU milk production over the medium term (2024–2035), exacerbated by herd reductions, environmental constraints, and recurring disease outbreaks such as Bluetongue and FMD. For the first half of 2025, milk output is expected to contract by 0.32%.

Adding to the uncertainty, new trade tariffs imposed by the Trump administration—effective from April 5—could disrupt EU dairy export flows. These changes may prompt a realignment in global market access and shelf presence based on price competitiveness.

Despite these headwinds, stable consumer demand, bolstered by rising disposable incomes, may help offset some of the volatility—though inflationary pressure in retail and food sectors remains a concern.