Ornua’s December 2025 market report presents a cautious assessment of global dairy markets, highlighting a widening imbalance between milk supply growth and demand. While consumption remains broadly steady across key regions, it is not strong enough to absorb the significant increase in supply expected in the final quarter of the year, particularly in Europe.

European dairy commodity prices continued to ease through late 2025, reflecting persistently weak market sentiment. This softness has been exacerbated by stronger-than-anticipated milk collections, with EU-27 supply now forecast to rise by approximately 4.0% in the fourth quarter alone. Against this backdrop, buyers are increasingly reluctant to commit to forward purchases, especially as Q1 2026 futures remain flat or weaker.

Supply growth outpacing demand

Globally, milk supply growth has exceeded earlier expectations. Ornua estimates that worldwide milk production will increase by around 2.2% in 2025. While demand has not deteriorated, it has failed to accelerate sufficiently to clear the additional volumes coming onto the market. As a result, product availability has increased, and near-term pricing power remains limited.

Ornua notes that demand typically improves in the second quarter of the year, but a meaningful recovery in prices will depend on a tightening of milk supply. Until then, the market is likely to remain under pressure.

Exporters: widespread expansion

Milk collections among major exporting regions rose by 4.3% in October, with most regions contributing to the expansion:

EU-27: Collections increased by 4.2% in September and by approximately 5.0% in October.

United States: Milk supply remained strong, expanding by a further 3.7% in October.

New Zealand: Output continues to grow, supported by favourable pasture conditions.

Argentina: Milk production is improving, driven by the removal of export subsidies and higher yields per cow.

In contrast, Australia is expected to see a contraction of around 2.0% in 2025 due to adverse weather conditions and rising production costs. In China, milk output is forecast to decline over the year, although Ornua reports signs of stabilisation in recent months.

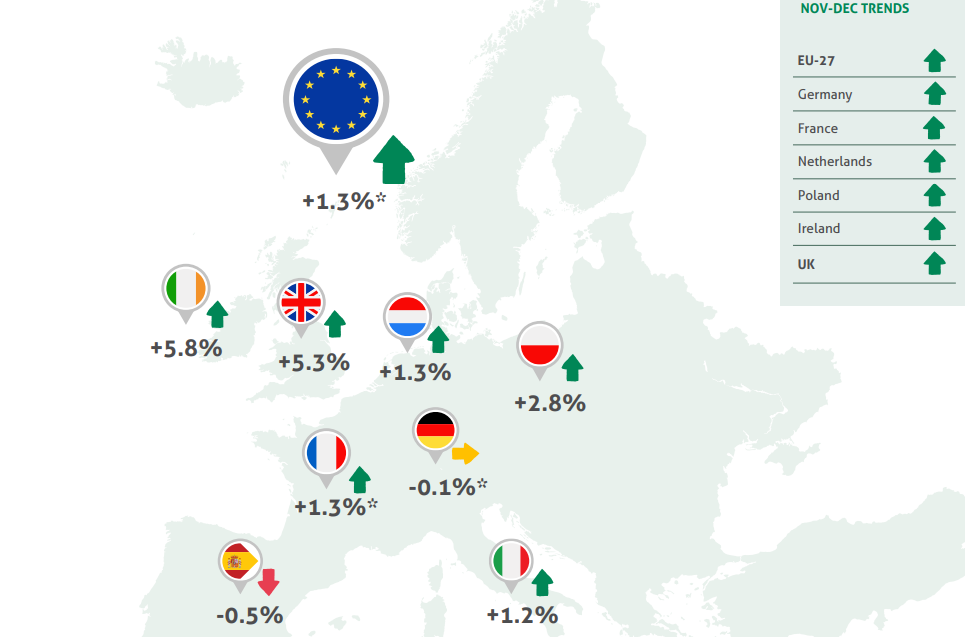

Europe: stronger collections surprise the market

European milk supply exceeded expectations in both September and October. Improved margins, higher yield per cow and effective control of bluetongue contributed to the uplift. As a result, Ornua revised its annual EU milk growth forecast for 2025 upward from +0.5% to +1.5%.

Performance across individual markets was notably strong:

Ireland: October production rose by 5.2%, although growth is expected to moderate.

France and Germany: Both countries recorded stronger-than-anticipated growth in September and October, largely yield-driven.

The Netherlands: October collections reached a record high, again underpinned by higher yields.

Poland: Milk supply has expanded consistently throughout 2025, with October up 4.4%.

United Kingdom: Output rose sharply, increasing by 6.2% in September and 7.0% in October.

Outlook for 2026

Looking ahead, Ornua expects EU-27 milk collections to ease in 2026, potentially declining by around 1.0%, with most of the contraction occurring in the second half of the year. Irish milk flows are also forecast to weaken slightly, while recent bluetongue cases in Northern Ireland remain a risk factor. Commodity futures remain flat, and buying activity for January 2026 is described as “usually quiet”. With supply still ample, European dairy commodity prices are unlikely to show significant improvement in the first quarter of 2026.

However, Ornua anticipates that once prices stabilise and demand improves, buyers will return to the market, with activity typically picking up in Q2. The pace and scale of any recovery will depend on how quickly lower milk prices begin to curb production growth. While a price recovery is expected in the second half of 2026 under a scenario of easing supply and improving demand, Ornua cautions that a return to the price levels seen in early 2025 is unlikely.