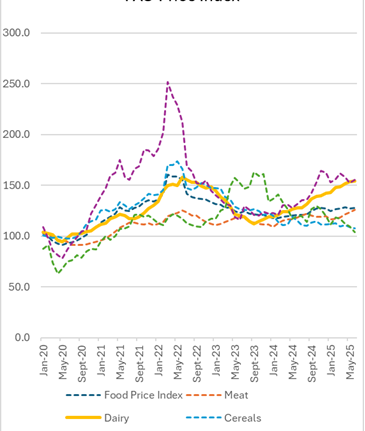

The global dairy industry is entering an era of steady expansion, driven by rising worldwide demand for dairy products. IndexBox’s latest report delivers a comprehensive analysis of the dairy produce market—covering market forecasts, consumption trends, production statistics, and international trade dynamics. This article breaks down the report’s findings to help industry professionals, investors, and enthusiasts understand where the dairy market is headed.

A Promising Outlook: Market Forecast

According to IndexBox, the global dairy market is set to experience robust growth over the next decade. Analysts project a compound annual growth rate (CAGR) of +1.8% from 2024 to 2035. This growth trajectory is expected to drive market volume to 1,469 million tons and increase market value to an impressive $1,488.9 billion by 2035. Such forecasts highlight a landscape ripe with opportunities, suggesting that both producers and traders should prepare for an increasingly competitive market.

Shifts in Global Dairy Consumption

Consumption Trends on a Global Scale

While global dairy consumption has largely experienced upward momentum over the past decade, 2024 witnessed a slight dip of -0.5%, bringing total consumption to 1,207 million tons. This minor decline followed eleven years of consistent growth, where consumption had peaked at 1,213 million tons in 2023. Despite these fluctuations, the long-term trend remains positive, with an average annual growth rate of +1.8% recorded between 2013 and 2024.

Key Consumer Markets and Per Capita Insights

India, the United States, and Pakistan lead global dairy consumption, together accounting for 37% of the market. Notably, India not only ranks as a top consumer with 246 million tons but also boasts the fastest growth rate, with a CAGR of +5.0%. In terms of per capita consumption, New Zealand stands out by an impressive margin—registering 5,567 kg per person. Other notable leaders include Germany, France, and the United States, though the global average sits at a modest 149 kg per person.

Product Preferences Driving Consumption

Whole fresh milk dominates the consumption landscape, accounting for 80% of total dairy volume at 960 million tons. Skim milk and yoghurt/fermented milk follow behind, each contributing to the diversity of consumer choices. The report indicates that whole fresh milk consumption grew at an average annual rate of +2.0% from 2013 to 2024, reinforcing its position as the market’s cornerstone product.

Production: Sustaining Growth Amidst Fluctuations

The production side of the dairy market presents a similar story of steady expansion. Although 2024 saw a slight contraction of -0.6%—bringing global production to 1,205 million tons—the industry maintained an average growth rate of +1.8% over the past decade. India, the United States, and Pakistan again lead the production charts, contributing a combined 38% of the total output. Once more, whole fresh milk emerges as the primary product, emphasizing its critical role in both consumption and production dynamics.

Navigating International Trade: Imports and Exports

Dairy Imports: Steady, Yet Evolving

Global imports of dairy produce slightly decreased by -1.1% in 2024, totaling 33 million tons. Although this marks a downturn following years of growth, the overall import trend from 2013 to 2024 shows an average annual increase of +1.1%. Key importing countries include Germany, the Netherlands, Belgium, Italy, and China—collectively accounting for 37% of total imports. Whole fresh milk, cheese, and powdered milk make up roughly 71% of imported dairy products, underscoring their pivotal role in international trade. Import pricing also reflects a dynamic market, with an average price of $2,797 per ton in 2024, down by 3.3% from the previous year.

Dairy Exports: A Balancing Act

On the export front, the global dairy market shipped approximately 31 million tons in 2024—a 6.3% decline from 2023 figures. However, the long-term export trend remains relatively flat, with significant market players such as Germany, New Zealand, the Netherlands, France, and Belgium leading the charge. In value terms, dairy exports were valued at $91.3 billion in 2024, after peaking in 2023. Key exported products include whole fresh milk, cheese, and powdered milk, with cheese alone representing a dominant share of export value at $40.9 billion. Average export prices remained steady at $2,917 per ton, reflecting the market’s stability amid global trade fluctuations.

Conclusion: Strategic Insights for a Dynamic Market

IndexBox’s new report provides critical insights into the global dairy produce market, highlighting steady growth and the evolving dynamics of consumption, production, and trade. With projections of increased volume and value by 2035, industry stakeholders—from farmers and manufacturers to importers and exporters—must adapt to seize emerging opportunities. Whether you’re looking to invest or simply stay informed about market trends, this report serves as an essential resource for navigating the complex, ever-changing dairy landscape.

For a more detailed analysis and additional data, consider downloading the full report from IndexBox to stay ahead in this dynamic industry.