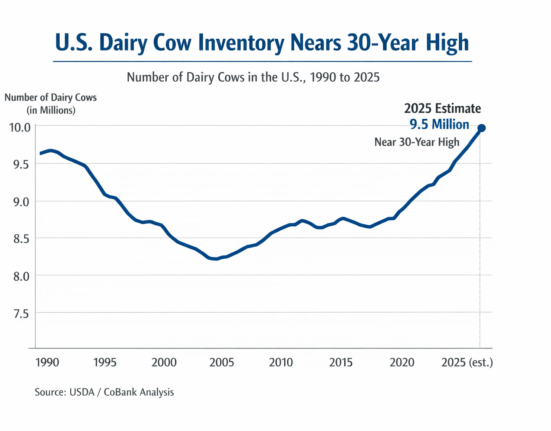

Abundant milk supplies from key producing regions continue to depress global dairy commodity markets, with the latest Global Dairy Trade (GDT) auction recording its sixth consecutive decline. The overall index fell 2.4%, reflecting persistent downward pressure driven by oversupply conditions and softening demand.

Whole milk powder (WMP), the market’s cornerstone product, dropped 2.7% to US$3,503/MT, extending its steady decline from US$4,036/MT in August. The consistent price slide signals weakened buyer momentum and growing market hesitation.

Cristina Alvarado, NZX’s head of dairy insights, said the auction results aligned with expectations. “The result reflects a market weighed down by abundant milk supplies from New Zealand, Europe, the US and Argentina, while demand has softened following heavy buying earlier in the season,” she explained.

Seasonal buying cycles also appear to be contributing to reduced urgency. With the product now aligned to key consumption windows, including Christmas, New Year, Chinese New Year, and Ramadan, buyers are maintaining current coverage rather than extending commitments.

This marks the fifth straight drop for WMP across GDT Events, despite strong export flows. New Zealand’s WMP exports were up 12% year on year in September, indicating that a substantial volume of product has already been contracted, minimising fresh impulse buying at auction.

Alvarado noted that buyers remain firmly in a hand-to-mouth purchasing pattern, reflecting muted import demand from Southeast Asia and Oceania. Limited forward buying reinforces the view that market fundamentals will stay weak until either supply tightens or demand strengthens.

With milk output remaining high across major producing regions and inventories well-positioned, global dairy prices face ongoing resistance, suggesting further pricing pressure in upcoming auctions.