A Structural Shift in Taxation

On 22 September 2025, the Goods and Services Tax (GST) Council ushered in a landmark reform for India’s food and dairy industry. The new structure rationalises the earlier four-tier system into a streamlined two-slab regime, with essentials largely brought under nil or 5% GST. For dairy, the impact is immediate and far-reaching:

- Paneer (pre-packaged) and UHT milk are now exempt (0%).

- Ghee, butter, butter oil, and cheese have moved from 12% to 5%.

- Other value-added dairy categories, such as ice cream, have also been reduced to 5%.

This reset is more than a tax cut; it is a recalibration of affordability, competitiveness, and sectoral formalisation.

Affordability and Consumer Access

For the average Indian household, dairy staples are non-negotiable. Even a 5–7% price reduction changes purchasing behaviour. The zero-rating of paneer and UHT milk, and the halving of GST on ghee and butter, will ease monthly grocery bills across income groups.

Mrs. Bhuvaneswari Nara, Vice Chairperson and Managing Director of Heritage Foods, noted:

“These essentials touch nearly 100% of Indian households. The reforms not only lighten the monthly grocery bill but also allow branded products to compete more effectively with unorganised players. Heritage Foods will pass on the full benefit to consumers and scale capacity to capture the expected market expansion.”

Such measures directly address the protein and nutrition gap in India, making high-quality dairy more accessible to families that had previously cut back or substituted with inferior alternatives due to cost pressures.

Rural Multiplier Effect

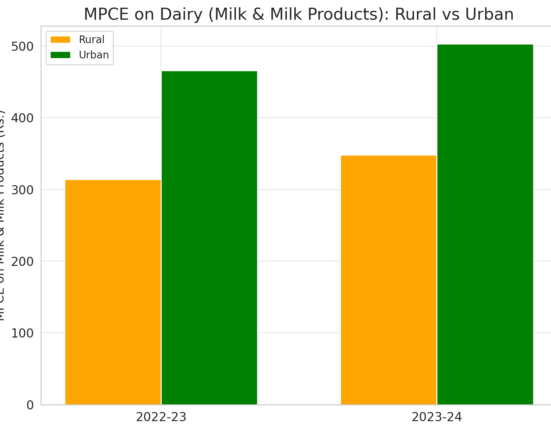

The most profound growth is likely to occur in semi-urban and rural India, where dairy consumption is deeply embedded in diets but constrained by price sensitivity. A few rupees saved per litre or per packet can unlock substantial incremental demand.

Devendra Shah, Chairman of Parag Milk Foods, emphasised the dual benefit:

“This move makes commonly consumed items more affordable in price-sensitive areas, while also giving farmers better income stability and the confidence to invest in cattle care and feed. Over time, this uplift translates into a better quality of life for dairy farming families.”

With over 80 million dairy farmer households engaged in production, even a modest rise in branded consumption strengthens procurement networks, ensures offtake, and underpins farmer livelihoods.

Formalisation and Supply Chain Gains

India’s dairy sector has long operated in two parallel streams: a vast informal supply chain with low compliance but attractive pricing, and a formal branded market competing under higher tax and regulatory costs. The GST rationalisation narrows this gap, creating an inflection point for formalisation.

Deepak Jolly, Chairperson of the Indian Food & Beverage Association (IFBA), framed the change as:

“A watershed moment that simplifies compliance, expands affordability, and encourages innovation across the food and beverage sector.”

Ravin Saluja, Director of Sterling Agro Industries (Nova Dairy), echoed this sentiment:

“Nova Dairy appreciates wholeheartedly the GST 2.0 reforms as a milestone step towards affordability, fairness, and all-around development. The simplification of tax slabs to 5% and 18% with more dairy necessities falling under the 5% slab renders classic staples such as ghee and butter easier for India’s low- and middle-income families to access—lightening family budgets without any sacrifice on quality or tradition.

For the ₹19 lakh crore dairy sector, this is a welcome fillip. De-tariffing lowers adulteration, raises demand, and reinforces the leverage of organized, branded players. But more significantly, it comes directly to the rescue of over 8 crore dairy-farming households by helping rural incomes and creating larger markets.

We look forward to a favourable change in consumer taste towards hygienic, branded dairy products—galvanizing innovation, safety, and quality. As we enter the festival season, GST 2.0 is not only a tax reform; it’s a celebration of India’s food culture, economic strength, and inclusive growth. Nova Dairy is committed to assist in bringing these gains to all parts of the nation.”

By levelling the field, the reforms are expected to:

- Draw more consumers into the formal sector, improving food safety and trust.

- Reduce incentives for tax evasion and adulteration.

- Encourage investment in distribution, cold chain, and farmer extension services.

Strategic Implications for Dairy Businesses

The tax relief provides headroom for companies to reinvest in capacity, innovation, and farmer development. Heritage Foods has already confirmed capacity ramp-ups, while others such as Parag Milk Foods and Nova Dairy are focusing on strengthening farmer linkages and innovation pipelines. Dairy boards and cooperatives are expected to leverage lower tax incidence to expand branded portfolios and upgrade infrastructure such as chilling centres and packaging lines.

Crucially, these reforms arrive ahead of the festive season – traditionally a peak period for ghee, paneer, and sweet-making ingredients. For organised players, this is an opportunity to consolidate market share from the fragmented unorganised sector.

Outlook: Towards Inclusive Growth

The GST reset should be seen as more than fiscal policy. It is a lever for:

- Nutritional security – improving access to protein and calcium across socio-economic strata.

- Farmer empowerment – generating stable demand and incentivising better productivity.

- Formalisation – narrowing the grey market and strengthening consumer trust in quality.

- Sector expansion – unlocking higher volume growth, which analysts expect to outpace the broader FMCG market in the medium term.

India’s dairy economy, valued at nearly ₹19 trillion, is entering a new cycle of affordability-driven growth. For consumers, it means more milk, paneer, ghee, and butter at fairer prices. For farmers, it offers stability and reinvestment in productivity. For businesses, it represents a structural advantage in building stronger brands and supply chains.

The new GST regime is therefore not just a tax reform – it is a catalyst for the next phase of India’s dairy ascendancy, where affordability, quality, and inclusivity converge to reshape both demand and supply.