India is unexpectedly carving out a strong position in the global mozzarella market, challenging long-established Western suppliers and signalling a strategic shift in the country’s dairy export ecosystem. Fresh trade data indicate that India’s mozzarella exports, previously negligible, have expanded at an extraordinary pace over the past three years despite continued pressure from trade partners seeking greater access to India’s protected dairy market.

According to government data reviewed by Mint, mozzarella exports climbed from nil in FY23 to $0.71 million in FY24, rising further to $2.29 million in FY25. The momentum has accelerated dramatically in the current fiscal year, with exports touching $3.29 million in April–September 2025, representing a year-on-year increase of more than 1,200%. This sits within a broader surge in India’s dairy exports, which reached $493 million in FY25, up 80% from the previous year.

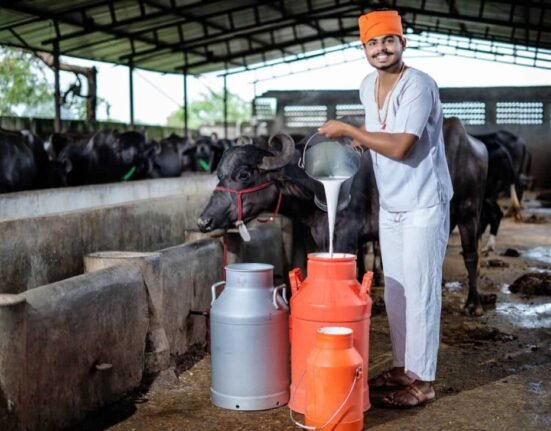

Buffalo-Milk Advantage and Shifting Global Dynamics

Industry analysts attribute India’s newfound export competitiveness to a mix of structural strengths and evolving global consumption trends. The global appetite for pizza continues to expand, and with it the demand for mozzarella, particularly the firmer, high-fat variety made from buffalo milk.

Tarun Shridhar, former secretary of animal husbandry & dairying and director general of the Indian Chamber of Food and Agriculture (ICFA), notes that mozzarella in India is predominantly buffalo-milk based, giving it a distinctive texture prized by industrial buyers. With the world’s largest buffalo population, India enjoys a natural comparative advantage that is now being translated into export performance.

Exporters report increasing recognition of buffalo-milk mozzarella among international buyers, helping India move gradually up the dairy value chain long dominated by Europe, the United States and New Zealand.

PLI Scheme Spurs Investment and Capacity Expansion

A decisive factor behind the export surge has been the government’s move to include mozzarella under the Production-Linked Incentive (PLI) scheme in 2021. This policy has encouraged dairy companies to invest in modern processing technologies and enhance manufacturing capacities.

Amul, the country’s largest dairy cooperative, invested ₹200 crore to scale up production of buffalo-milk mozzarella for both domestic and export markets, a plan originally announced in 2021. Rupinder Singh Sodhi, president of the Indian Dairy Association and former managing director of Amul’s parent federation, emphasised that India now possesses surplus cheese-making capacity along with globally competitive prices for butter and cheese commodities.

Expanding Export Markets Across Regions

Demand from the Middle East, North Africa and parts of Eastern Europe has been particularly strong. According to Sudarshan Patil, Manager of Finance at Maharashtra-based Sonai Dairy, markets such as Morocco, Egypt, and Georgia are driving growing orders not only for mozzarella but also for other cheese varieties, like cheddar.

These developments suggest that India’s dairy sector is shifting its focus beyond traditional milk-powder-led exports towards higher-value processed dairy products, a strategic transition that could position the country as a more influential player in the global dairy trade over the next decade.