Introduction

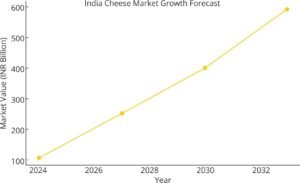

India’s cheese industry is undergoing a structural shift. What was once a small, urban-concentrated indulgence category is now gaining strategic significance within the dairy economy. The rise of food-service formats such as pizza chains, burger QSRs, bakery cafés and modern retail stores has transformed how cheese is perceived and consumed. A new generation of consumers sees cheese less as a Western novelty and more as an everyday protein that improves meal convenience, taste and nutrition.

India’s cheese industry is undergoing a structural shift. What was once a small, urban-concentrated indulgence category is now gaining strategic significance within the dairy economy. The rise of food-service formats such as pizza chains, burger QSRs, bakery cafés and modern retail stores has transformed how cheese is perceived and consumed. A new generation of consumers sees cheese less as a Western novelty and more as an everyday protein that improves meal convenience, taste and nutrition.

For dairy processors seeking higher margins and insulation from volatile liquid milk economics, cheese represents a clear path to stronger value capture — but one that demands tight integration of milk quality, processing efficiency, market positioning and logistics discipline.

“Cheese is fast becoming the most powerful value-add story emerging from Indian milk.”

Market Growth and Evolving Consumption

Urbanisation and the rapid expansion of organised food service have created a robust demand engine for mozzarella and processed cheese. Pizzas, burgers, sandwiches, and bakery preparations — once limited to metros — now drive mainstream consumption across India’s Tier-II and Tier-III towns. At the household level, cheese spreads, slices and snack formats are increasingly part of routine shopping baskets, particularly for young families who value fast-to-prepare meal components with better protein density.

As disposable incomes increase and palates evolve, premium cheese experiences are also emerging. Small artisanal producers and established brands are experimenting with localised products, region-inspired flavours, and cleaner labels, signalling a market diversifying beyond commodity formats.

Production Efficiency and Milk Quality — Unlocking Yield

Cheese manufacturing economics are fundamentally driven by yield and repeatability. India faces structural barriers on both fronts. Milk quality can vary significantly by season and geography, with shifts in fat and protein affecting consistency and curd recovery. Somatic cell count (SCC) management is inconsistent, and antibiotic residues — even at low frequency — pose compliance risks and potential batch rejections.

Process plants also grapple with high energy utilisation, labour dependence, and shrinkage caused by manual intervention. Without automation in key steps such as curd cutting, whey handling and ripening control, cost per kilogram remains elevated. To build competitive unit economics, processors must implement tighter upstream QA, invest in modernisation, and cultivate a strong hygiene-based culture across the value chain.

“Yield, hygiene and temperature discipline are worth more than stainless steel — if upstream QA is weak, downstream capex won’t save margins.”

Export Potential — Execution-Heavy but Promising

India has a credibility and price advantage in select export markets, particularly the GCC and parts of Southeast Asia, where food-service mozzarella and processed cheese are in steady demand. However, global buyers expect

- Strict consistency in baking and melting performance

- Robust packaging integrity to prevent moisture loss

- Certified compliance with microbiological and chemical standards

- Traceability documentation that protects against origin risks

Indian processors must demonstrate repeatability across multiple production cycles, provide tight service-level agreements, and invest in shelf-life validation through real-world transport simulations. Those who strengthen logistics and regulatory readiness will find a growing export opportunity that complements domestic growth.

Technological Upgrading and Valorisation

Modern cheese plants that succeed in competitive markets treat whey not as a by-product but as a monetisable ingredient stream. Membrane filtration technologies, such as ultrafiltration, improve standardisation and yield while enabling the conversion of whey into whey protein concentrates (WPC), lactose, and beverage bases. Automated curd handling reduces variability and labour intensity. Precision ripening under controlled humidity and temperature enhances product performance and customer satisfaction.

Investments in energy-efficient utilities further reduce the cost per kilogram. For India to unlock global competitiveness, such process innovations must move from isolated capex decisions to systematic production planning.

Quality-Linked Sourcing — A Win-Win Model

Sourcing programmes that pay farmers for measurable quality improvements have demonstrated excellent payback in cheese processing worldwide. When SCC and antibiotic residues are adequately controlled, yields improve, shrinkage reduces, and complaint rates drop. This creates a self-reinforcing cycle: processors recycle margin gains into farm-level incentives, while producers gradually invest in better hygiene, feed management, and veterinary oversight. Transparent communication of incentives and long-term procurement contracts helps stabilise seasonal supply fluctuations and reduce dependence on spot procurement markets.

“Premiums tied to measurable QA unlock win-wins — higher farm incomes and repeatable plant yields.”

Mass Versus Premium — Portfolio Strategy

India’s cheese market will bifurcate into two clear paths. The mass-market will continue to grow through processed cheese and mozzarella, supplying QSRs and institutional kitchens where consistency and cost leadership are key. The premium segment — small but rapidly evolving — will focus on cheeses with local identity, artisanal craftsmanship or functional benefits such as higher protein or cleaner labels. Brand trust will increasingly depend on transparency around sourcing, origin and process discipline. Traceability, farmer-share stories and antibiotic-free claims will drive differentiation.

Enabling Ecosystem and Policy Support

For India to accelerate cheese competitiveness, stakeholders need stronger cold-chain linkages, validated export corridors, and access to targeted financing for technology upgradation. Regulatory clarity around cheese grades and compositional requirements tailored to Indian conditions would provide manufacturers with a more precise roadmap.

Investment in local testing infrastructure — including SCC, antibiotic, and microbial monitoring — would standardise quality assurance and enhance both safety and profitability. Policy incentives encouraging dairy clusters that combine processing, packaging and logistics would reduce transaction costs and encourage scale.

A Sequenced Roadmap for 12–18 Months

A Sequenced Roadmap for 12–18 Months

Cheese ambitions must be matched with disciplined execution.

First 6 months: baseline QA parameters across catchments, launch a pilot premium sourcing programme with selected farms, and run energy and yield audits to identify technological priorities.

Mid-cycle: implement partial automation and launch a dual-tier portfolio—food-service core plus one premium SKU—to build brand presence.

Final phase: expand farmer onboarding, secure GCC buyer agreements, document traceability success stories, and reinvest margin gains into both brand building and farm improvement.

This phased transformation ensures both upstream and downstream capabilities strengthen in tandem.

Conclusion

Cheese is India’s clearest pathway to sustained value-added growth in dairy. When processors secure cheese-grade milk, drive efficiency through automation and whey monetisation, and communicate trust through traceability and performance, they unlock superior returns across the chain.

The winners will be those who build integrated systems that connect farm-level QA → efficient processing → disciplined cold chain → and differentiated market positioning. In doing so, Indian dairy will not only serve domestic aspirations but also compete credibly on the global stage.

By Prashant Tripathi