By 2030, India is expected to contribute nearly 30% of the world’s milk production, up from its current 24%. With an annual output exceeding 240 billion litres, India is no longer just a milk-producing giant‚ÄĒit’s a potential global dairy superpower. But here’s the critical question: Is India ready to handle a surplus dairy economy‚ÄĒand can it truly compete on the world stage?

While India’s domestic dairy success is rightly celebrated, the next phase of growth‚ÄĒsustainable, profitable exports‚ÄĒrequires more than just volume. It demands strategy, consistency, investment, and global vision.

ūüďą India’s Dairy Scale: A Remarkable Rise, But What Next?

From milk-deficient in the 1970s to self-sufficiency and surplus today, India’s dairy transformation is historic. With over 300 million cattle and 10 million producers‚ÄĒ75% of whom are women‚ÄĒIndia’s dairy sector is both socially embedded and economically vital.

However, in 2023‚Äď24, production growth slowed to 3.8%, compared to the previous trend of 6‚Äď7%. While this may seem like a decline, global milk production is growing at a rate of just 1% per year. In this context, India remains the world’s leading dairy producer.

By 2027‚Äď28, India could match the combined production of the top five dairy-exporting countries: New Zealand, the United States, the European Union, Australia, and Argentina. But production without corresponding export readiness creates a dangerous imbalance.

ūüßĪ Cracks in the Foundation: Surplus Without Strategy

India produces around 600,000 tonnes of skim milk powder (SMP) annually. In a typical year:

- 350,000 tonnes are used for recombination during the lean season.

- 150,000 tonnes are absorbed into domestic food applications.

- The rest‚ÄĒup to 100,000 tonnes or more‚ÄĒremains as unutilized surplus.

In recent years, this “rolling stock” has ballooned, reaching over 300,000 tonnes at times‚ÄĒdepressing SMP prices, straining processor cash flows, and undercutting farmer payments.

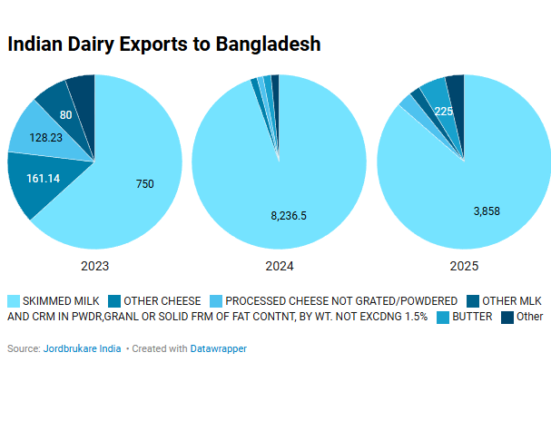

Exporting this surplus seems like an obvious solution. However, Indian SMP lacks global competitiveness in terms of¬†price, quality, and technical consistency. Global demand (especially from China) is soft, and India’s products often fail to meet the processing needs of global buyers.

‚ö†ÔłŹ Pitfalls for Indian Dairy in Global Markets

As a dairy policy and trade expert, I’ve identified five significant challenges that Indian dairy exporters must urgently address:

1. Inconsistent Quality Standards

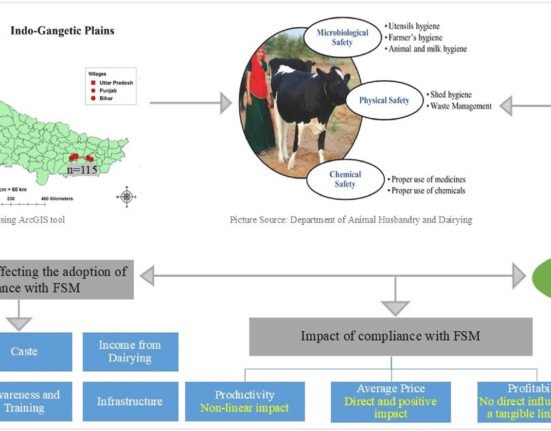

Global buyers demand product uniformity‚ÄĒbatch after batch, year after year. India’s fragmented milk procurement system, reliance on smallholders, and limited bulk milk cooling create challenges in maintaining consistent microbiological and compositional quality.

2. Limited Product Diversification

India continues to focus heavily on Medium Heat SMP and ghee. But the world needs Low Heat SMP (for cheese making), High Heat SMP (for recombined evaporated milk), and customised dairy ingredients. Specialised equipment and R&D are essential.

3. Regulatory Hurdles

Key target markets like the EU, China, and Russia require rigorous traceability, animal health certifications, and FSMS compliance. India must strengthen its food safety systems and negotiate bilateral equivalence agreements to ensure food safety.

4. Lack of Market Intelligence & Branding

Exporting isn’t just logistics‚ÄĒit’s market positioning. India lacks an international dairy auction system (like New Zealand’s GDT), global brand visibility (beyond Amul), or tailored B2B strategies in emerging markets.

5. Fragmented Industry Vision

India’s dairy policy remains inward-looking, focusing on self-sufficiency and affordability. Without aligning with export-oriented incentives, infrastructure, and trade diplomacy, we risk being left behind in a rapidly shifting global market.

‚úÖ Strategic Imperatives: From Quantity to Value

India’s future in global dairy exports lies not in bulk commodities, but in value-added, specialised, and culturally distinct products. Here’s how we get there:

ūüߨ A. Upgrade Processing Capabilities

Invest in technology to produce:

- Low & High Heat SMP

- Anhydrous Milk Fat (AMF)

- Lactose-free and fortified products

- Heat-stable dairy protein concentrates

- UHT and ambient dairy drinks

ūüď¶ B. Expand B2C Offerings

India’s proximity to Asia, the Gulf, and Africa gives it a significant advantage. Export potential exists in:

- UHT and flavoured milk

- Shelf-stable cream and dahi

- Ready-to-drink lassi

- Ice cream mixes and cheese spreads

ūüßÄ C. Leverage Buffalo Milk Advantage

India is the largest buffalo milk producer, giving ita  unique positioning in:

- Mozzarella (for pizza chains)

- White cheese (for West Asian markets)

- High-fat dairy bases for frozen desserts

ūüć¨ D. Innovate in Ethnic & Fusion Foods

India’s sweetmeats and dairy-rich desserts are in high demand globally. Shelf-stable, culturally adaptive versions of rasgulla, peda, and kheer could create a new category in international ethnic food aisles.

ūüĆé Who Should We Be Targeting?

India must move beyond traditional buyers and explore:

- East Aisa (once regulatory barriers ease)

- Africa (price-sensitive, high SMP/AMF demand)

- Russia and CIS countries

- Southeast Asia (ready for UHT and consumer dairy)

- Latin America (dairy-deficient zones like Mexico, Brazil)

And yes, India needs to set up an “Indian Dairy Export Exchange”‚ÄĒa transparent pricing and auction system to serve global B2B buyers, inspired by New Zealand’s GDT.

ūüĆź Conclusion: Lead or Lag?

India is poised to be the largest dairy economy in history. But scale is not strategy. If we don’t align our surplus with global demand, it will become a source of distress‚ÄĒfor farmers, processors, and policymakers alike.

Dairy export success demands:

- Visionary policy alignment

- Strategic investment in technology

- Market intelligence and product innovation

- Stronger public-private coordination

- Diplomatic and regulatory groundwork

The window of opportunity is open‚ÄĒbut not forever. If India acts decisively now, it can shift from being the world’s dairy workhorse to a globally respected dairy powerhouse.

Let’s not miss the moment.