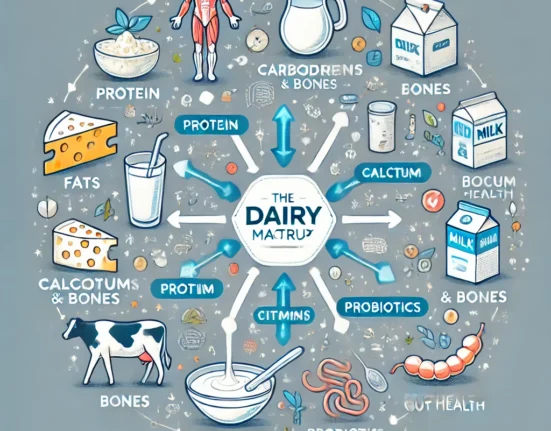

India’s Protein Gap Fuels Dairy and Nutrition Innovation: Startups and Giants Alike Rush to Fill the Deficit

As India grapples with a widening protein consumption gap, both startups and legacy dairy giants are racing to deliver innovative, functional, protein-rich products to meet rising consumer demand. With average daily protein supply at just 70.5 grams per person—well below global standards—experts say India’s protein market is on the cusp of transformation, and dairy is at the center of the action.

🥤 Startup Surge: Functional Formats Gain Traction

Be Brawn, a Noida-based startup, is leading the charge with protein-infused water, offering 20g of protein per 330ml can. Co-founder Aditya Rahul confirmed that the company is in advanced pre-seed funding talks, with a clear focus on breaking away from the saturated protein powder category.

“Consuming protein should be as simple as drinking water,” Rahul said. Be Brawn’s formula uses whey protein isolate and digestive enzymes, targeting urban consumers seeking convenience.

Similarly, Naturaltein, a Pune-based manufacturer of protein powder and supplements, is undergoing active investor evaluation. Venture capital interest is surging due to the rising awareness of India’s protein-deficient diets, particularly in urban areas. A 2024 IMRB survey found that over 90% of Indians are unaware of their protein needs, and 73% of urban diets fall short.

🧀 Dairy Giants Respond with Fortified Products

Legacy players are also taking advantage of the opportunity.

- Mother Dairy launched Pro Milk in the Delhi-NCR region, a protein-fortified milk offering 30% more protein than regular variants at ₹70 per litre.

- Amul has rolled out high-protein curd, protein powders, and ready-to-drink shakes.

- Britannia added protein-rich bread and biscuits to its product line.

“Pro Milk provides about 40 grams more protein per serving,” said Manish Bandlish, MD of Mother Dairy. “It will help democratize the protein market.”

🥗 Traditional Foods Get a Protein Makeover

iD Fresh Foods, known for its ready-to-cook South Indian staples, has introduced a high-protein idli-dosa batter. CEO Rajat Diwaker said the goal is to make functional nutrition more accessible through culturally familiar formats. “It’s about adding value without changing habits,” he noted.

📊 A Market Poised for Growth

India’s protein supplement market was valued at $1.4 billion in 2024, projected to reach $1.8 billion by 2029, according to Mordor Intelligence. Investors are now prioritising format innovation and brand differentiation.

For example:

-

Super You, a startup backed by actor Ranveer Singh and Rainmatter Capital, has launched protein-rich snacks, including wafer bars and multigrain chips, with 10g of protein per 40g pack.

“Urban India is waking up to protein’s role in health,” said Zoeb Ali Khan of Sauce.vc, early backers of The Whole Truth, which raised $15M in a Series C round this year.

⚠️ Regulatory Scrutiny Rises

Despite market momentum, regulators are tightening oversight. In May, the National Institute of Nutrition (NIN), under the Indian Council of Medical Research (ICMR), issued advisories warning against the excessive use of protein supplements for muscle building. The FSSAI now enforces strict guidelines for nutraceuticals to mitigate the risk associated with kidney and heart health.

Be Brawn’s Aditya Rahul clarified that their product complies with all norms and holds certifications, including:

- FSSAI license

- HACCP (Hazard Analysis Critical Control Point)

- GMP (Good Manufacturing Practices)