Tehran, May 2025 ‚Äď Iran has witnessed a dramatic 43% surge in the value of dairy exports in 2024, despite a historic low in per capita domestic dairy consumption‚ÄĒa paradox that is drawing increasing concern from public health experts, economists, and food policy analysts.

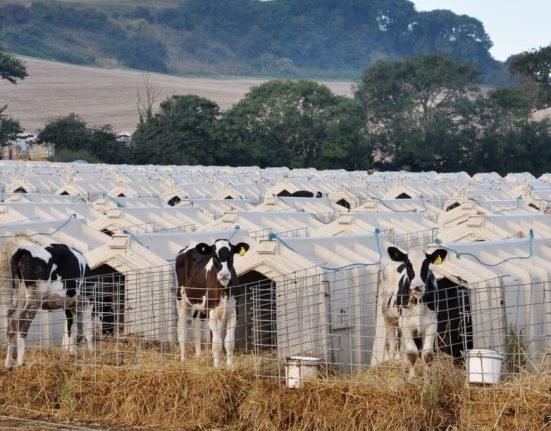

According to data released by Iran’s Customs Office, over 587,347 tons of dairy products valued at nearly $948.9 million were exported to 46 countries, marking a significant uptick from previous years. This rise in export volume coincides with global price increases in powdered milk, strengthening speculation that raw milk is being diverted from domestic supply to maximize export revenue.

ūüďČ A 58% Drop in Dairy Intake Since 2010

Iran‚Äôs per capita dairy consumption has fallen from 130 kg in 2010 to just 55 kg in 2024, far below the global average of 150‚Äď160 kg, and significantly less than countries like France or Denmark, where consumption exceeds 250‚Äď300 kg per person annually.

‚ÄúThis is not a shift in consumer preference‚ÄĒit‚Äôs a crisis driven by affordability,‚ÄĚ says a senior nutritionist in Tehran.

ūüö® Export Incentives vs. Public Nutrition

While rising exports have benefited dairy processors‚ÄĒwho continue to enjoy government-subsidized livestock feed‚ÄĒconsumers have been left behind. Dairy prices have soared, pushing essential products like milk and yogurt out of the reach of many Iranian households.

Health officials are warning of long-term consequences:

- Increased calcium deficiency and osteoporosis

- Stunted growth among children

- Worsening health outcomes for the elderly and low-income populations

ūüßģ Milk Inflation Explained: 65‚Äď90% Price Hike Forecast

On May 17, Iran’s government announced a significant raw milk price hike, raising the base procurement rate by 50,000 rials per kg. Given that raw milk contributes 27.7% to the final cost of dairy products, analysts estimate that consumer prices could rise by up to 90%.

- A 1L packet of pasteurized low-fat milk could rise from 390,000 rials to 550,000+ rials (~$0.66)

- Cheese and yogurt prices are expected to follow similar inflationary trends

ūüď¶ The Powdered Milk Factor: Feeding Export, Starving Domestic Supply

Iran‚Äôs dairy industry has increasingly focused on powdered milk production, which fetches high returns in global markets. Critics argue this pivot is not just opportunistic‚ÄĒit‚Äôs strategic, aimed at channeling government-subsidized milk into export products while inflating domestic prices.

Between 2021 and 2024, Iranian families faced:

- Powdered milk rationing by national ID

- Distribution bottlenecks

- Black-market exploitation

ūüß≠ Expert Consensus: Iran‚Äôs Dairy Sector is Prioritizing Export Revenue Over Public Health

Industry insiders and food economists alike have questioned the long-term sustainability of this export-first model. Despite the availability of subsidies to support local production, very little direct support reaches consumers.

‚ÄúRedirecting subsidies toward end consumers, instead of producers, might have prevented this nutritional decline,‚ÄĚ noted Mohammadreza Banitaba, former spokesperson of Iran‚Äôs Dairy Industry Association.

ūüďä Dairy Policy Lessons for India & the Global South

The Iranian case offers a cautionary tale for countries like India, where balancing dairy exports, farmer income, and public nutrition remains a complex challenge.

While dairy exports support national GDP and rural livelihoods, unchecked price hikes and consumer neglect can reverse decades of nutritional progress.

India’s focus on fortified milk, cooperative pricing models, and milk inclusion in school meal programs offers a more balanced approach to dairy sector development.