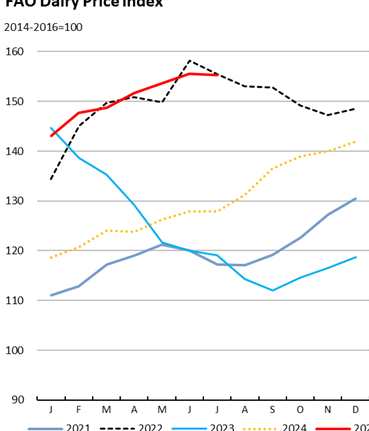

The UK dairy sector is under intensifying pressure as global milk production accelerates across Britain, the EU and the US, creating a synchronised oversupply. Promar International reports that rising inventories and only modest demand growth are pushing international dairy commodity prices down sharply.

PromarŌĆÖs managing director, David Eudall, stresses that while prices show little sign of recovery, farmers can still protect margins. Targeted efficiency gains such as better feed optimisation, youngstock performance, energy use and daily routines can materially reduce cost per litre. Immediate action, he argues, is essential to prevent short-term volatility from evolving into deeper structural challenges.

Processors are also moving to stabilise the market. Ahead of the spring flush, UK processors are tightening volume controls, with seasonality-based payment mechanisms discouraging excess spring production. Muller, working with MMG Dairy Farmers, has updated its pricing structure after on-farm collections rose five per cent in 2025, an increase equivalent to 100 extra tankers per week, and forecasts a December surplus above 12.5 per cent.

With milk prices sliding towards 30p/litre, the sector faces a prolonged low-price phase. Analysts suggest that improved business discipline, tighter cashflow management and clearer benchmarking against top-performing herds will be critical in the months ahead. Some producers are also exploring diversification options, from contract adjustments to value-added on-farm processing, as they seek greater insulation from commodity volatility.

Ultimately, resilience will depend on decisive operational change and closer alignment with processor requirements, ensuring farms remain competitive even as global markets remain unsettled.