By Jordbrukare Analysis Team.

June 2025

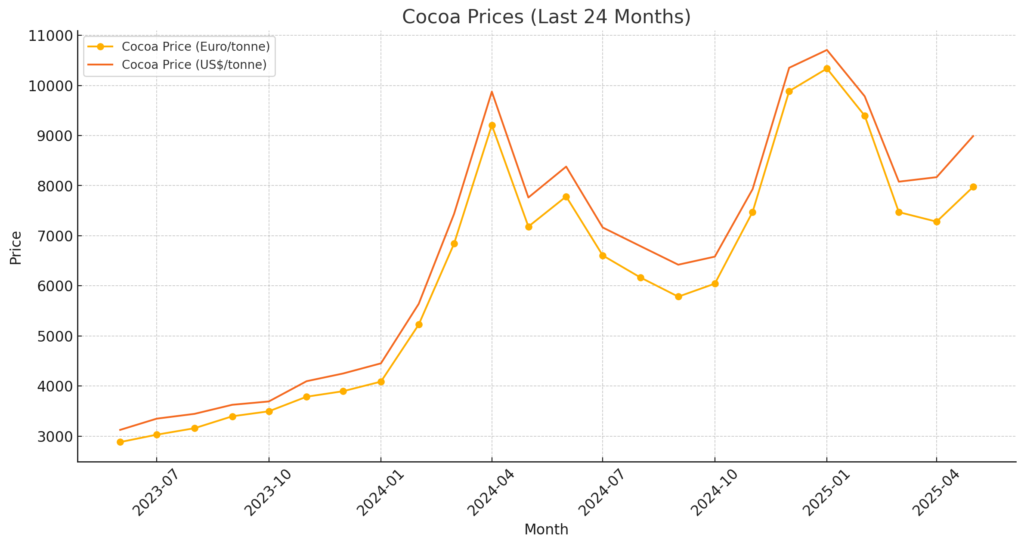

In a dramatic turn of events for the global food commodities market, cocoa prices have soared to unprecedented levels, shaking the foundations of the chocolate industry. As of May 2025, cocoa is trading at €7,975.96 per tonne, or nearly $9,000 per tonne, according to the latest commodity data, marking an increase of over 200% year-on-year and nearly 400% since early 2023.

This price surge, rooted in global supply shocks, is beginning to impact India’s rapidly expanding chocolate sector, from mass-market brands to boutique chocolatiers and confectionery exporters.

📈 Cocoa Prices: The Multi-Year High

Between January 2023 and January 2025, cocoa prices climbed from €2,357.59 to €10,338.01 per tonne, peaking in early 2025. Though prices cooled marginally in May, the current levels remain well above long-term averages and continue to pressure procurement and profitability.

5-Year Snapshot of Cocoa Prices (Euro/tonne)

| Month | Price (€) | YoY Growth |

|---|---|---|

| Jan 2023 | 2,357.59 | – |

| Jan 2024 | 4,087.55 | +73% |

| Jan 2025 | 10,338.01 | +153% |

| May 2025 | 7,975.96 | +198% |

This spike has been primarily attributed to:

- Poor harvests in West Africa due to extreme weather and diseases

- Labour shortages in Ghana and Côte d’Ivoire

- Speculative commodity trading

- Tight inventories and delayed shipments

🇮🇳 Impact on Indian Chocolate Makers

India, which consumes over 80,000 tonnes of cocoa annually but produces only about 30,000 tonnes, is heavily reliant on imports for its cocoa needs. This makes domestic manufacturers especially vulnerable to global price movements.

Key Effects on the Indian Market

- Input cost surge: Cocoa constitutes 35–50% of the raw material cost in chocolate production.

- Profit margin compression: Particularly in ₹10–₹20 price point SKUs.

- Price hikes and shrinkflation: Brands are reducing pack sizes or quietly increasing prices without notice.

- Export competitiveness is eroding: Indian exporters may lose their edge to producers with stronger hedging capabilities.

🔧 Potential Strategic Responses by Indian FMCG Players

| Company | Response Strategy |

|---|---|

| Mondelez India | Focus on portfolio rationalisation and pricing realignment for Dairy Milk and Bournville. |

| Amul | Exploring Ghanaian partnerships and value-engineering of select chocolate lines |

| ITC Fabelle | Likely to maintain luxury tier via smaller formats and premium positioning |

| Artisan Brands | Many are switching to compound chocolate or increasing the use of dairy solids. |

Some players are reportedly evaluating import substitution by enhancing domestic cocoa cultivation through cooperative farming models, though this remains a long-term play.

👛 Consumer Trends and Challenges Ahead

Consumers are beginning to notice the impact of these price dynamics. A 100g chocolate bar that retailed at ₹100 last year may now sell for ₹120–130 or shrink in size by up to 15%. Price-sensitive segments, especially in tier-2 and tier-3 cities, are showing early signs of reduced purchasing frequency or a shift toward cocoa-free alternatives.

India’s premium chocolate segment — led by dark and bean-to-bar offerings — is most at risk due to its higher cocoa content and dependence on imported couverture.

🧾 Policy and Trade Considerations

India’s import strategy for cocoa and its derivatives may need urgent recalibration. Trade incentives, warehousing support, and revised customs duty structures are under discussion. Additionally, the Ministry of Commerce has been exploring sourcing alliances with African nations as part of India’s Africa Development Partnership.

🔮 Outlook: Volatility to Persist

According to the International Cocoa Organisation (ICCO), cocoa prices are likely to remain volatile through late 2025 due to continued weather uncertainty and supply-chain disruptions. Futures markets suggest some relief in Q4 2025, but the floor is expected to remain well above pre-2023 levels.

🧭 Conclusion: An Industry at the Crossroads

The Indian chocolate industry — estimated to be worth ₹20,000 crore — is at a critical juncture. While large FMCG players may weather the storm through scale, hedging, and R&D, small and medium players will need to innovate or diversify rapidly to stay relevant.

If cocoa inflation persists, the future of affordable chocolate in India may depend not just on economic resilience but also on sourcing ingenuity, consumer trust, and supply chain redesign.