1. Current State of the EU Dairy Sector (2023–2025 baseline)

The EU dairy sector enters the 2025–2035 outlook period from a position of structural maturity rather than volume-driven growth. Milk production has largely stabilised despite a declining dairy cow herd, with output sustained through higher yields and rising milk solids content. This reflects long-term investments in genetics, feeding efficiency, animal health and farm consolidation.

At present, the EU remains fully self-sufficient in milk and dairy products, and dairy continues to be one of the most significant contributors to agricultural output value. Cheese has consolidated its role as the EU’s flagship dairy product, both domestically and in exports. At the same time, whey ingredients have emerged as a fast-growing, strategically important segment driven by demand in nutrition, sports, infant formula, and food processing.

However, the sector also faces elevated cost structures, notably for feed, energy and fertilisers, alongside tightening environmental and animal welfare regulations. Farm profitability has become increasingly size- and efficiency-dependent, with larger, specialised dairy farms better positioned to absorb volatility than smaller holdings.

EU Dairy Outlook

2. Medium- to Long-Term Outlook for EU Dairy (to 2035)

Milk Supply: Stability without Expansion

Milk Supply: Stability without Expansion

Over the outlook period, total EU milk production is projected to remain broadly stable, even as cow numbers continue to decline. Annual milk yield growth is expected to slow to around 1.2% per year, compared with nearly 2% in the previous decade, reflecting biological limits, climate stress, and sustainability-driven production constraints.

This marks a clear shift: the EU dairy sector is no longer optimising for volume, but for value per litre.

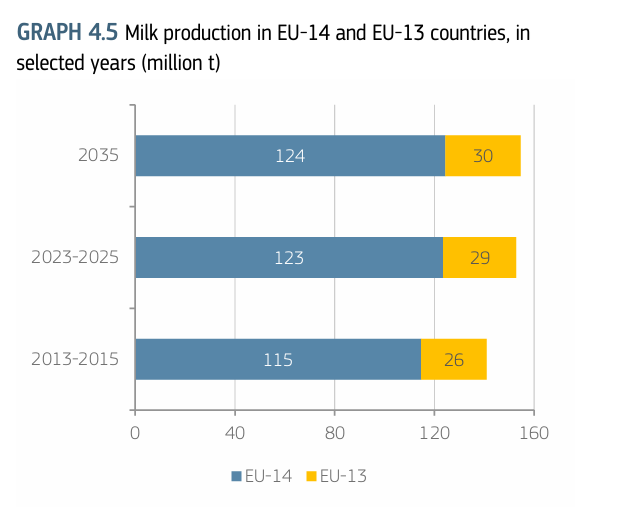

Milk production in EU-14 and EU-13 countries (million tonnes)

This graph highlights the geographical rebalancing within EU milk production.

- Total EU milk production rises modestly from about 141 million tonnes (2013–15) to 154 million tonnes by 2035

- EU-14 countries (older member states) remain dominant, growing from 115 million tonnes to 124 million tonnes

- EU-13 countries increase production from 26 to 30 million tonnes

While growth in EU-13 countries is proportionally faster, the absolute gains are modest. Significantly, this expansion does not offset stagnation in core EU-14 regions, where environmental ceilings, land constraints and societal pressures are most binding.

Editorial takeaway:

The EU’s internal milk growth is incremental and regionally uneven, reinforcing the outlook’s conclusion that future competitiveness will not come from expanding raw milk supply, but from processing sophistication and export value per tonne.

Developments in EU milk production, yields and dairy cow numbers

This chart captures the structural shift underway in EU dairying.

Between 2015 and 2025, EU milk production grew by about 0.8%, primarily driven by strong yield growth of 2.0%, even as dairy cow numbers declined by 1.1%. This period benefited from genetic gains, better feeding practices and farm consolidation.

Looking ahead to 2025–2035, the picture changes noticeably:

- Milk production growth slows sharply to just 0.1%

- Yield growth moderates to 1.2%

- Cow numbers continue to fall at roughly 1.1%

The key message is that the EU dairy sector is approaching biological, environmental and regulatory limits. Yield gains remain positive but are no longer sufficient to deliver meaningful production growth. Climate stress, tighter environmental rules, animal welfare standards and reduced input intensity all contribute to this deceleration.

Editorial takeaway:

EU dairy is no longer a volume-growth sector. It is transitioning into a maintenance-and-optimisation phase, where the strategic focus shifts from litres to milk solids, quality, and value-added processing.

Product Mix: Value Over Volume

The outlook clearly indicates divergent trajectories within dairy products:

- Cheese: Continued growth in both production and exports, supported by strong global demand and product differentiation.

- Whey powders and ingredients: One of the strongest growth segments, with production and exports rising steadily due to demand for protein-rich and functional ingredients.

- Butter and SMP: Marginal growth, largely demand-driven, but constrained by competitiveness and substitution.

- WMP: Structural decline, reflecting weaker global demand and intensifying competition from lower-cost exporters.

Consumer preferences for protein-rich, low-fat, low-sugar, and fortified dairy products are expected to further reshape processing portfolios, favouring ingredient-led, nutrition-oriented strategies over commodity powders.

Trade and Competitiveness

While EU dairy export volumes are projected to remain relatively stable, export value growth will increasingly depend on product mix, not tonnage. The EU is expected to lose market share in bulk dairy commodities such as SMP and WMP, but to gain or hold share in higher-value categories such as cheese and whey derivatives.

Global competition is intensifying as traditional importing regions improve self-sufficiency and new exporters emerge. As a result, EU dairy competitiveness will rely less on price and more on quality, functionality, safety standards and sustainability credentials.

3. Farm Economics and Sustainability Implications

From a farm-level perspective, dairy stands out as one of the more resilient agricultural sectors in the EU outlook. Dairy farms are among the few farm types projected to see improvements in gross income, supported by stable demand and value-added processing.

Environmentally, dairy plays a central role in the EU’s sustainability transition. The outlook projects:

- A reduction in greenhouse gas emissions, driven mainly by herd contraction and efficiency gains.

- Lower nitrogen surplus due to reduced feed demand and improved nutrient management.

However, this transition also implies higher compliance costs and capital intensity, reinforcing structural consolidation and widening the gap between efficient and marginal producers.

What This Means for India: Strategic Observations

The EU dairy outlook offers several necessary signals for India, even though India follows a very different dairy development pathway.

1. Global Dairy Growth Is Shifting from Volume to Value

The EU’s stabilising milk output and pivot towards high-value dairy ingredients highlights a broader global trend: future competitiveness will be driven less by raw milk volumes and more by milk quality, solids, processing sophistication and end-use functionality.

For India, this underscores the risk of remaining overly focused on liquid milk and basic commodities. In contrast, high-growth segments such as whey proteins, specialised powders and nutrition-led dairy remain underdeveloped.

2. Whey and Ingredients: A Structural Opportunity for India

The EU outlook clearly positions whey and protein ingredients as growth engines, even as traditional powders stagnate. This has direct relevance for India, which remains a net importer of whey and advanced dairy ingredients.

As EU suppliers prioritise value-added exports and tighten sustainability requirements, India has an opportunity to:

- Develop domestic whey processing capacity

- Invest in protein standardisation, MPCs and functional dairy ingredients

- Reduce import dependence while building export-oriented capabilities

3. Sustainability as a Trade Filter

EU dairy competitiveness increasingly rests on environmental performance, traceability and regulatory compliance. Over time, these factors are likely to influence trade norms, customer requirements and even non-tariff barriers.

For India, this suggests that quality, residue management, aflatoxin control and carbon efficiency will matter not just for domestic consumers, but also for accessing premium international markets and global food companies.

4. Lessons for Farm Structure and Productivity

The EU experience reinforces a critical lesson: productivity gains alone cannot offset structural inefficiencies indefinitely. Despite advanced technology, EU milk yield growth is slowing due to climate and sustainability constraints.

India, still early in its productivity curve, must therefore pursue balanced intensification—raising yields and milk solids while avoiding the long-term ecological and cost traps now facing mature dairy economies.

Concluding Perspective

The EU dairy outlook to 2035 paints a picture of a highly evolved, value-driven dairy sector—stable in volume, selective in growth, and increasingly shaped by sustainability, nutrition and trade competitiveness. For India, the relevance lies not in replication, but in anticipation.

As the EU and other advanced dairy regions move up the value chain, the global dairy landscape is opening up space for new ingredient hubs, alternative supply bases, and differentiated, quality-led producers. Whether India captures this opportunity will depend on how quickly it shifts from being the world’s largest milk producer to becoming a globally relevant dairy value creator.

Source: Structural Shifts in EU Milk Supply: What the Data Really Shows – Jordbrukare