Australian Dairy Farmers Push Back Against Price Cuts Amid Global Milk Glut

As the global dairy market faces growing turbulence due to an oversupply of milk, Australian dairy farmers are pushing back against any attempt by processors to reduce farmgate prices. Their warning highlights a crucial global pattern that has significant implications for the Indian dairy industry.

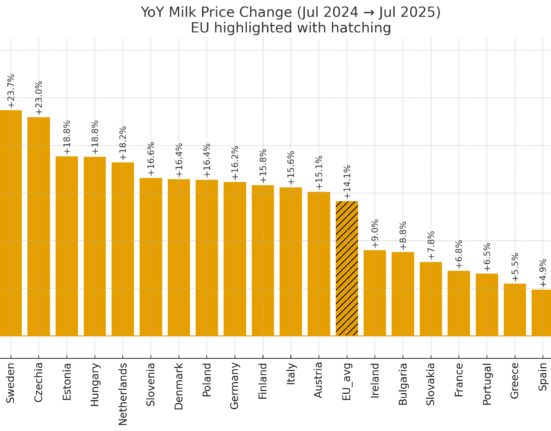

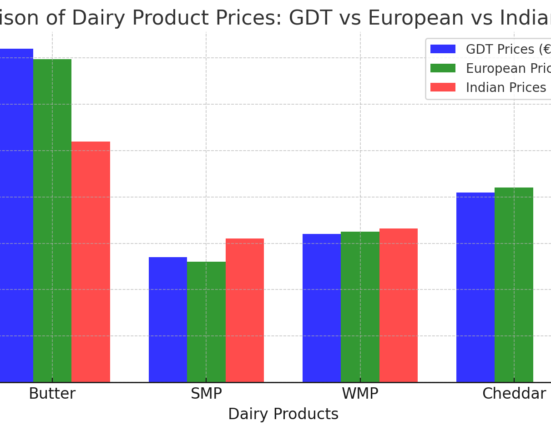

Australian producers argue that price reductions in response to commodity market downturns risk undermining farm viability and long-term sustainability. This resistance comes at a time when international dairy commodity prices—especially for skim milk powder and butter—have dropped sharply, driven by persistent overproduction in key export regions such as the US, EU, and New Zealand.

Global Oversupply Meets Local Tensions

The concerns raised in Australia reflect a broader global phenomenon. Recent Global Dairy Trade (GDT) auctions have registered their seventh consecutive decline, underscoring a steady fall in international dairy prices. Despite this, Australian producers assert that cutting farmgate prices is not a sustainable response, especially when production costs—fuel, feed, and labour—remain high.

For the Indian dairy sector, which has historically remained insulated from global price swings due to strong domestic demand, this global surplus poses both risks and opportunities.

Lessons for India’s Dairy Market

India, the world’s largest milk producer, is also witnessing mounting pressure on procurement prices, especially in regions experiencing milk supply surpluses or lagging demand for value-added dairy products.

“India must remain cautious,” said a senior policy advisor at a leading dairy cooperative. “Reacting to global oversupply by slashing prices could hurt millions of small-scale farmers who rely on steady procurement rates. Instead, efforts should focus on expanding export avenues and enhancing value-chain efficiency.”

Australia’s dairy industry structure—largely export-driven—is feeling the brunt of global downturns more immediately. Yet, its resistance to price cuts serves as a reminder that short-term market forces must be balanced with long-term producer sustainability.

India’s Strategic Outlook: Avoiding a Ripple Effect

With dairy inflation in India stabilising in 2025 and milk procurement prices holding firm, Indian cooperatives are under increasing pressure to avoid price volatility. Stakeholders must be watchful of market signals, especially given potential shifts in dairy export news, which could affect domestic buffer stocks and pricing frameworks.

India’s policymakers and processors might take a cue from Australia’s producers, prioritising fair pricing models that support both supply security and farmer welfare, rather than mirroring global market trends blindly.

Conclusion

The Australian standoff between farmers and processors is more than a local story—it’s a cautionary tale for emerging dairy markets like India. As milk production trends continue to outpace demand globally, India must tread carefully, maintaining a balance between market competitiveness and rural livelihoods.