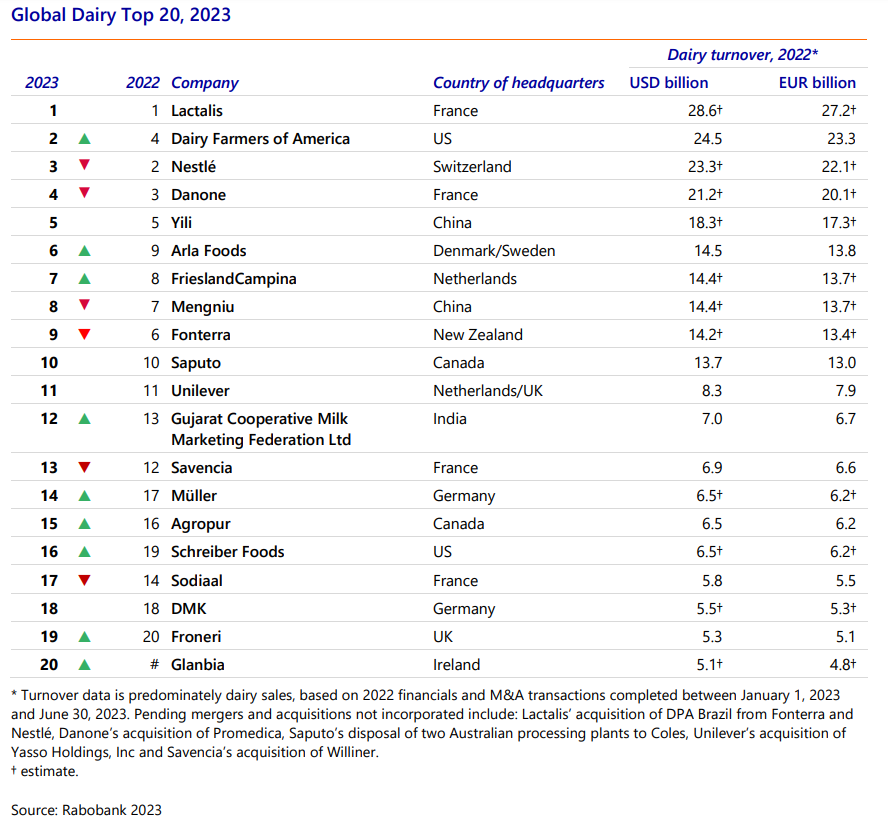

In the 2023 Rabobank rankings of the dairy industry, significant changes have occurred, driven by foreign exchange market fluctuations. Overall turnover for the top 20 dairy companies increased impressively in both US dollar and euro terms, although there was a notable slowdown in deal activity compared to the previous year. Amul’s consistent growth has led to a remarkable improvement in its ranking within the global dairy industry. Moreover, the industry is experiencing a shift towards precision fermentation-derived proteins, indicating changing consumer preferences and market dynamics. This evolution is causing major players to pivot away from traditional plant-based dairy alternatives. As the dairy industry evolves, these rankings provide valuable insights into the changing landscape and the companies leading the way.

In Rabobank’s annual assessment of the dairy industry’s top players based on their turnover, 2023 has brought significant changes. Only five companies maintained their positions from the previous year, largely due to fluctuations in the foreign exchange market. The collective turnover of the top 20 dairy companies increased by 7.4% in US dollar terms and a substantial 21% in euros, primarily attributed to favourable dairy commodity prices. However, Rabobank noted a slowdown in activity, with only eight deals announced in the first half of 2023 compared to 12 in H1 2022.

Amul’s Remarkable Progress

A standout in these rankings is the remarkable ascent of Amul, an Indian dairy cooperative. Over the years, Amul has consistently climbed the ranks, exhibiting impressive turnover growth. While specific details about Amul’s 2023 ranking are not provided in the source, it’s evident that their consistent performance has contributed to an improved position, highlighting the cooperative’s strong global presence.

Shifting Trends in the Dairy Landscape

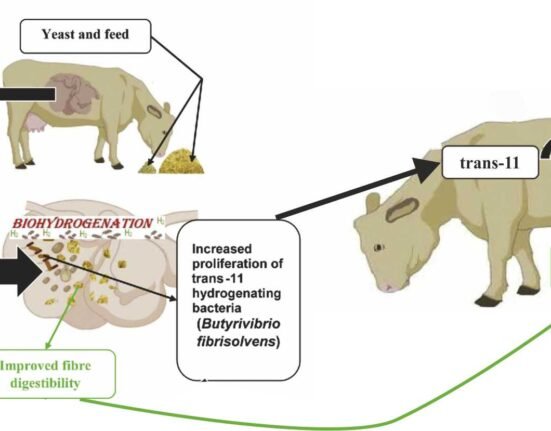

The 2023 rankings also shed light on noteworthy shifts in the global dairy landscape. Precision fermentation-derived proteins are emerging as the new trend, with major players like Nestlé, Danone, Fonterra, and FrieslandCampina collaborating with specialists in this field. This transition signifies a departure from traditional plant-based dairy alternatives.

Key Highlights

- Lactalis, which secured the top spot in 2021, maintained its lead in the rankings with a turnover just shy of $30 billion. The company’s turnover grew by 20.5% from 2021, reaching €27.2 billion ($28.6 billion) in 2022, driven by acquisitions like Italian cheesemaker Ambrosi.

- Dairy Farmers of America (DFA) made a substantial leap from fourth to second place, surpassing Nestlé and Danone. DFA attributed its rise to high dairy product prices and organic growth, achieving turnover gains of 26.9% to reach $24.5 billion (€23.3 billion), up 42.6% in euros.

- Danone’s dairy turnover increased by 13.6% (€2.4 billion) to €20.1 billion ($21.2 billion in US dollars), while Nestlé reported $23.3 billion (€22.1 billion) in turnover. Nestlé also holds a non-controlling equity share in Froneri, a UK-based ice cream company ranked 19th in dairy turnover.

- Developments surrounding Danone’s Russian business, recently taken over by a Russian federal government agency, hold significance for investors, given its status as the company’s fifth-largest sales contributor. Danone is increasingly focusing on specialized nutrition with strategic acquisitions and divestitures.

- Rabobank’s analysis highlights the impact of unfavourable foreign exchange market developments on companies reporting in New Zealand dollars, yen, and renminbi. This resulted in changes in rankings for New Zealand’s Fonterra, China’s Yili and Mengnui, and the exit of Japan’s Meiji from the list.

- In the lower half of the rankings, Unilever maintained 11th place, with its newly-formed ice cream division reporting increased sales. India’s Amul and France’s Savencia swapped positions, while Muller climbed three places. Glanbia PLC entered the list at #20, capitalizing on increased sales in US dollars and significant market movements.

- Rabobank’s analysis also observes a shift in the dairy alternatives landscape, with the industry transitioning from plant-based products to precision fermentation-derived proteins, signalling evolving consumer preferences and market dynamics.

Looking Forward

Rabobank anticipates a challenging year for profitability in the dairy industry in 2023 due to weakening dairy and retail prices. The outlook suggests muted growth in the coming year, with some companies unlikely to replicate their 2022 revenue gains.