The global dairy industry continues to evolve, with the European Union, the United States, and New Zealand playing key roles in milk production, pricing, and dairy exports. This report provides an analytical overview of the latest trends in milk and butter prices, as well as production dynamics across key regions.

1. Milk Prices: EU Leads the Market

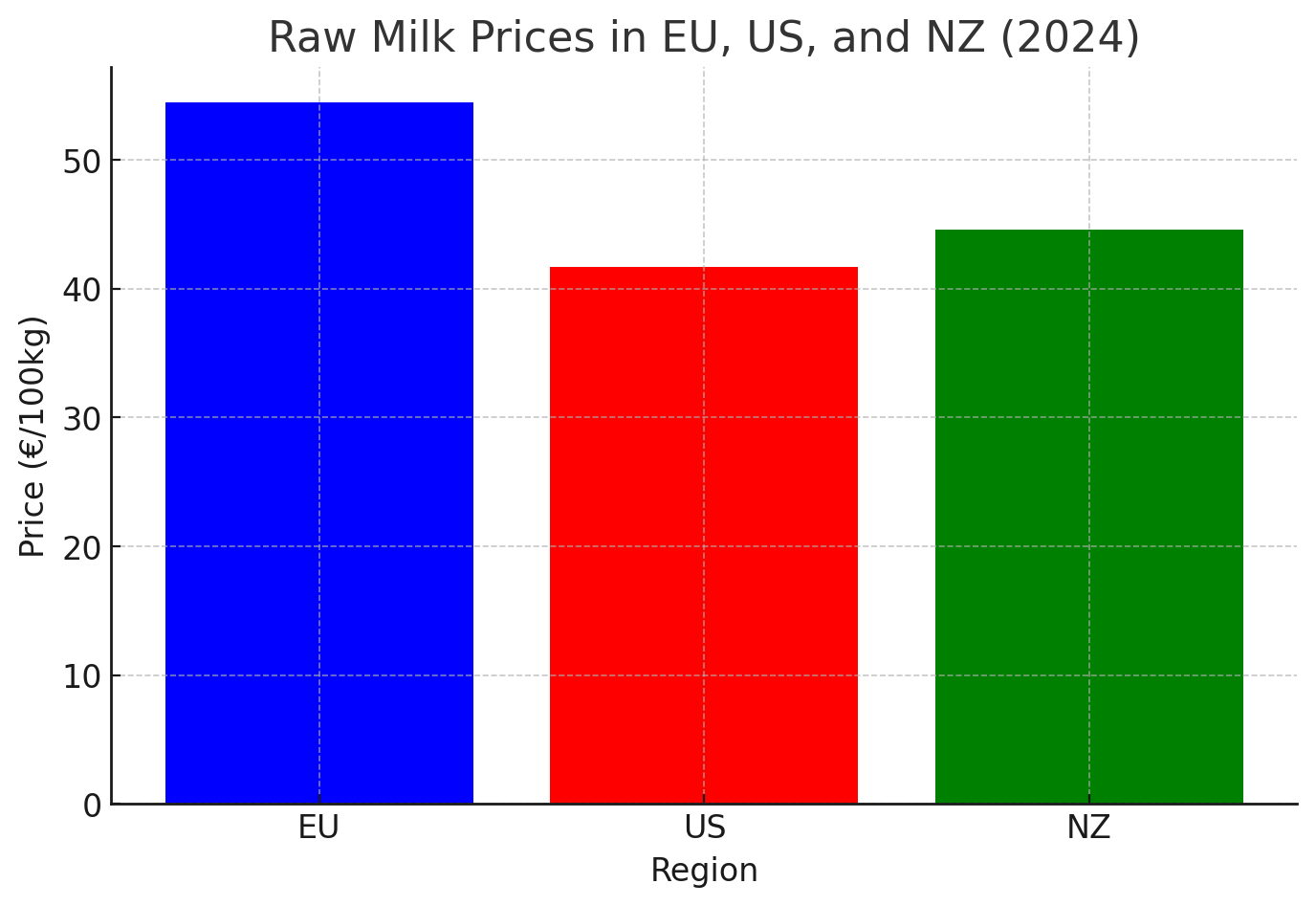

Raw milk prices have shown significant regional variations in 2024. The EU recorded the highest price at €54.5 per 100kg, significantly above New Zealand (€44.6/100kg) and the US (€41.7/100kg). These price differences stem from various factors, including production costs, government subsidies, and local demand-supply dynamics.

Raw milk prices have shown significant regional variations in 2024. The EU recorded the highest price at €54.5 per 100kg, significantly above New Zealand (€44.6/100kg) and the US (€41.7/100kg). These price differences stem from various factors, including production costs, government subsidies, and local demand-supply dynamics.

2. Butter Prices: EU Remains Dominant

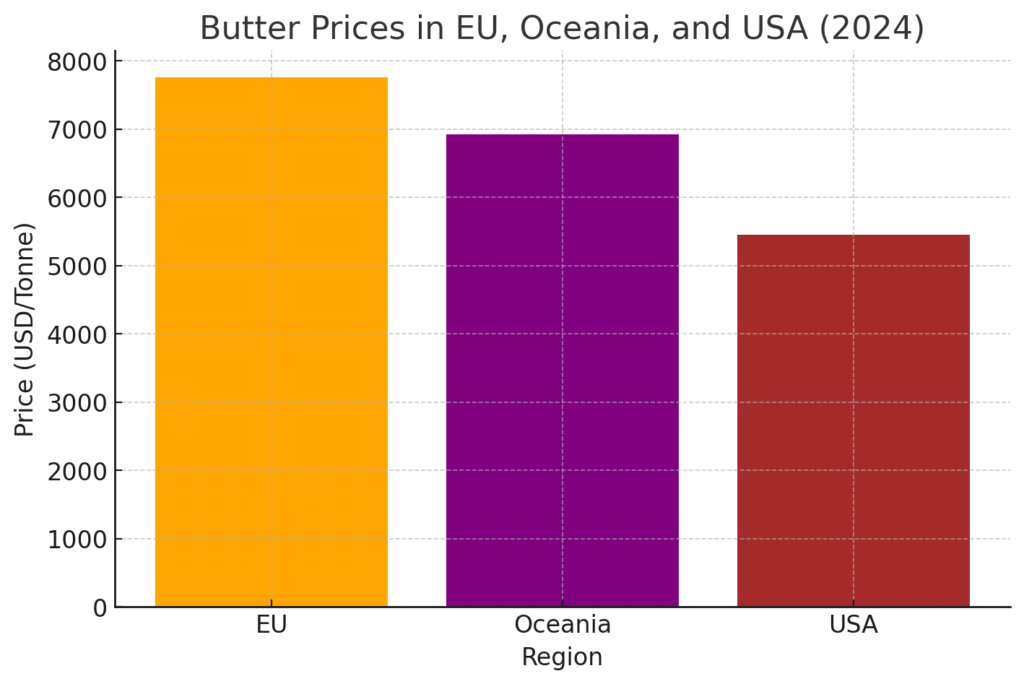

Butter prices followed a similar trend, with the EU setting the highest price at $7,759 per tonne, while Oceania ($6,925 per tonne) and the US ($5,455 per tonne) trailed behind. The EU’s strong position in butter pricing is driven by high domestic demand, strict quality standards, and a strong export market.

Butter prices followed a similar trend, with the EU setting the highest price at $7,759 per tonne, while Oceania ($6,925 per tonne) and the US ($5,455 per tonne) trailed behind. The EU’s strong position in butter pricing is driven by high domestic demand, strict quality standards, and a strong export market.

3. Milk Production Trends: Growth in the EU and NZ, Stagnation in the US

Milk production across major regions showed distinct patterns over the past four years:

Milk production across major regions showed distinct patterns over the past four years:

- EU production has steadily increased from 11,000 thousand tonnes in 2021 to 12,000 thousand tonnes in 2024.

- New Zealand has also experienced a moderate increase, reaching 3,500 thousand tonnes in 2024.

- The US, however, has seen slight fluctuations, with a small decline in 2024 to 9,150 thousand tonnes, suggesting challenges in production efficiency or demand slowdowns.

4. Market Outlook for 2025

With increasing global demand for dairy products, prices are expected to remain stable or rise in the near term. However, factors such as energy costs, feed prices, and geopolitical events may influence future market trends.

The European Union remains the market leader in dairy pricing and production growth, whereas the US faces production challenges. New Zealand continues to expand its milk production capacity, positioning itself as a competitive player in the global dairy sector.

Conclusion

The dairy industry in 2024 showcases resilience amid fluctuating global economic conditions. The EU maintains its lead in pricing and production, while other major players adjust their strategies to meet evolving market demands. Moving forward, sustainability, cost control, and market expansion will be critical factors shaping the industry in 2025 and beyond.