ğ Farm-gate milk prices across the European Union have surged to their highest level in over a decade, driven by constrained production, seasonal demand, and policy-related investment hesitation. The impact is being felt unevenly across member states, exposing structural imbalances in Europe’s dairy supply chain.

ğ A Historic High: EU Average Tops â¬0.53/kg

In April 2025, the average EU farm-gate milk price reached â¬0.53/kg, representing a 13% year-on-year increase. This bullish trend continued into June, with upward pressure sustained by regional supply deficits and strong downstream demand, particularly in the cheese and value-added segments.

ğ What’s Driving the Price Surge?

According to dairy market analysts and EU monitoring reports, the current price rally is supported by four critical forces:

1. ğ Constrained Supply from Disease and Drought

Ongoing bluetongue outbreaks, weather shocks, and stringent nitrate regulations in countries such as the Netherlands and Belgium have depressed production volumes. A projected 0.2% decline in EU milk output for 2025 underscores the structural nature of the tightening.

2. ğ Seasonal Uplift in Demand

As summer ramps up, so does demand for butter, cream, and ice cream, particularly in tourism-heavy regions such as Southern Europe. This intensifies local shortages, elevating prices in net-deficit countries.

3. ğ¶ Input Cost Inflation

Feed prices remain elevated due to global supply constraints. Additionally, energy and labour costs across Europe have skyrocketed. For many small- and mid-sized farmers, rising operational costs have offset much of the gains from higher milk prices.

4. ğï¸ Policy Paralysis Stifling Investment

Major processors and farmer cooperatives cite regulatory uncertaintyâespecially around the EU’s evolving climate goalsâas a barrier to capital expansion. Arla Foods’ CEO recently warned that “green rules without clarity are making long-term investment risky” (Financial Times, FT.com).

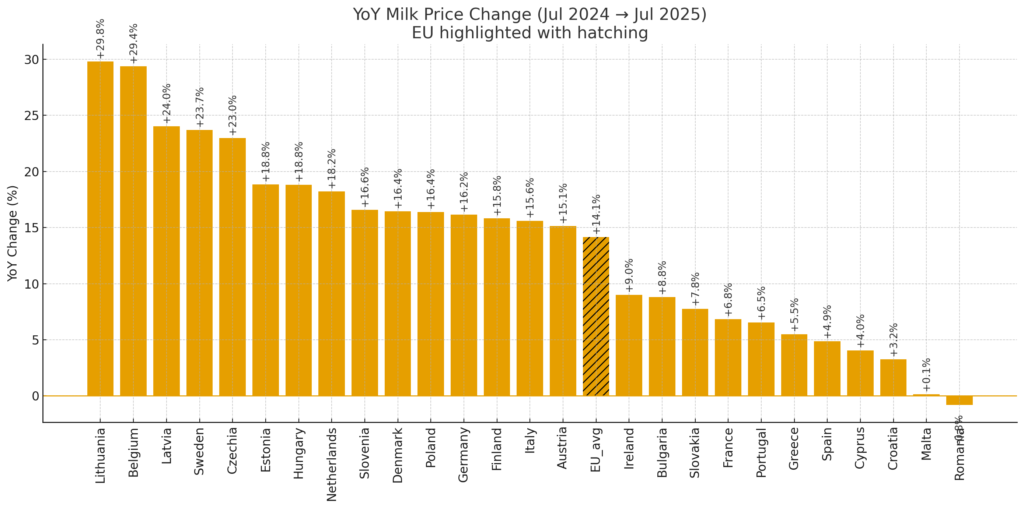

ğ Regional Disparities: Not All Milk Is Valued Equally

While the EU average price paints a bullish picture, the situation varies widely between member states. Some countries are experiencing explosive growth in farm-gate prices, while others show only marginal improvement.

ğ Comparative Table: April/June 2025 vs MoM and YoY

| Country | Price (â¬/kg) | MoM Change | YoY Change | Key Drivers |

|---|---|---|---|---|

| Sweden | â¬0.56 | +2.5% | +33.0% | Tight local supply, high processing costs |

| Lithuania | â¬0.52 | +1.9% | +29.8% | Strong export demand, herd decline |

| Ireland | â¬0.54 | +1.2% | +24.0% | Cheese demand, seasonal surge |

| Netherlands | â¬0.55 | +1.5% | +15.4% | High-value dairy, stable demand |

| Germany | â¬0.53 | +1.0% | +12.3% | Moderate supply tightening |

| France | â¬0.51 | +0.8% | +10.2% | Steady consumer demand |

| Poland | â¬0.48 | +0.7% | +8.5% | Input costs are moderating growth |

| Spain | â¬0.50 | +0.5% | +3.0% | Overcapacity, less price momentum |

| Croatia | â¬0.47 | +0.4% | +2.1% | Stagnant output, small market |

| Cyprus | â¬0.46 | +0.3% | +4.0% | Import-reliant, slow rebound |

| EU Average | â¬0.53 | +1.3% | +15.0% | – |

ğ Insight: The strongest YoY increases were seen in Sweden, Lithuania, and Ireland, while Southern Europeâincluding Spain and Cyprusâlags behind due to structural oversupply and slower product diversification.

ğ§ Strategic Implications for Dairy Stakeholders

ğ For Dairy Farmers:

- Short-term margins improve, but cost pressures continue to be a drag.

- Climate policy clarity is essential to justify herd expansions or facility upgrades.

ğ§ For Processors:

- Opportunities lie in high-value segments (cheese, protein concentrates).

- Supply chain risks must be mitigated with diversified sourcing and longer-term contracts.

ğ§ For Policymakers:

- Investment in alternative protein feed can reduce reliance on imports and stabilise producer costs.

- Clear, phased environmental rules will help unlock CAPEX across the value chain.

ğ Conclusion: Boom or Breaking Point?

The EU dairy sector is riding a historic price wave, but beneath the surface lie serious concerns: investment reluctance, environmental compliance stress, and a fragile feed supply system.

If these issues are not addressed proactively, today’s price surge could be a temporary peak rather than a platform for stable, sustainable growth.

ğ§ For the dairy sector to truly capitalise, the EU needs a coordinated strategy: clear green policies, investment in protein independence, and support for modernising supply chains.