In a decisive move that signals the deepening consolidation of Europe’s dairy industry, Arla Foods and Germany’s DMK Group have announced their intent to merge—forming what Arla calls the “strongest dairy cooperative in Europe.” The merger, subject to approval by cooperative representatives and regulatory bodies, will unite more than 12,000 farmers and is projected to generate a combined pro forma revenue of €19 billion.

This historic alliance comes just weeks after the announcement that Dutch cooperative FrieslandCampina and Belgian counterpart Milcobel also plan to merge. Together, these developments underscore a growing trend: the convergence of German, Danish, Dutch, and Belgian dairy powerhouses into larger, transnational cooperatives designed to meet the challenges of a maturing European dairy market.

A Shared Vision Anchored in Farmer Ownership

The merged Arla–DMK entity will operate under the Arla name and be headquartered in Viby J, Denmark. Peder Tuborgh will remain CEO of the unified group, with Jan Toft Nørgaard as chair and DMK’s Ingo Müller stepping into Arla’s executive management as Executive Vice President for post-merger integration.

“This merger is a natural continuation of a close collaboration built on trust, shared values, and mutual respect,”

— Peder Tuborgh, CEO, Arla Foods“DMK is Germany’s largest dairy cooperative and an ideal strategic partner. Together, we can create greater value across the dairy chain—from farm to fork—while securing competitive milk prices for our farmers.”

The merger is not just a structural reorganization—it’s a philosophical alignment. Both cooperatives have long prioritized sustainability, product innovation, and farmer-centric governance. Their combined scale will enable broader market access, increased investment in food technology, and a deeper innovation pipeline.

“We are creating a cooperative that’s fit for the future,”

— Jan Toft Nørgaard, Chair, Arla Foods“Our ambition is not just size—it’s resilience, relevance, and responsibility to our farmer members and to society.”

Extending Global Reach and Business Resilience

DMK’s Ingo Müller emphasized the strategic benefits of combining with Arla:

“This partnership opens doors to over 160 global markets and strengthens our business resilience.

Our complementary strengths—Arla’s international reach and DMK’s German foundation—position us to lead not just in volume, but in quality, sustainability, and innovation.”

The merged cooperative will have a more diversified product portfolio across branded and private label dairy segments. It also aims to play a greater role in advancing sustainable dairy production and reducing the environmental footprint of the industry—critical priorities amid rising consumer scrutiny and regulatory pressure.

Responding to Structural Shifts in Dairy

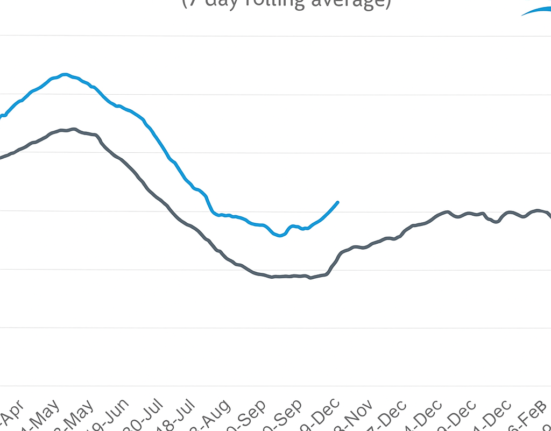

The European milk pool is expected to decline in the coming years due to demographic changes, land use competition, and stricter environmental regulations. For farmer-owned cooperatives, scale and strategic flexibility have become essential.

“This merger significantly strengthens our members’ position in a competitive global marketplace,”

— Heinz Korte, Chair, DMK Group“It enhances our ability to invest in value-added production and consumer-driven innovation, which are essential to securing the long-term viability of dairy farming in Europe.”

A Continental Realignment in Dairy Cooperatives

With the Arla–DMK and FrieslandCampina–Milcobel mergers now on the table, a new cooperative geography is emerging across northern Europe. These four major players—representing Denmark, Germany, the Netherlands, and Belgium—are consolidating not only to compete more effectively with investor-led multinational dairies, but to safeguard the cooperative model itself.

Together, they signal a shift toward more agile, capital-efficient, and market-responsive dairy organizations—ones that retain their farmer-centric ethos while operating at truly global scale.

As these mega-cooperatives prepare for integration, all eyes will be on how they balance farmer interests with the demands of global competitiveness—and whether these mergers will redefine the future of cooperative dairy in Europe and beyond.