The Finance Minister of India has emphasized the urgency of addressing rising inflation and stressed that raising interest rates is not the sole solution. As annual retail inflation hit a 15-month peak in July, propelled by soaring vegetable and cereal prices, the government faces mounting pressure to intervene. While efforts have been made to stabilize prices, including increasing supplies of essential goods, the persistence of high food prices is anticipated due to weather-related challenges. The Finance Minister underscored the need to consider growth-related priorities along with inflation control when formulating policies. Central banks, she indicated, should adopt a holistic approach for economic recovery. The Reserve Bank of India had recently maintained its key lending rate, but the situation remains sensitive due to the impact of food price fluctuations.

With annual retail inflation surging to a 15-month high in July, India’s Finance Minister has emphasized the importance of tackling inflation and pointed out that increasing interest rates isn’t the sole remedy. The sharp increase in prices, driven by soaring vegetable and cereal costs, has created mounting pressure on the government to address the situation promptly.

Nirmala Sitharaman, the Finance Minister, expressed that the fixation on using interest rates exclusively to manage inflation, without addressing the supply-side factors, will fall short of providing a comprehensive solution.

July witnessed a substantial escalation in retail inflation, exceeding market expectations and raising concerns. Skyrocketing vegetable and cereal prices were at the core of this inflation surge, prompting calls for immediate government action.

The government has already initiated steps to stabilize prices, including augmenting the supply of items like tomatoes and onions through distribution networks, and releasing stocks of wheat and sugar to alleviate price pressures.

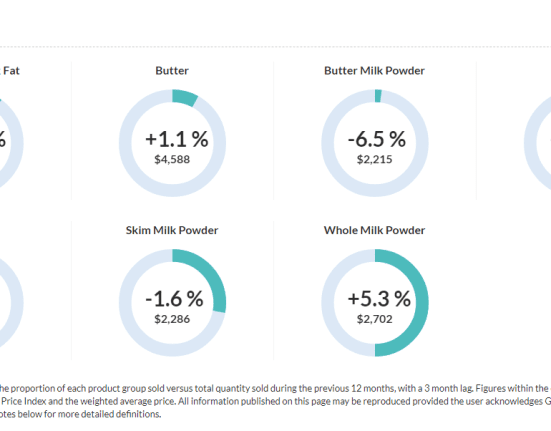

However, the challenge remains, as the unusual aridity experienced in August has impacted various sectors such as cereals, vegetables, sugar, spices, meat, and dairy products. This factor is likely to maintain elevated food prices in the coming months.

While the Reserve Bank of India (RBI) recently decided to keep its key lending rate unchanged, it has undertaken measures to reduce the amount of cash circulating in the banking system due to renewed inflation concerns.

Nirmala Sitharaman noted that central banks should take a comprehensive approach, considering both growth-related priorities and inflation control, as higher interest rates could potentially hinder economic recovery. The Finance Minister’s remarks come in the backdrop of the intricate balancing act that central banks often face in managing multiple economic objectives.

The consumer price index (CPI) inflation in India surged to 7.44 % in July 2023, a 15-month peak, primarily driven by soaring food and vegetable prices. The consumer food price index (CFPI) for July also climbed to 11.51 %, the highest level since October 2020, as reported by the Ministry of Statistics and Programme Implementation.

Within the food category, vegetable prices registered an astounding 37.34 % increase, compared to a contraction of 0.93 % in the previous year. This surge in inflation can be partly attributed to the exceptional increase in tomato prices, which reached as high as ₹150-200 per kg in certain cities.

The Finance Minister reiterated that addressing inflation isn’t merely a matter of returning within acceptable bounds, but rather, a focused effort should be made to align inflation with the target rate of 4.0 %. The challenge lies not only in controlling headline inflation but also in considering its various components and underlying causes.

Given the substantial weightage of food items in the inflation basket, the fluctuations in food prices exert a significant influence on overall inflation rates. Fluctuations in essential food items such as vegetables, grains, and dairy can impact households’ purchasing power and cost of living. The Finance Minister’s call for a comprehensive approach underscores the complexity of managing inflation in a multifaceted economic landscape.