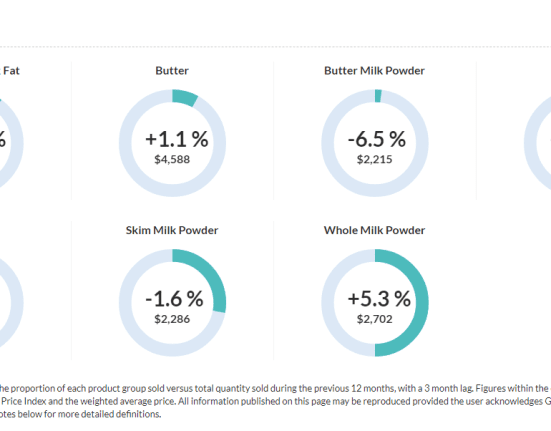

Global milk supplies continue to influence market dynamics, with tracking focused on the six key exporting regions: EU-27, UK, Argentina, Australia, New Zealand, and the United States. These regions collectively contribute to the majority of cow’s milk production and dairy product exports globally. May’s figures reveal a 1.1% year-on-year increase in average daily milk deliveries, reaching 825.2 million litres. Growth was observed in all regions except Argentina, while the EU-27 and the US exhibited notable gains. The Southern Hemisphere’s transition into the winter season has affected production in Australia and New Zealand, while Argentina contends with challenges due to production costs and limited forage availability.

Global milk production trends have a significant impact on market dynamics, and tracking milk deliveries across key exporting regions provides crucial insights into current production levels and global supply trends. The six primary exporting regions, namely the EU-27, UK, Argentina, Australia, New Zealand, and the United States, collectively contribute to over 65% of global cow’s milk production and approximately 80% of worldwide dairy product exports.

In May, global milk deliveries averaged 825.2 million litres per day, registering a modest increase of 1.1% (equivalent to 8.9 million litres) compared to the same period the previous year. Year-on-year growth in average daily deliveries was evident across all regions except Argentina.

Milk production within the EU-27 experienced a 1.2% year-on-year increase in May, with deliveries growing by 1.5% month-on-month during the peak production period. Noteworthy gains were observed in countries such as Germany (2.4%), Poland (4.0%), the Netherlands (1.9%), and Italy (1.7%). However, France recorded the most significant decline at -3.4% year-on-year.

Meanwhile, the United States saw a year-on-year production growth of 0.7%. This growth trend was attributed to a larger-than-expected increase in the herd during the first quarter of 2023.

Australia witnessed a 1.6% increase in production compared to the previous year. In New Zealand, production surged by 7.4% year-on-year in May. However, production declined month-on-month due to the onset of the winter season in the Southern Hemisphere. Farmers in New Zealand faced challenges with inflationary input costs, contributing to the dip in production during the month.

Argentinian milk production experienced a 2.4% year-on-year decline. Nevertheless, month-on-month production showed an increase. The country encountered challenges stemming from rising production costs, dry weather conditions, and limited forage availability. These factors combined to impact overall production for the season, resulting in a 0.6% decrease.

The trends in global milk supplies provide critical insights into the dairy market’s dynamics, affecting pricing, trade, and industry trends. The variations in production across different regions underline the intricate interplay of factors shaping the global dairy landscape.