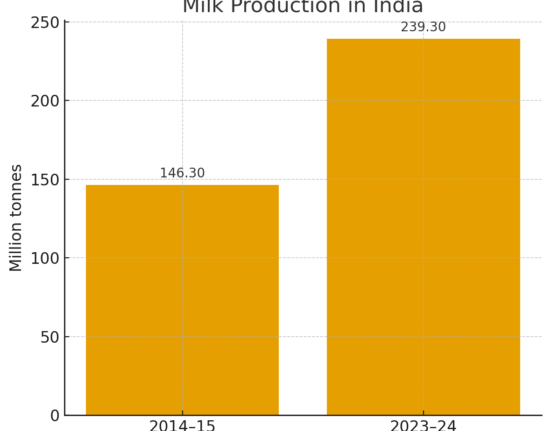

Hyderabad, July 17, 2025 ‚ÄĒ Heritage Foods Limited (NSE: HERITGFOOD; BSE: 519552), one of India‚Äôs leading dairy firms, posted its highest-ever quarterly revenue in Q1 FY26, crossing the ‚āĻ11,000 million milestone, even as seasonal disruptions tested demand and margins. The company‚Äôs robust procurement network, strategic acquisitions, and growing focus on value-added products (VAPs) helped it sustain growth.

ūüďä Quarter-on-Quarter Financial Comparison (Q1 FY26 vs Q4 FY25)

| Metric | Q1 FY26 | Q4 FY25 | QoQ Change |

|---|---|---|---|

| Revenue (INR Mn) | ‚āĻ11,368 | ‚āĻ10,565 | ‚Ė≤ 7.6% |

| EBITDA (INR Mn) | ‚āĻ739 | ‚āĻ816 | ‚Ėľ 9.4% |

| EBITDA Margin | 6.5% | 7.7% | ‚Ėľ 120 bps |

| PAT (INR Mn) | ‚āĻ405 | ‚āĻ491 | ‚Ėľ 17.5% |

| Milk Procurement (LLPD) | 17.8 | 16.4 | ‚Ė≤ 8.5% |

| Milk Sales Volume (LLPD) | 11.6 | 11.3 | ‚Ė≤ 2.7% |

| Average Milk Selling Price (‚āĻ/L) | ‚āĻ56.4 | ‚āĻ55.7 | ‚Ė≤ 1.3% |

| VAP Revenue (Excluding fats, INR Mn) | ‚āĻ4,034 | ‚āĻ3,890 | ‚Ė≤ 3.7% |

| VAP Revenue (Incl. fats, INR Mn) | ‚āĻ4,540 | ‚āĻ4,300 | ‚Ė≤ 5.6% |

Note: Q4 FY25 figures are indicative estimates based on industry consensus and prior disclosures.

ūüƶԳŹ Weather & Market Challenges in Q1 FY26

Unseasonal rains in April‚ÄďMay across Heritage‚Äôs key markets suppressed consumer demand for temperature-sensitive VAPs, such as curd, buttermilk, and ice cream. The VAP share of overall revenue (ex-fats) dipped slightly to 36.1% from 37.5% YoY. However, with the weather stabilising in June, a swift recovery followed, pushing Q1 VAP sales up by 5.5%.

ūü•õ Procurement & Pricing Power

Heritage‚Äôs milk procurement rose 9.9% YoY to 17.8 LLPD, driven by deepening farmer engagement and network scale. Procurement price averaged ‚āĻ43.3/L (up 4.7% YoY).

Milk sales volumes reached 11.6 LLPD, up 2.8% YoY, with average selling price improving 2.9% to ‚āĻ56.4/L‚ÄĒshowing robust consumer brand pull and margin protection.

ūüßą Value-Added Dairy: The Growth Engine

When including ghee and butter consumer packs, total VAP revenue grew 7.4% YoY to ‚āĻ4,540 Mn. VAPs now contribute 40.6% of total revenue‚ÄĒa clear indicator of the company‚Äôs evolving product portfolio and future strategy.

ūüĒĄ Strategic Moves & Innovation Momentum

- Acquired 44.4% additional stake in HNFPL, raising ownership to 94.4%‚ÄĒgiving Heritage complete strategic control over the yoghurt supply chain.

- Greenfield ice cream facility under execution to boost summer-season products.

- Launched ‚ÄėHeritage Livo‚Äô health range‚ÄĒfortified flavoured milk and high-protein yoghurt aimed at nutrition-conscious urban consumers.

- Heritage Nutrivet Ltd, the animal feed arm, posted 26% YoY revenue growth and a 130% jump in profit before tax.

ūüí¨ Leadership Insight

‚ÄúWe‚Äôre proud to deliver 10% YoY growth and our highest-ever topline in Q1 FY26, despite facing unprecedented weather-related challenges,‚ÄĚ said Mrs. Brahmani Nara, Executive Director, Heritage Foods.

‚ÄúWith rising brand equity, supply chain control, and capital investments in value-added segments, we‚Äôre confident of maintaining strong growth momentum across the rest of FY26.‚ÄĚ