Heritage Foods Limited, one of India’s leading integrated dairy companies, has reported robust consolidated revenue of ₹11,192 million (~$134 million USD) for Q3 FY26 (ended December 31, 2025), marking an 8% year-on-year increase despite facing significant raw milk shortages and heightened input costs. This is the third consecutive quarter that Heritage has crossed the ₹11,000 million revenue mark, underlining the strength of its consumer-facing dairy strategy.

In the face of volatile procurement conditions and erratic weather patterns, Heritage Foods continues to demonstrate strategic agility and operational excellence — anchored by its growing value-added products (VAP) portfolio.

Value-Added Products Power Resilient Growth

The company’s VAP business, which includes high-margin consumer products such as ghee, butter, curd, lassi, and paneer, recorded a 13.8% YoY revenue increase to ₹3,271 million (~$39.2 million USD), accounting for 38.4% of total revenues. Within this, consumer fats such as ghee and butter surged 22.6%, reflecting strong demand and wider market reach.

Despite prolonged cold weather and higher-than-average rainfall across regions, VAP volumes grew 6.8% YoY, showcasing underlying demand resilience.

Key growth categories include:

-

Curd: +6% YoY; surpassed 400 tonnes/day for the first time

-

Paneer: +25%

-

Lassi: +29%

-

Milkshakes: +36%

-

Ice Cream: +18% — despite weather challenges

This broad-based VAP growth aligns with larger India dairy trends, where urban and semi-urban consumers are shifting to convenient, fortified, and premium dairy formats.

Milk Procurement and Price Dynamics

While milk sales rose 2.1% YoY to 11.94 LLPD, supported by pricing strength, procurement fell sharply by 9% YoY to 16.73 LLPD, reflecting stress in raw milk supply due to climatic disruptions.

-

Average milk realisation rose to ₹57.31/L (~$0.69 USD) — up 4.9% YoY

-

Procurement cost increased to ₹45.55/L (~$0.55 USD) — up 9% YoY

This mismatch between procurement volume and cost reflects the milk supply shortage in several states and underscores ongoing input inflation in the dairy sector India.

Butter prices also surged amid supply constraints, while ghee prices remained subdued — impacting fat margins. Despite this, Heritage maintained pricing discipline and product mix optimisation, helping offset cost escalations.

Financial Performance (Q3 FY26)

| Metric | INR Mn | USD Mn* | YoY Change |

|---|---|---|---|

| Revenue | ₹11,192 Mn | ~$134 Mn | +8% |

| EBITDA | ₹629 Mn | ~$7.5 Mn | -15% |

| EBITDA Margin | 5.6% | — | -154 bps |

| PAT | ₹346 Mn | ~$4.1 Mn | -20% |

| Gross Margin | 23% | — | -120 bps |

*Exchange rate: ₹83.5 = $1 USD

Heritage’s margin compression stems from steep procurement inflation, yet its profitability was preserved through retail execution, category mix control, and cost efficiency.

Strategic Expansion Ahead of Peak Season

Heritage is preparing for summer-led demand with two capacity expansions:

- Shamirpet Ice Cream Plant – trial production underway; commercial launch in Q4 FY26

- Flavoured Milk Plant – expected commissioning in Q4 FY26

These additions are designed to bolster the company’s high-growth dairy beverage and frozen dessert segments — categories showing rapid uptake across Indian metros and Tier-II cities.

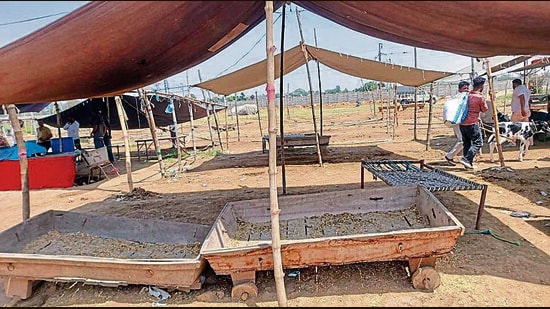

Subsidiary Performance: Heritage Nutrivet

Heritage Nutrivet Limited, the group’s animal nutrition arm, reported:

- Revenue: ₹645 million (~$7.7 million USD) | +27% YoY

- Profit Before Tax: ₹55 million (~$0.66 million USD)

This reflects strong traction in B2B channels and integrated value chain support for dairy farmers.

Industry Recognition and ESG Commitment

Mrs. Nara Bhuvaneswari, Vice Chairperson and MD, was conferred the Outstanding Dairy Professional Award – 2025 by the Indian Dairy Association (IDA) – South Zone, recognising her longstanding contributions to dairy innovation and sustainability.

Additionally, the company recognised a one-time employee benefit expense of ₹27.78 million (~$0.33 million USD) following India’s new Labour Code guidelines under Ind AS 19.

Leadership Commentary

Mrs. Brahmani Nara, Executive Director, stated:

“Q3 FY26 was characterised by milk shortages, elevated procurement costs, and heightened competitive intensity. Despite this, we delivered 8% topline growth through strong execution and a focused push on value-added categories. Our upcoming capacity expansions, innovation pipeline, and deep consumer trust position us well for sustainable growth in FY26 and beyond.”