By Dairy Dimension Staff | April 2025

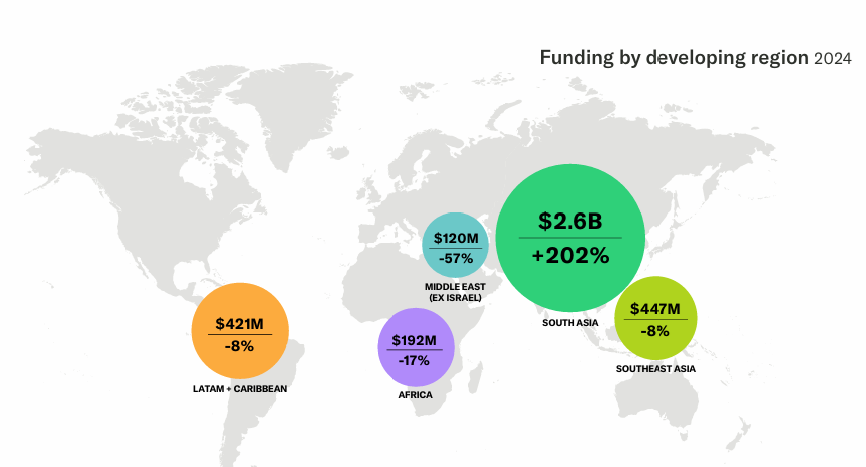

In a year when global agrifood tech investments shrank by 4%, developing markets surged forward with a 63% year-over-year increase, totalling $3.7 billion in 2024. Much of this charge was led by India, which outpaced all other emerging economies, accounting for over two-thirds of the total and delivering 218 deals worth $2.5 billion.

While eGrocery platforms like Zepto dominated headlines, a quieter yet more transformative story has been unfolding in dairy tech, where fintech, midstream logistics, and animal health innovations are converging to reshape India’s most rural and vital sector.

🏆 India at the Helm: At the Core of Agritech Leadership

India was the clear leader in agrifoodtech investment among developing countries, posting a 215% jump in total funding. While Brazil continued to lead in Latin America with $224 million, it experienced a 32% decline year-on-year, suggesting a regional slowdown that contrasts sharply with South Asia’s dynamism.

A maturing tech ecosystem and government policy increasingly aligned with climate-smart agriculture, cooperative-led innovation, and formalisation of the dairy supply chain are driving this growth.

🚚 Midstream and Infrastructure: The Dairy Logistics Opportunity

Midstream technologies in developing markets attracted $444 million (+94% YoY). For India’s 80 million dairy farmers, this means a new frontier in milk collection, cold chain, and B2B logistics.

Impacts for dairy startups include:

- GPS-enabled chilling units that notify cooperatives of temperature breaches.

- Blockchain-based batch tracking systems that reduce export rejections.

- Milk truck route optimisation software that minimises fuel use and increases frequency.

Startups like Country Delight and Stellapps are already integrating some of these systems to enable real-time quality monitoring from udder to end-user.

💸 Agri-Fintech: Turning Milk into Collateral

Ag Marketplaces & Fintech was the top-funded upstream category in 2024, raising $561 million across 96 deals. The application in dairy is profound:

- Farmers supplying cooperatives can now use digital milk records to access credit, bypassing traditional banking barriers.

- Insurance models pegged to lactation cycles and animal health allow risk-sharing and encourage herd expansion.

- BNPL models for feed, mineral mixtures, and vet services are being integrated into cooperative systems.

India’s Sarvagram (raised $67M) and Brazil’s Agrolend already prove that credit + milk = scalable rural prosperity.

🐄 Animal Health, Biotech & Precision Dairy

Although ag biotech investments dropped globally, developing markets posted a 52% increase, with new applications in dairy cattle nutrition, disease detection, and reproductive health.

Emerging technologies include:

- AI-enabled image diagnostics for mastitis and foot-and-mouth disease.

- Wearables for behavioural tracking in cows (e.g., heat cycles, feeding disruptions).

- Precision dosage tools for vaccines and deworming schedules.

These solutions are vital for Indian dairying, which still grapples with high somatic cell counts, irregular calving intervals, and post-partum health issues.

🌍 Carbon & Climate Tech: Green Dairy is Bankable Dairy

Dairy is under scrutiny for its methane footprint, but it’s also a low-hanging fruit for climate gains in India. Startups like Mitti Labs (working on reducing methane in rice) hint at where dairy is headed.

Opportunities for startups:

- Carbon credit aggregation models for low-emission dairy cooperatives.

- Tools to calculate emissions per litre of milk, linked to green finance access.

- Integration with MRV platforms that connect FPOS to global climate buyers.

This aligns with the EU and the Middle East’s evolving low-carbon sourcing mandates, which are critical for India’s growing dairy exports.

📈 Why the Time is Now for Dairy Entrepreneurs

AgFunder’s data shows a shift from full-stack platforms to specialist tech with sharp execution. For dairy-tech founders, this is validation of:

- Focused innovation around feed, health, quality, and credit.

- Partnering with midstream players instead of building entire supply chains.

- Leveraging VC and blended finance instead of waiting for government grants.

With India already ahead of the curve, this is an opportunity for local startups and global players looking to replicate scalable models in Africa, Southeast Asia, and Latin America.

🚀 Conclusion: Dairy is No Longer Just Agri—It’s AgriFin + Climate + Infra + BioTech

India’s rise in agrifood tech is more than an investment story—it’s a signal of where rural transformation is headed. And in this future, dairy isn’t lagging behind—it’s leading the charge.

For startups, cooperatives, processors, and investors: the question isn’t if dairy-tech is viable. It’s how fast you can plug in.

📥 Download the full report: AgFunder 2025 – Developing Markets AgriFoodTech Investment Report