India’s dairy sector, a linchpin of the nation’s agricultural economy, plays an indispensable role in ensuring nutritional security and driving rural economic growth. As the world’s largest milk producer, India has carved a niche for itself on the global stage. However, recent trends expose significant vulnerabilities and systemic challenges that threaten sustained growth. This article delves into production dynamics, species-wise contributions, state-level performances, and structural barriers, offering strategic insights for policymakers and stakeholders.

Milk Production Trends: Alarming Deceleration in Growth

India’s milk production reached a record 239.30 million tonnes in 2023-24, representing a modest 3.78% increase from the previous year. While the decade has seen a cumulative growth of 51.05%, annual growth rates have consistently declined:

While the decade has seen a cumulative growth of 51.05%, annual growth rates have consistently declined:

The declining growth trajectory raises critical concerns for the industry. Contributing factors include outbreaks such as Lumpy Skin Disease and uneven resource distribution. Furthermore, per capita milk availability—currently 471 grams/day—remains skewed, disproportionately affecting rural and economically disadvantaged populations. Strategic interventions to address these systemic inefficiencies are imperative.

Species-Wise Contributions: Shifting Production Dynamics

India’s milk production landscape is marked by diversity but also significant imbalances. Contributions by species in 2023-24 are as follows:

- Buffalo (Indigenous): 31.49%

- Buffalo (Non-Descript): 13.83%

- Cow (Crossbreed): 31.17%

- Cow (Exotic): 2.10%

- Cow (Indigenous): 11.36%

- Cow (Non-Descript): 10.11%

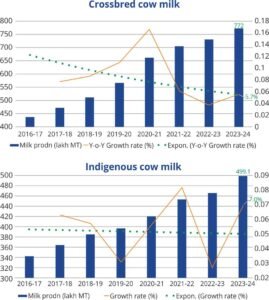

Buffaloes dominate the production landscape, contributing nearly 45% of total output. However, their production fell by 16% in 2023-24, highlighting vulnerabilities in buffalo-reliant systems. In contrast, exotic and crossbred cattle posted an 8% growth, while indigenous/non-descript cows recorded an unprecedented 44.76% increase. This shift underscores the potential of inclusive breeding programs to enhance productivity across all species.

- Uttar Pradesh: 16.21%

- Rajasthan: 14.51%

- Madhya Pradesh: 8.91%

- Gujarat: 7.65%

- Maharashtra: 6.71%

State-Wise Performance: Uneven Contributions and Growth

The top five milk-producing states—Uttar Pradesh, Rajasthan, Madhya Pradesh, Gujarat, and Maharashtra—accounted for 53.99% of India’s total milk production in 2023-24. Their contributions are as follows:

While these states lead the nation’s production, disparities persist as other regions grapple with infrastructural deficits, inadequate veterinary services, and limited market linkages. Addressing these inequalities is crucial for achieving balanced and sustainable growth.

Global Comparisons: Leadership Amid Productivity Shortfalls

India’s contribution of 24% to global milk production cements its position as a dairy powerhouse, surpassing nations like the United States and China. However, the sector faces a persistent productivity challenge. Exotic and crossbred cows yield 8.12 kg/day, while indigenous and non-descript cows produce only 4.01 kg/day. Closing this gap requires investments in advanced feeding practices, robust veterinary services, and climate-resilient livestock systems.

Economic and Social Impacts: Opportunities and Challenges

Supporting over 70% of rural households, the dairy sector is a cornerstone of rural livelihoods. Contributing 30.23% to agricultural Gross Value Added (GVA), it holds immense potential as a poverty alleviation tool. However, systemic issues such as gender disparities and limited access to training for women hinder its full potential. Empowering women and marginalized smallholders is essential to unlocking the sector’s economic and social benefits.

Challenges: Persistent Barriers to Growth

The Indian dairy sector faces numerous hurdles that threaten its growth trajectory:

- Low Productivity: Suboptimal yields continue to constrain efficiency.

- Feed and Fodder Scarcity: Quality feed shortages compromise livestock health and output.

- Climate Vulnerabilities: Erratic weather patterns exacerbate risks to livestock and fodder production.

- Disease Impact: Outbreaks like Lumpy Skin Disease disrupt productivity.

- Infrastructure Deficits: Gaps in cold storage, transportation, and processing facilities impede market access.

- Economic Instability: Fluctuating feed costs and volatile global dairy prices create financial uncertainty for smallholders.

Demand-Supply Imbalances: Navigating a Looming Crisis

Rising demand, fuelled by population growth, urbanization, and shifting dietary preferences, threatens to outpace production. Key drivers include:

- Urbanization: Increased consumption of value-added products like cheese and yogurt.

- Health Trends: Growing preference for fortified dairy products and milk-based proteins.

- Export Pressures: Rising global demand adds strain to domestic supply chains.

Failure to align production with demand risks price inflation, reduced accessibility, and potential dependency on imports.

Future Outlook: A Strategic Path Forward

To secure its leadership and sustain growth, the Indian dairy sector must prioritize:

- Boosting Productivity: Leverage advanced breeding techniques and enhanced animal nutrition.

- Infrastructure Investments: Develop robust cold storage and processing facilities to minimize wastage.

- Disease Management: Strengthen veterinary services and implement preventive measures.

- Value Chain Innovations: Employ technology for traceability and quality assurance.

- Policy Support: Increase funding for research and promote sustainable practices.

Projected to surpass 250 million tonnes by 2025, India’s dairy industry can achieve its ambitious targets through strategic interventions and equitable resource distribution.

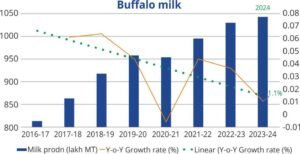

The decline in growth observed during 2022 and 2023 can plausibly be attributed to lingering impacts of the mobility restrictions imposed during the COVID-19 waves in India. These restrictions disrupted critical cattle breeding phases due to the following factors:

- Limited Veterinary Services: Restricted movement led to reduced access to veterinary care, impacting livestock health and productivity.

- Feed Supply Chain Disruptions: Mobility restrictions caused challenges in the availability and transportation of feed and fodder, adversely affecting livestock nutrition.

- Breeding Program Delays: Artificial insemination and other breeding programs faced delays, reducing the number of productive cattle.

Projected Recovery

As the effects of COVID-19 subside and normalcy returns:

- Improved Veterinary Services: Resumption of uninterrupted veterinary care and breeding programs can enhance cattle health and productivity.

- Supply Chain Stabilization: Restored feed and fodder supplies will support livestock recovery.

- Delayed Breeding Results: Breeding cycles affected during the pandemic are likely to yield improved production outcomes in the upcoming two years.

Thus, a recovery in milk production growth can reasonably be expected over the next two years (2024–2025), barring any other disruptive factors.

The projected recovery in milk production growth for 2024 and 2025 stems from the normalization of breeding cycles disrupted by COVID-19, stabilization of supply chains, improved veterinary services, and the positive impacts of government programs like the Rashtriya Gokul Mission. Rising urban and export demand for value-added dairy products further supports this optimistic outlook.

Dairy Dimension connected with dairy experts with more than 2 decades of experience in Indian dairy segment to understand their outlook on the survey, below are the excerpts:

outlook on the survey, below are the excerpts:

Do you believe India’s dairy sector is prepared to address the projected demand-supply gap?

No. India’s dairy sector is not prepared to address the projected demand-supply gap as the government and its development and research institutions responsible for “developing” this sector have not even acknowledged the reducing growth rate in milk production. Despite data a medium- to long-term downtrend in the growth rate of milk production by buffaloes and crossbred cows, the demand is growing due to rising per capita income, a growing middle-income population, and urbanization. These factors lead to fewer people owning dairy animals and a net milk deficit at the individual household level.

The growth rate of milk production by buffaloes in 2023-24 was only 1.1%. This downtrend has resulted in the proportion of buffalo milk to total milk production from the three types of bovines decreasing over the past 7 years, from 51% in 2016-17 to 45% in 2023-24.

Crossbred cows, which produced 33% of the milk in 2023-24 (up from 27.5% in 2016-17), also showed a steep decline in the growth rate of total production, with only a 5.7% increase in 2023-24. There is little hope for improvement ahead, as hybrid vigour is no longer present to drive higher productivity.

Crossbred cows, which produced 33% of the milk in 2023-24 (up from 27.5% in 2016-17), also showed a steep decline in the growth rate of total production, with only a 5.7% increase in 2023-24. There is little hope for improvement ahead, as hybrid vigour is no longer present to drive higher productivity.

Indian cows have shown a flat growth rate, contributing 22% of the total milk produced by bovine animals in 2023-24.

What are the critical steps that would sustain the Indian dairy sector?

What are the critical steps that would sustain the Indian dairy sector?

- The figures analyzed for buffaloes include the total of 17 recognized breeds, while the figures for indigenous cows encompass 47 recognized breeds. Therefore, granular data at the individual breed level for each state is required to better understand both the challenges and opportunities ahead.

- The declining growth rate in total milk production and productivity indicates that the large-scale AI program using frozen semen, along with the use of sexed semen from a few bulls specifically selected for crossbred animals by professionals, has been ineffective. Milk production by crossbred cows will not be the solution for increasing milk production in the future.

- Therefore, each state government needs to conduct a similar analysis of the growth trends in milk production by its locally recognized buffalo breeds and indigenous cows, independently.

- Each state government should engage in discussions with breeders’ associations of the respective breeds to assess growth rates and identify opportunities. Localized actions involving these associations should focus on breed improvement and productivity enhancement using local resources.

- Parent/breeder stock should be identified at the village level for each breed: the top 50% for females and the top 20% for males. Associations should handle segregation and unique identification, with farmer involvement.

- A separate market mechanism needs to be established to enable breeders to receive a higher price for young stock born from parent/breeder stock, as compared to animals sold solely for milk production.

Given the downward trend in growth, policies need to be finalized urgently. With rising per capita income and a growing middle-income population in urban areas, the demand for milk and milk products is expected to increase further, exacerbating the milk demand-supply gap.

Given the downward trend in growth, policies need to be finalized urgently. With rising per capita income and a growing middle-income population in urban areas, the demand for milk and milk products is expected to increase further, exacerbating the milk demand-supply gap.

What steps should India take to ensure self-sufficiency in dairy production as consumption growth surpasses production? What are the global best practices that the sector should adopt?

India has largely remained self-sufficient until FY2022, with annual milk production growth at 5.77%. However, starting from FY2023, the annual milk production growth dropped to 3.83% and 3.76% in FY2024, as demand outpaces production. Consumer demand for milk and milk products is growing at 6.42% year-on-year and is expected to grow at a 45% CAGR by 2030. Such trends are concerning not only to policymakers from the perspective of food security but also to the dairy industry. Immediate steps necessary to address these issues include:

- Aggressively support both the forage and feed industries. Without proper nutrition, the already much-improved genetics of crossbred dairy cows and buffaloes cannot be sustained to maintain higher production levels.

- The Government of India must create the right platform to bring all relevant stakeholders together for a positive dialogue on improving the genetic potential of indigenous cows. This should also include strengthening plans for the rehabilitation of abandoned cows, regulations on crossbreeding programs, and supporting dairy farmers and milk cooperatives in a manner similar to MSP for agriculturists, to avoid losses for livestock stakeholders.

- Feed millers and milk cooperatives must step forward to support awareness programs for dairy farmers on nutrition, health, and management, similar to the poultry industry, where farmers are more aware than the average dairy farmer.

- Create courses in veterinary universities and institutes for on-farm supervisors, dairy farm management, and feed mill operations. This will address the acute shortage of skilled professionals and workers, which is crucial to maintaining and growing the dairy industry, and to overcoming the skills shortage in the workforce engaged in the sector.

Regarding the adoption and learning from global best practices, it’s essential to consider Indian realities. A live example is the revision of current BIS norms with the inclusion of AftB1 claims at a maximum of 20 ppb. While I do not wish to question the worthiness of these changes, one must remember that the Western world worked aggressively to establish and create the right supply chain before adopting such measures. This revision has had a significant impact on the desired growth of the cattle feed business. It has affected feed millers’ profitability, as input costs have raised substantially, hampering their ability to invest further in capacity growth. We must also remember that until post-harvest management and warehousing of grains and oilseeds improve, cattle feed millers will continue to struggle with managing revised BIS norms, as it is beyond their control to manage grains and oil meals.

What we can learn from global best practices is the involvement of research institutes, veterinary universities, feed additives, and animal health and nutrition companies to contribute the right knowledge and technologies to feed millers and milk cooperatives. We should also look to other livestock sectors, especially poultry and aquaculture, where technology and knowledge deployment are at a higher scale than in the dairy sector. While it is easy to point to the fragmented nature of the dairy upstream (i.e., farms), I consider this a strength rather than a weakness, considering the welfare and employment opportunities it provides in India. Personally, I am an admirer of “Dr. Kurien’s Dairy Model,” which is more realistic for India’s needs, but the time has come to perfect it with modern knowledge and technologies.

How can technology and innovation be leveraged to improve productivity and reduce post-production losses in the dairy sector?

The dairy industry must create an internal dialogue to focus on improving existing technologies and invest time and money in “innovations,” as this field is still largely neglected compared to other industries, where people are working on AI and ML (Artificial Intelligence and Machine Learning). In the current scenario, no industry can afford to lag behind in such initiatives.

Although some AI-driven farm software has been introduced at dairy farms, its cost-effectiveness and efficacy remain questionable. I am a strong believer in contextual and practical technologies that are not only relevant from a practical standpoint but also affordable. Until these technologies become affordable for the average dairy farmer and demonstrate a solid return on investment, they will remain more of a showcase value than of real value.

Feed mill management and efficiency are closely tied to the existing infrastructure, which requires a makeover. The dairy feed industry must realize that for high-quality feed production, systems and processes are crucial. Cattle feed should be viewed as a technical product, which involves more than simply mixing and forming pellets from a few raw materials. This is an area where we can learn from the Western world, where animal and human food systems share similar manufacturing setups and quality controls. My exposure to IIT Delhi has changed my perspective on quality and efficiency, which are critical for any industry to grow and flourish. I strongly believe that veterinary universities should consider advancing their existing curriculum and teaching, with a greater emphasis on practical aspects that are more closely aligned with industry needs.

Another important aspect is the analytical services framework in the dairy industry, with a focus on improving overall quality orientation and efficiency. Although awareness has grown in the industry over the past several years, much more needs to be done. Data management and its interpretation are critical from a technological standpoint, and this is an area where AI and ML can play a significant role. The use of artificial intelligence and machine learning in agriculture is steadily growing, particularly in crop management. Similarly, dairy farms, feed mills, milk supply chains, and processing plants should explore the potential for adopting such technologies.

Conclusion

India’s dairy sector exemplifies both progress and persistent challenges. Addressing slowing growth rates, regional disparities, and systemic inefficiencies is imperative to sustain its global leadership. With targeted strategies and inclusive policies, the sector can emerge as a resilient driver of rural development and economic prosperity.