Chennai, July 2025: In a bold step that signals the maturing of India’s value-added dairy segment, Milky Mist Dairy Food Pvt Ltd has filed its Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) for an Initial Public Offering (IPO) aimed at raising ‚āĻ2,035 crore.

The IPO includes:

- A fresh issue of ‚āĻ1,785 crore

- An Offer for Sale (OFS) of ‚āĻ250 crore by existing promoters

Proceeds from the IPO will be directed toward debt reduction, expansion of manufacturing infrastructure, and corporate growth initiatives, making it one of the most strategically structured IPOs in India’s dairy landscape.

ūüßÄ Where the Money Will Go: A Strategic Investment Blueprint

According to its DRHP, Milky Mist will allocate the proceeds as follows:

| Purpose | Amount (‚āĻ crore) |

|---|---|

| Debt Repayment | 750 |

| Expansion of Perundurai Manufacturing Plant | 414 |

| Cold Chain Equipment (Visi coolers, Ice cream freezers, Chocolate coolers) | 129 |

| General Corporate Purposes | Remaining amount |

The Perundurai expansion will include new production lines for:

- Whey protein concentrate

- Yoghurt

- Cream cheese

This product-level diversification will enable Milky Mist to tap into high-growth functional food and protein-rich dairy categories, both in India and abroad.

ūüßģ Financial Performance Snapshot

For FY25, Milky Mist reported:

- Revenue from operations: ‚āĻ2,349 crore

- EBITDA: ‚āĻ310 crore

The company’s profitability metrics and cash efficiency reflect the strength of its high-margin, value-added product portfolio, which is distinct from that of traditional liquid milk players.

ūüŹ≠ Business Model: Dairy Meets FMCG

Milky Mist has deliberately excluded liquid milk from its portfolio‚ÄĒallowing it to focus on products with:

- Longer shelf life

- Stronger unit economics

- Better scalability in retail & exports

Its in-house logistics and fully automated, tech-driven plants enable tight quality control and cost optimisation. The company sources directly from over 67,000 farmers, ensuring a consistent raw material supply while building backwards linkages.

This vertically integrated model positions Milky Mist at the intersection of dairy and FMCG, aligning it with global trends toward ready-to-eat dairy, functional nutrition, and premium snacking.

ūüďä Market Implications and Competitive Positioning

Milky Mist’s IPO signals a broader shift within the Indian dairy sector:

‚úÖ 1. Focus on Value Addition

With stagnant margins in traditional milk sales, Milky Mist’s model highlights the growing viability of premium, processed dairy‚ÄĒa categoryforecforecastedo grow ata¬† a CAGRoof f¬† 12‚Äď15% over the nefivetfive5 years.

‚úÖ 2. Cold Chain Infrastructure Push

The ‚āĻ129 crore allocated to visi coolers and freezers supports the brand’s aggressive retail expansion and could help it deepen its rural and Tier II‚ÄďIII penetration.

‚úÖ 3. Debt Optimization

Using ‚āĻ750 crore for debt repayment not only boosts financial health but also strengthens investor confidence, paving the way for sustained capital investment.

‚ö†ÔłŹ Potential Risks and Pitfalls

Despite its strong fundamentals, Milky Mist faces some industry-wide and structural challenges:

- High input costs: Volatility in milk procurement pricing can pressure margins

- Dependence on rural sourcing: Climatic or fodder supply shocks could disrupt milk flow

- Brand competition: As India’s dairy shifts toward premium formats, Milky Mist must compete with Amul, Nestl√©, Mother Dairy, and new-age D2C brands

- Cold chain execution: Retail refrigeration rollout is capital-intensive and logistically demanding

ūüó£ÔłŹ Expert View

‚ÄúMilky Mist‚Äôs IPO is not just a capital event‚ÄĒit‚Äôs a strategic move reflecting the future of India‚Äôs dairy. Their success could set a blueprint for how Indian dairy brands evolve from cooperative-led supply chains to FMCG-aligned, innovation-first enterprises.‚ÄĚ

‚ÄĒ Prashant Tripathi, Dairy Strategy Consultant

ūüĆŹ What This Means for Indian Dairy

Milky Mist’s move highlights a new narrative for Indian dairy:

- From bulk to brand

- From commodity to cuisine

- From rural enterprise to boardroom-ready business

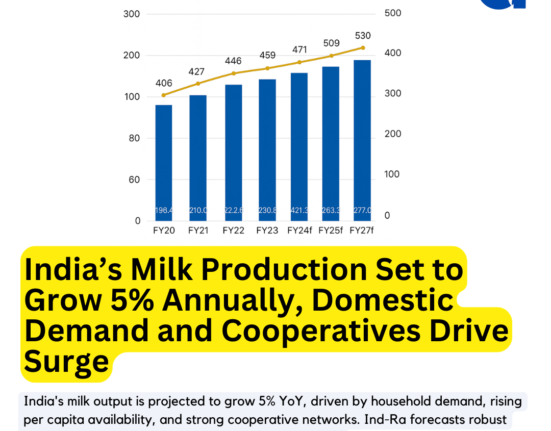

As India targets 30% of global milk output by 2030, the need for value-added dairy transformation‚ÄĒand capital to power it‚ÄĒhas never been greater.

1 Comment