The U.S. dairy industry is navigating a critical period marked by historic policy reforms, record investments in processing, and volatile global dynamics. While bullish trends such as rising beef prices and major infrastructure projects offer hope, bearish forces, including Federal policy shifts, trade uncertainties, and efficiency-led oversupply, loom large.

At the heart of the transformation are the 2025 Federal Milk Marketing Order (FMMO) reforms, which will roll out in phases beginning on June 1 and December 1, 2025 (see Table 1). These updates are expected to lower the all-milk price by 30 cents per hundredweight (cwt), with Class III milk prices seeing the most significant impact.

𧞠Key FMMO Changes to Watch

As per Table 1:

-

June 1, 2025:

⸠Removal of 500-lb cheddar barrel from Class III pricing

⸠New manufacturing cost allowances (e.g., Cheese: $0.2519/lb)

⸠Butterfat recovery factor set to 91%

⸠Return of âhigher-ofâ Class I formula

⸠Extended Shelf Life (ESL) Class I pricing adjustment -

December 1, 2025:

⸠Revised skim milk composition standards:

â True Protein: 3.3%, Other Solids: 6.0%, Nonfat Solids: 9.3%

These reforms are a structural reset designed to reflect real-world costs better, but they may exert downward pressure on milk prices, especially for cheese-oriented processors.

đ° Bullish Trends: Investment, Exports, and Beef

More than $8 billion in dairy processing infrastructure is underway across the U.S., with marquee projects from Walmart ($350M), fairlife ($650M), and Chobani ($1.2B). While many of these facilities focus on cheese, their startup will likely tighten milk supplies and support prices in the short term.

Simultaneously, high beef prices are allowing dairy farms to optimise culling strategies and increase herd efficiency. Yet despite smaller replacement inventories, overall milk solids production is rising due to improved feed-to-milk conversion and a national herd that grew by 57,000 head YoY.

đ Bearish Headwinds: Policy, Trade & Efficiency

Policy risks are intensifying. Analysis by Dr. Charles Nicholson (University of WisconsinâMadison) shows:

- A 25% retaliatory tariff could cut all-milk prices by $1.90/cwt and cost the industry $22 billion in exports over 4 years

- A 4% cut in food assistance programs (SNAP, WIC, school meals) could lower all-milk prices by $0.65/cwt

- Proposed immigration restrictions increasing wage costs by 20% and reducing labour efficiency could drop farm income by 30.9%

Meanwhile, efficiency gains are shifting market fundamentals. Though total U.S. milk production fell in 2024, butterfat (4.36%) and protein content (3.38%) in 2025 are at record highs. This 1.65% rise in solids production offsets volume decline and can lead to oversupply in value-added markets.

đ§ Class III vs. Class IV: Price Divergence Deepens

- Cheese (Class III) remains price-bound, with USDA AMS data showing a long-term price range of $3.49â$4.39/lb, limiting upside.

- Butter (Class IV) has broken out, now ranging $3.79â$4.79/lb at retail, supporting stronger Class IV prices.

With most new investment focused on cheese, the pressure on Class III utilisation and pricing is likely to intensify.

đ Global Context: Export Boosts vs. Fragile Advantage

- U.S. cheese exports surged due to favourable pricing vs. EU products

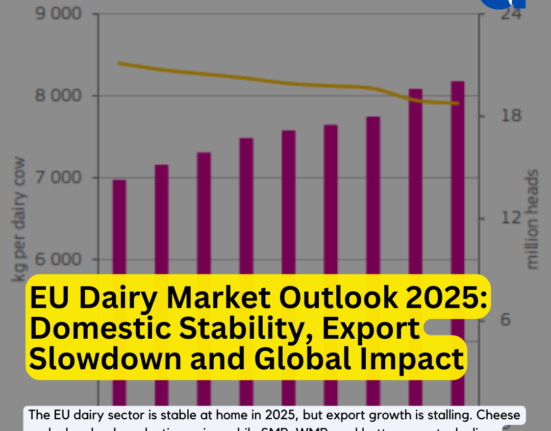

- However, EU milk output is recovering, and the competitive advantage may not last

- Domestic consumption remains weak, particularly in foodservice and QSR chains

- Food inflation and consumer caution are slowing the demand rebound

- Trade-driven pre-buying ahead of tariff shifts further clouds demand visibility

đ§ What This Means for Indian Stakeholders

For Indian dairy exporters, processors, and policymakers, the evolving U.S. landscape offers critical cues:

â

More Class IV insulation amid global instability suggests a strategic shift toward butter and milk powder production

â

Export competitiveness in cheese hinges on narrow price advantages â Indiaâs new dairy export policies must emphasise agility

â

Efficiency-driven supply growth in solids reflects a global trend India must match via precision dairy farming

â

As FMMO reforms rebalance U.S. pricing logic, Indian cooperatives must prepare for shifting global price signals in SMP, whey, and cheese