India’s fruits and vegetables (F&V) sector is expanding rapidly, outpacing cereals and contributing nearly 30% of the total crop value. This sector is not only more nutritious but also essential for dietary diversity. Yet, it remains neglected in terms of policy support, institutional backing, and organized value chains.

Unlike cereals and dairy, which have benefited from structured procurement, processing, and distribution, the F&V sector faces severe challenges—including price volatility, post-harvest losses, and fragmented supply chains. Without efficient storage, processing infrastructure, or direct market linkages, nearly 8.1% of fruits and 7.3% of vegetables are lost post-harvest, amounting to ₹1.53 lakh crore in annual losses (NABCONS, 2022). Farmers often receive only 30% of the consumer price, a stark contrast to the dairy sector, where producers under cooperative models like Amul receive 75-80% of the consumer price.

Can India Replicate the Amul Model in F&V?

The success of India’s dairy revolution, led by Verghese Kurien and Operation Flood, transformed the country from a milk-deficient nation to the world’s largest producer of milk (239 million tonnes in FY24). This achievement was made possible by cooperative models that empowered farmers, eliminated middlemen, and created efficient, value-driven supply chains.

The question is: Can India replicate this success in the F&V sector?

While the challenge is more complex—due to the seasonality, perishability, and diversity of produce—a structured approach focusing on farmer producer organizations (FPOs), processing infrastructure, and direct market access can redefine India’s agricultural landscape.

A Blueprint for Success: The Sahyadri Model

A promising example comes from Sahyadri Farmer Producer Company Ltd (SFPCL), based in Nashik, Maharashtra. Founded in 2004 by Vilas Shinde, SFPCL started with just 10 farmers and has since grown into India’s largest FPO, spanning 252 villages, 31,000 acres, and over 26,500 registered farmers.

Its success is reflected in its remarkable growth:

- Annual turnover rose from ₹13 crore in FY12 to ₹1,549 crore in FY24.

- 64.6% of revenue comes from the domestic market, while exports contribute 35.4%.

- SFPCL is India’s largest grape exporter, shipping 90% of its grapes to the European Union and UAE, ensuring farmers receive an average of 55% of the Free On Board (FOB) price.

At the heart of Sahyadri’s success is its ability to integrate aggregation, processing, value addition, and direct market linkages—ensuring farmers secure higher incomes while reducing dependency on middlemen.

Processing: The Key to Price Stability

Unlike traditional farming setups that suffer from price crashes during seasonal gluts, SFPCL has invested heavily in processing infrastructure:

- Tomatoes, which form 35% of domestic revenue, are processed into ketchup, puree, and sauces, stabilizing prices and ensuring steady farmer incomes.

- Processing has generated 6,000+ jobs, of which 32% are held by women, contributing to rural economic growth.

Scaling Up: What India Needs to Do

The Sahyadri model provides a proven framework for scaling up India’s F&V sector. The government’s target of forming 10,000 FPOs (with 8,875 already registered as of August 2024) is a step in the right direction. However, to truly transform the sector, three key interventions are required:

-

Strengthening FPOs with Institutional Support

- Access to working capital, cold storage, logistics, and digital platforms.

- Integration with Open Network for Digital Commerce (ONDC) to improve market access.

- Use of blockchain for transparency and traceability, ensuring better price realization for farmers.

-

Reviving and Expanding Operation Greens & Horticulture Missions

- Operation Greens (launched in 2018 with ₹500 crore funding) needs better execution and a visionary leader like Verghese Kurien.

- A revamped National Horticulture Mission should focus on infrastructure, financing, and global market access.

-

A National Board for Fruits & Vegetables

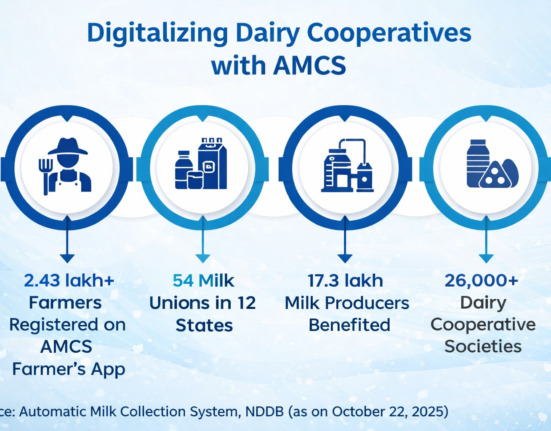

- India needs a National Fruit and Vegetable Board (NFVB), akin to the National Dairy Development Board (NDDB).

- The board should streamline procurement, storage, and processing while integrating major retail chains like Safal.

- At least 10-20% of total F&V production must be processed to avoid distress sales and stabilize farmgate prices.

The Future of India’s F&V Sector

The time has come for India to create its own ‘Amul moment’ in the F&V sector. With leaders like Vilas Shinde paving the way, the Sahyadri experiment has already demonstrated that small farmers can access global markets, reduce losses, and increase incomes through collective action.

The final question remains: Can India find a Verghese Kurien for Fruits & Vegetables? With strong policy support, investment in value chains, and visionary leadership, the answer is a resounding yes. If done right, India’s F&V sector will not only feed the nation but also conquer global markets, ensuring farmers earn 55-60% of consumer prices—a game-changer for millions of livelihoods.

Source link of Original article from Ashok Gulati & Raya Das